How COVID-19 is Reshaping Retail And Services Industries in Sub-Saharan Africa

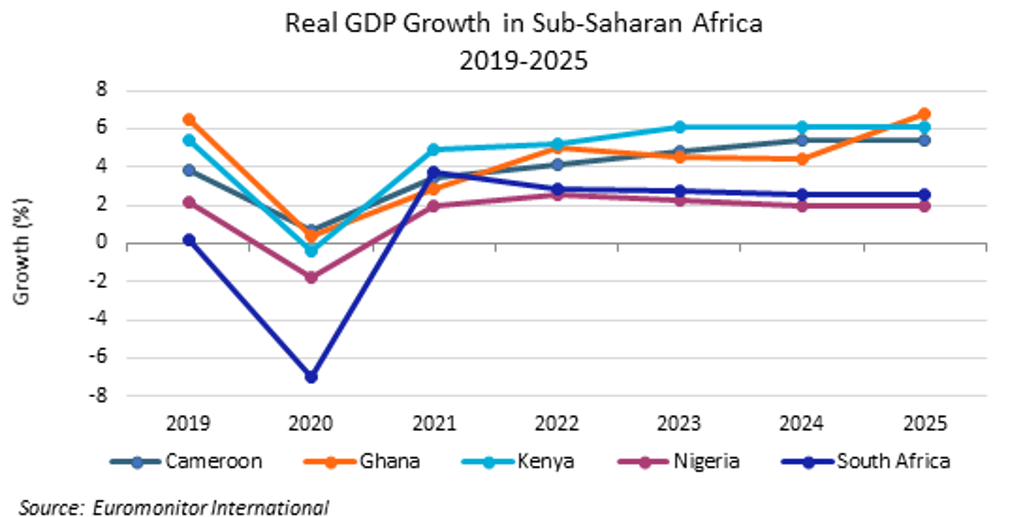

18 months after the World Health Organization declared COVID-19 a global pandemic, economic recovery in sub-Saharan Africa has been fuelled by increased commodity demand, mirroring the reopening of exports and rising demand in global private consumption. However, the unpredictable nature of new infection waves is forcing businesses to take a more conservative approach to managing their cash flows, placing further pressure on stagnant employment rates and disposable incomes. Nonetheless, there are new opportunities in the service and payment sectors, with restructuring, diversification, and digitalised models reshaping the future of retailing, foodservice, and travel over the forecast period.

