As many countries ease restrictions originally implemented to control the spread of COVID-19, including the reopening of shops and restaurants, consumption of pet care is expected to further increase, as consumers spend more on treats, healthcare products, and toys and accessories. More so than daily necessities such as pet food, these discretionary categories are set to benefit from economic recovery, especially in emerging markets.

The pet population recorded the strongest growth of the review period in Europe, North and Latin America and Australasia, which contributed to growth of global pet care sales. Consumers addressed loneliness through the adoption of pets as companions to face home seclusion.

Ongoing remote work policies post-pandemic, whereby consumers work from home either full-time or on a regular basis such as several days a week, are expected to become the “new normal”. This supports pet ownership, and will increase bonding time with companion animals, ultimately contributing to growth in the number of pet-owning households, which is an important factor in further expanding pet care demand.

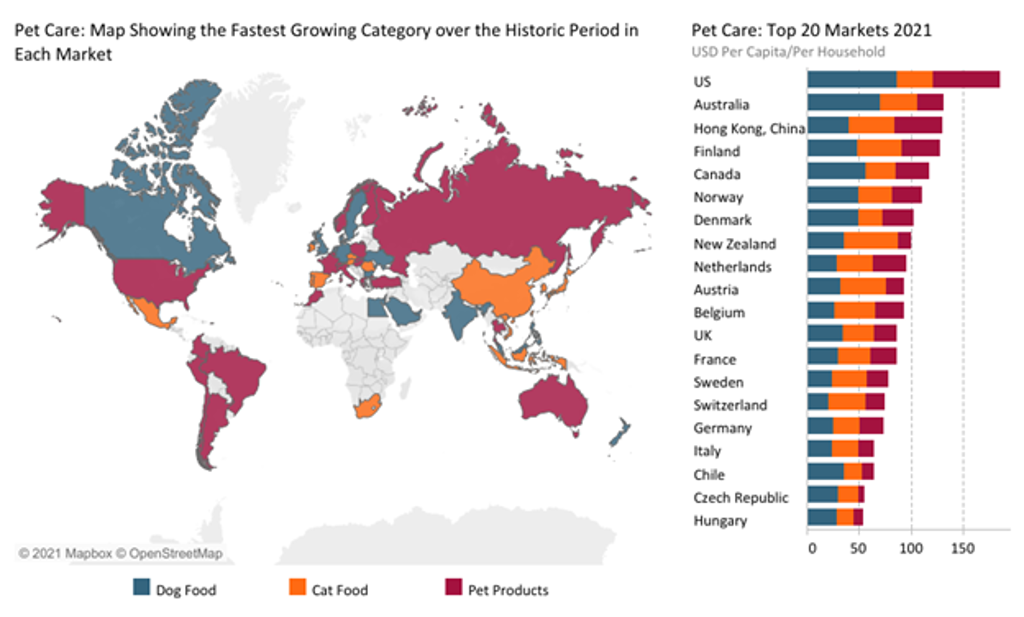

Key driving force differs by regions: Cat food in emerging markets and humanisation trend in developed countries

In Asia Pacific, the cat population has significantly increased, and this trend is predicted to continue over the forecast period. The trend of feeding and caring for stray cats in Asia will also contribute to growth of cat food. As a result, the mid-priced segment will be a driving force for cat food in Asia, which differs from developed regions, where the premium segment is expected to lead growth over the forecast period. Low prices will also enable pet owners in Asia Pacific to switch to purchasing commercial pet food instead of relying on leftovers or table scraps.

Meanwhile, in North America, Western Europe and Australasia, the humanisation trend will be the primary growth driver, as pet population growth slows post-pandemic. In these regions, pet products is expected to be the strongest growth category, as owners humanise their companions in new ways. In particular, digital products such as smart pet accessories are being actively introduced; these products were especially helpful for training and grooming pets at home during lockdown periods.

Whilst global top players remain strong, local players are rising in emerging markets

The two largest players to maintain solid leading positions within global pet care in 2020 were Nestlé SA, which gained value share as it was able to respond to high demand, and overall leading player Mars Inc, which lost marginal value share in a more competitive environment, despite seeing sales growth. In brand terms, the leader’s top three selling brands – Pedigree, Royal Canin and Whiskas – maintained their positions, based on consumer preference for familiar brands during the pandemic. The Hill’s brand from Colgate-Palmolive, performed well in 2020, as its scientific positioning appealed to consumers concerned with pet health issues such as improved immunity.

In Asia, local brands expanded their share due to offering a value-for-money positioning. As a result, the leading players in the region continue to lose significant ground. For example, Xuzhou Suchong Pet Products, based in China, recorded a value CAGR of 104%. It offers more affordable prices and strong knowledge of the demands of younger pet owners. Its digital-first distribution strategy is reaching consumers in new areas including lower-tier cities.

Private label did not experience share gain during the pandemic in 2020, as there were some supply issues as a result of stockpiling, although it maintained its leading position in Western Europe due to its price advantage during the pandemic as a result of reduced incomes.

Sustainability: The most important innovation area within pet care

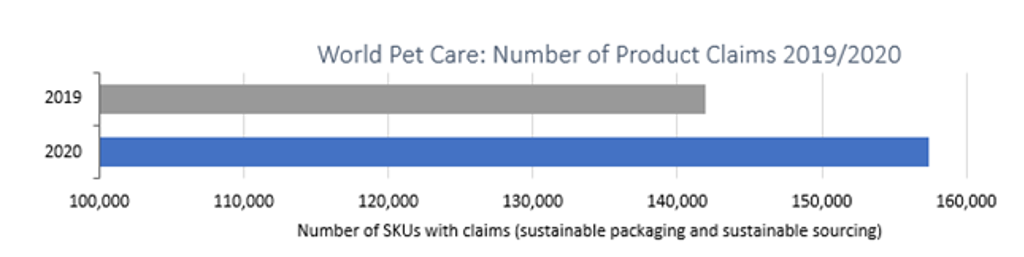

Over the forecast period, ethical products are likely to gain momentum by considering sustainability. It is increasingly important that pet care companies develop a sustainable strategy, establishing a clear sense of purpose in this space and communicating this to pet owners.

Pet owners are also more willing to take action to promote a sustainable life than non-pet owners. Sustainability concerns are playing more of a role in the purchasing of pet food and products, which is driving the global pet care industry to develop new products in terms of both packaging and ingredients.

According to Euromonitor International’s Product Claims and Positioning system, within the nearly 4.1 million global pet care SKUs tracked in 2020, there are animal welfare, environmentally friendly, sustainable packaging and sustainable sourcing claims included under ethical labels. World total SKUs with claims under these ethical labels in pet care increased by 11% in 2020 from the previous year.

More recently, insect-based and vegan pet foods are being watched more closely by owners with sustainability concerns, with these products expected to become increasingly relevant in the near future.

Source: Euromonitor International, Product Claims and Positioning

For further insight, please take a look at our World Market for Pet Care report.