The Coronavirus (COVID-19) pandemic has accelerated the rise of e-commerce globally, as consumers look to reduce in-store visits. This switch has also seen consumers facing a wider variety of product offers, that can often be hard to choose from. The growth of online shopping platforms has therefore placed a stronger importance on product claims and brand positioning to help consumers identify the brands that closest align with their personal interests (dietary, health or ethical).

The likely sustained channel shift towards e-commerce as more consumers experience the convenience of online shopping will mean investing in online product positioning will be crucial to long-term brand strategy.

Top online positioning trends for 2021

In light of COVID-19 and growing conscious consumerism, health, product safety and purposeful consumption have taken centre stage for consumers. COVID-19 has accelerated realignment sustainability priorities in the short/mid-term, with issues such as food waste, climate action and food security front-lined. These combined factors are expected to place a renewed interest in product claims such as natural, immune-boosting and environmentally friendly; claims that communicate desirable attributes to consumers as they shop around for the right products.

In this context, Euromonitor International has identified three key future opportunities that will shape product positioning in consumer goods.

Growing niche for immune positioning in consumer health, food, drinks and pet food

COVID-19 has made preventative health a priority for many consumers. The concept of food as medicine has also gained in importance when it comes to immune health. Concerns about the virus have driven consumers to seek products that help to strengthen their immune system. Ingredients that are known to be beneficial for a healthy immune system, such as probiotics, ginger or zinc, are expected to see stronger demand in the short to mid-term. Therefore, an increase in products that carry an immune system claim or contain ingredients that are linked to immune health is very likely soon.

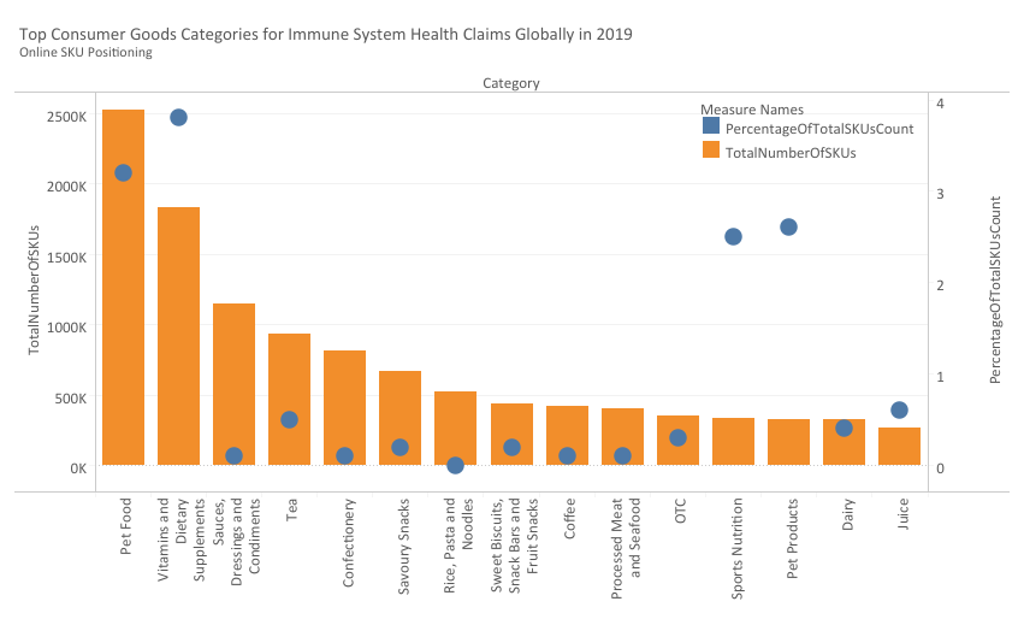

Categories less known for their immune positionings, such as snacks, tea and sauces, have seen the recent emergence of immune system health claims in 2019. In categories with a strong health positioning, such as green tea, supplements and yoghurt, manufacturers are expanding immune positioning to a wider consumer base. Global dairy leader, Danone, for example, launched its first non-dairy Actimel with an immune system health claim in the UK market in July 2020.

