The global economic outlook has improved since the end of 2020, primarily on a more positive note in developed countries, where vaccination progress is expected to lead to a stronger economic rebound in the second half of 2021. Vaccination campaigns in developing economies are expected to take longer and therefore are likely to face ongoing local Coronavirus (COVID-19) waves.

As of Q1 2021, five countries – Australia, China, Finland, Lithuania and Sweden – are expected to have fully recovered with consumer demand returning to 2019 levels, thanks to effective pandemic responses and continued fiscal stimulus. China is, however, the only country in this list where all pillars of the Recovery Index – real GDP, employment, retail sales, consumer spending, and consumer confidence – have surpassed 2019 levels.

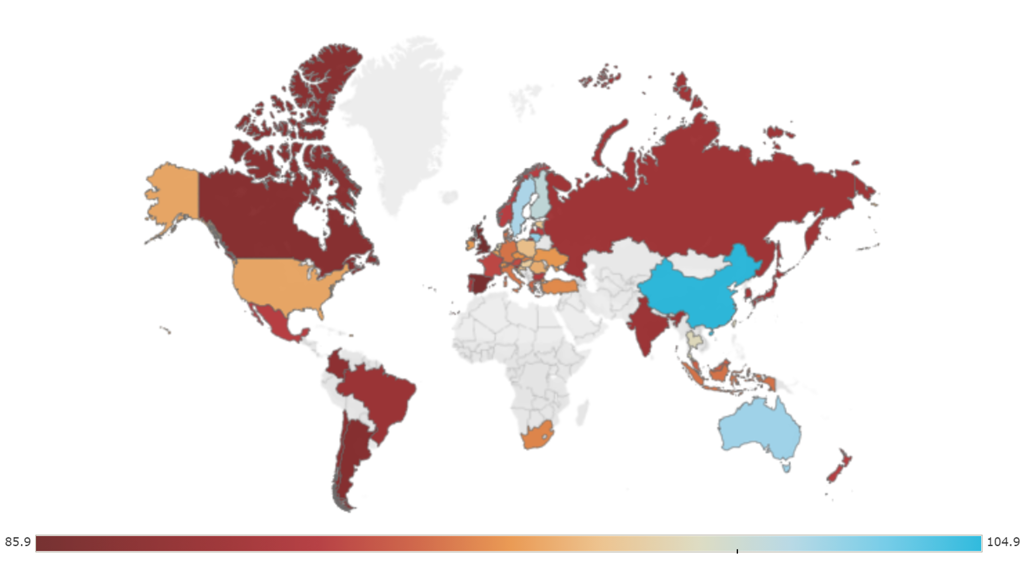

Global Overview for Recovery Index in Q1 2021

Source: Euromonitor’s Recovery Index

Recovery landscape in major economies: A mixed picture

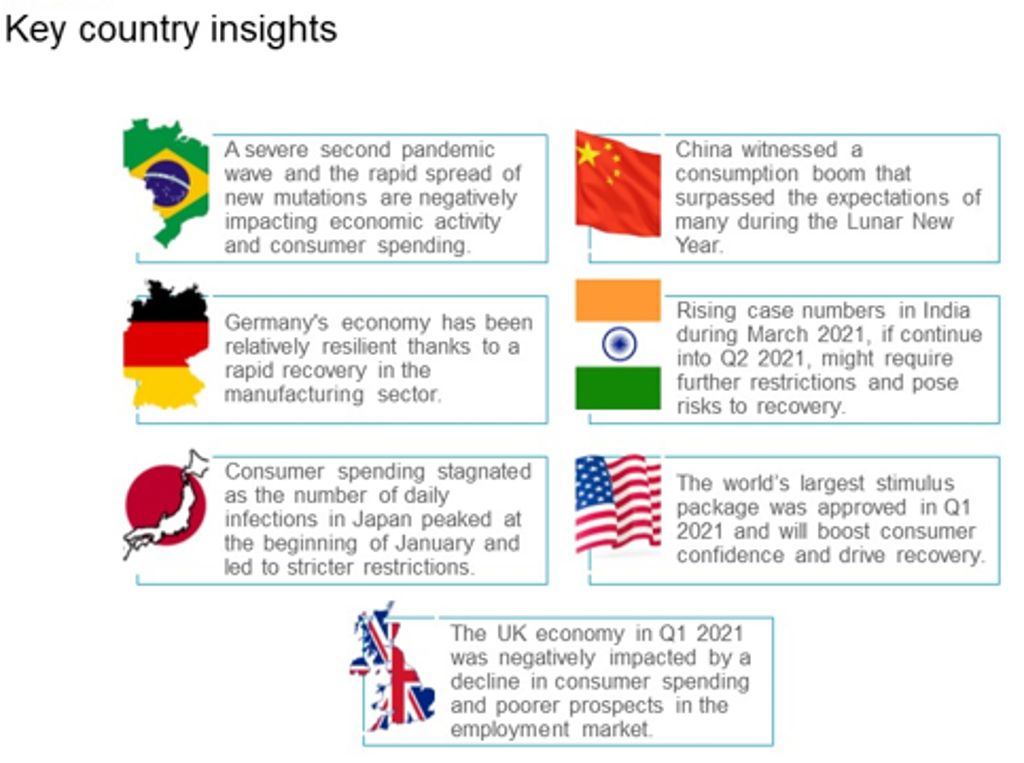

• The Recovery Index score for Brazil in Q1 2021 is estimated to have dropped to 89.6, from 92.5 in the previous quarter. A severe second wave of the pandemic and rapidly spreading COVID-19 mutations are negatively impacting economic activities in the country and consumer spending. Food and fuel prices are also rising, putting further pressure on consumer spending.

• In Q1 2021, the Recovery Index score for China is expected to have reached 104.9, almost unchanged from the previous quarter. China's retail sector activity surged at the beginning of 2021, as the country witnessed a consumption boom which surpassed the expectations of many during the Lunar New Year. Nevertheless, economic activity (measured by real GDP) is forecast to have declined slightly in Q1 2021 compared to the previous quarter. Manufacturing activity has also slowed down, hindered by falling new export orders amid rising COVID-19 cases globally and escalating geopolitical tensions. A resurgence of local COVID-19 cases in northern China also caused disruptions in industrial production.

• In Germany, the Recovery Index score is estimated to have reached 94.1 in Q1 2021 – a slight drop from 95.1 in the previous quarter. Germany's economy proved to be relatively resilient to the second COVID-19 pandemic wave and related containment measures, but deterioration within the labour market is anticipated, with rising unemployment being the main factor for the setback in recovery in Q1 2021.

• In India, the Recovery Index score is expected to have reached 89.6 in Q1 2021, a slight improvement from 88.4 in the previous quarter, thanks to continuing economic rebound and a stable COVID-19 situation. In Q1 2021, India’s real GDP is estimated to have grown by 7.2% over the previous quarter. However, rising case numbers during March 2021, if continuing into Q2 2021, might require further restrictions and pose risks to recovery.

• The Recovery Index score for Japan in Q1 2021 is expected to have reached 90.2, an increase from 88.4 in the previous quarter. On the one hand, consumer spending stagnated in Q1 as the number of daily COVID-19 infections peaked at the beginning of January and led to the second state emergency and stricter lockdown conditions. On the bright side, the additional USD708 billion stimulus package approved in December 2020, growing external demand, the roll-out of vaccines, and optimism regarding the Tokyo Olympic Games have helped to revive consumer confidence and pave way for economic rebound in Q2 2021.

• Thanks to one of the fastest vaccination campaigns in the world, the US Recovery Index score improved to 96.1 in Q1 2021, up from 95.2 in Q4 2020. At the end of Q1 2021, a USD1.9 trillion stimulus package was approved by President Joe Biden. The world’s largest stimulus package will support the unemployed via direct payments, assist state governments and fund vaccination. The new stimulus package will effectively boost consumer confidence in Q1 2021 and beyond and drive a recovery in economic activity.

• In contrast, the Recovery Index score for the UK is estimated to have declined to 85.9 in Q1 2021, from 87.3 in the previous quarter. The UK economy was negatively impacted by a drop in retail sales, falling consumer spending, and poorer prospects in the employment market. Beyond Q1 2021, however, business and consumer confidence should be buoyed by some key factors including the UK Prime Minister Boris Johnson's unveiling of a 4-stage plan at the end of February 2021 that will see the easing of restrictions in England, as well as the UK’s successful vaccine rollout, which, at the time of writing, has seen over half of the population aged 18 and over being administered at least one vaccine dose. This will provide light at the end of the tunnel for businesses, especially in retail and hospitality.