Source: Euromonitor International’s Product Claims and Positioning

The unmet market potential for naturally positioned consumer goods

Simpler ingredients lists and natural ingredients are still winning, as consumers prioritise health in light of COVID-19. Consumers are returning to back-to-basics options, choosing simpler and clean label products which they believe produce better results when it comes to overall health. Across premium consumer goods, there is a stronger emphasis on products that are inherently natural from conception, with accentuated natural claims and positioning a key means of communicating this.

As consumers trade up, natural claims have moved into the top five online product claims across all industries globally. But despite their popularity in marketing, natural claims accounted for no more than 6% of total online SKUs globally across any industry in 2019. This highlights the existing window of opportunity for manufacturers to expand within this segment. One industry with significant future growth potential is alcoholic drinks, with less than 1% of online SKUs adopting a natural positioning in 2019.

| Industry | Global Rank of Natural Claims 2019 (% of total online SKUs) |

| Alcoholic Drinks | 3 |

| Beauty and Personal Care | 1 |

| Consumer Health | 2 |

| Fresh Food | 2 |

| Home Care | 1 |

| Hot Drinks | 2 |

| Packaged Food | 6 |

| Pet Care | 1 |

| Soft Drinks | 1 |

| Tissue and Hygiene | 3 |

| Tobacco | 1 |

Source: Euromonitor International’s Product Claims and Positioning

Corporate responsibility commitments expected to translate into future brand positioning

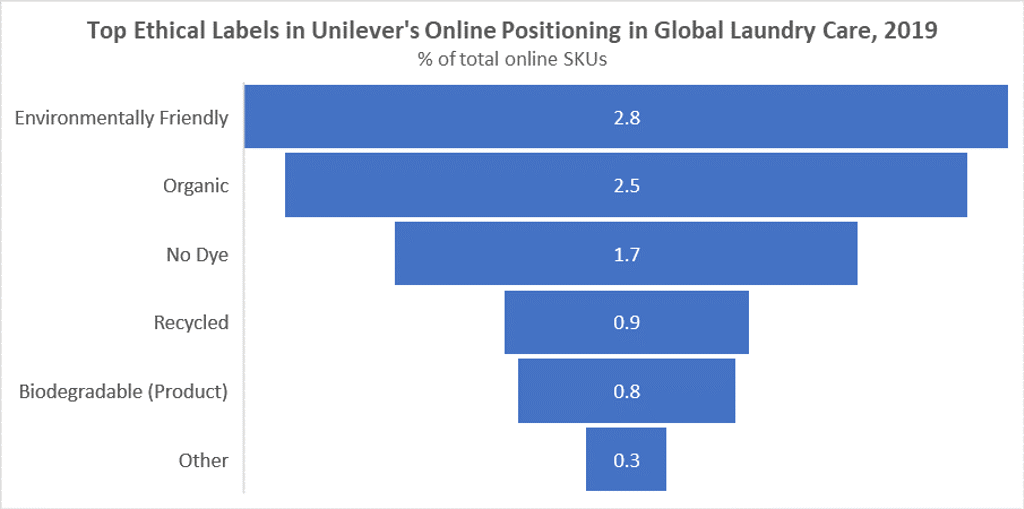

Corporate social responsibility is translating into online brand positioning. The continued focus on environmental welfare, encompassing areas such as recyclable packaging, local sourcing and organic certification, is apparent in ethical positioning in consumer goods. Within ethical labelling, organic and environmentally-friendly claims ranked in the top three labels for consumer goods manufacturers in 2019. This is exemplified by global sustainability leader, Unilever, in its online positioning in laundry care, its largest home care category.

Source: Euromonitor International’s Product Claims and Positioning

As global manufacturers restate sustainability commitments in 2020, brand positioning is likely to reflect these latest objectives. With the spotlight on climate action, climate-friendly claims such as carbon neutral and climate-neutral are likely to gain traction. For example, 2019 saw the launch of a Climate Neutral Certification in the US, which is gaining traction with local brands such as Allbirds and Cold Brew Club.

For manufacturers, investment in online positioning will not only be essential as more consumers switch to e-commerce; evaluating the impact of factors such as COVID-19, digitisation and ethical consumerism will also be key to understanding changing consumer demand. With more consumers researching products online, brands may need to rethink their product claims and attributes as well as their brand descriptions to increase visibility online. Sustained digitization of shopping habits could see e-commerce strategies become as important as traditional offline strategies around packaging claims and shelf visibility in-store.