The speed of the global recovery will depend on the speed of vaccination

In Q1 2021, the Recovery Index scores are forecast to have improved in 33 out of the 48 economies covered by Euromonitor International’s Recovery Index in comparison to the previous quarter, underpinned by the rollout of COVID-19 vaccination campaigns. Nevertheless, many countries, especially in Europe, have tightened lockdown measures in Q1 2021 amid the rapid spread of new Coronavirus variants, hindering economic recovery.

After Q1 2021, the speed of the recovery will be dependent on the speed of global mass vaccination in order to prevent significant rises in case numbers and the spread of new, more infectious variants of the virus. The path to herd immunity is long and might be prolonged even further due to supply shortages of vaccines. This is going to be a challenge, particularly for emerging and developing countries.

Under the baseline/most likely scenario, where there is one main global pandemic wave in the first half of 2021, economic conditions and consumer activity in most countries will remain below 2019 levels at the end of 2021. It is important for businesses to factor this recovery timeline into their planning and strategise accordingly.

Euromonitor Recovery Index

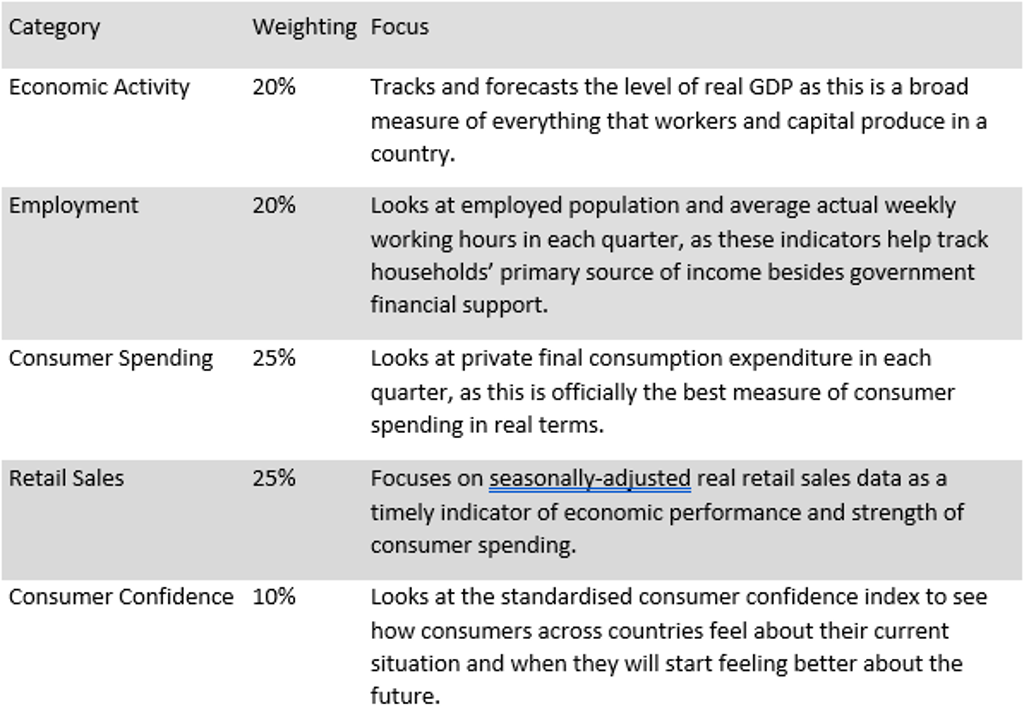

Euromonitor’s Recovery Index is a composite index that provides a quick overview of economic and consumer activity and helps businesses predict recovery in consumer demand in 48 major economies. The index takes into consideration total GDP and factors that determine consumer demand – employment, consumer spend, retail sales, and consumer confidence. Index scores measure the change relative to the average per quarter for 2019. A score of 100 and over indicates a full recovery in which economic output, labour market, and consumer spending all return to/exceed 2019 levels.

Recovery Index Breakdown

To learn more access the Global Recovery Tracker: Q1 2021 report.