The pandemic resets competition

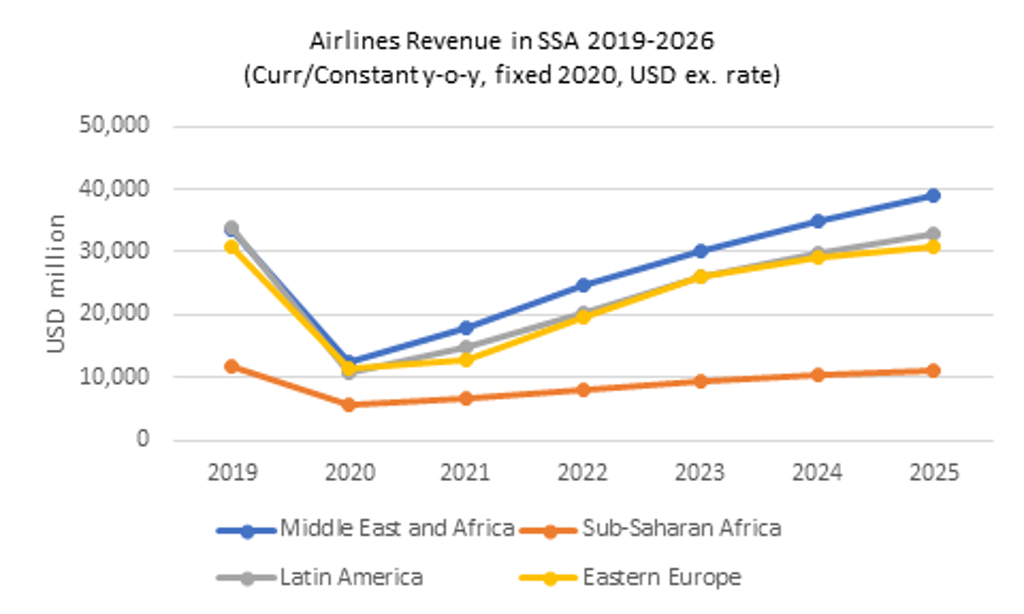

In the aftermath of harsh lockdowns, businesses continue to adjust their business models, with many revising expansion plans or exiting certain markets. Additionally, as the crisis highlights the financial vulnerability of retailers such as Edcon, local and international operators are taking advantage of such an opportunity to diversify their portfolios through acquisitions. Similarly, Tusky's portfolio reduction in Kenya, for example, enables existing competitors such as Naivas to access a new customer base. A similar trend is also being witnessed in travel, where a 66% decline in South African air passenger traffic in 2020 has led to the exit of operators such as South Africa Express, giving room to operators like Airlink to expand their local and regional routes.

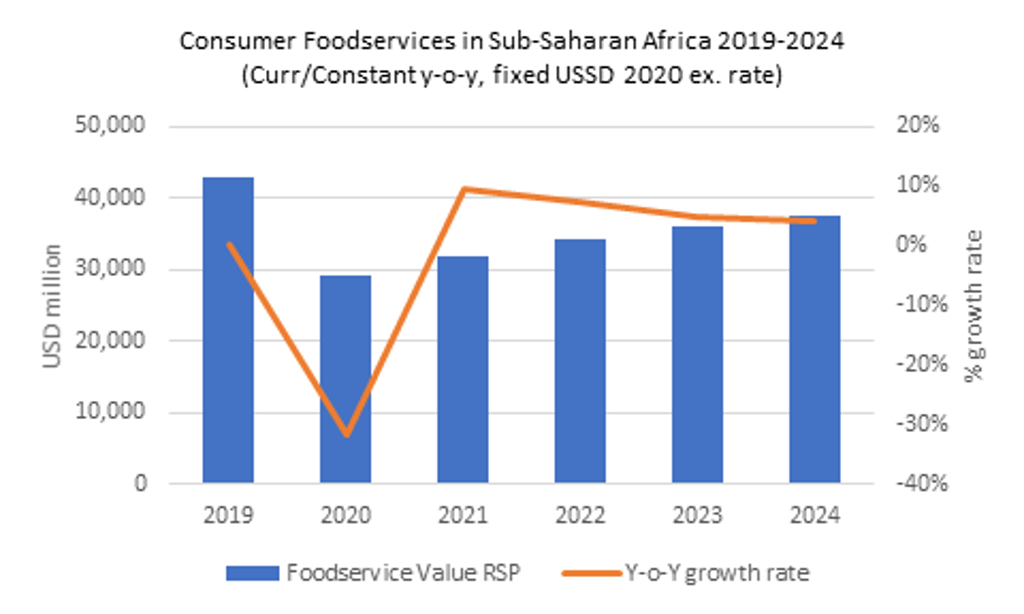

Moreover, the crisis highlights the importance of flexibility in operating formats by stimulating demand for smaller retailing channels such as convenience stores during lockdowns, due to households reducing their footprint in shopping centres. In addition, persisting international travel bans which led to over 70% decline in outbound and inbound tourism trips across sub-Saharan Africa in 2020, provided an opportunity for travel operators to reinvent their business models to cater to domestic market segments, a strategy that is likely to add value in the long term. Moreover, in countries such as Nigeria, consumer foodservice businesses are developing restaurants at petrol stations to capitalise on the 12% decline in forecourt outlets recorded in 2020, a strategy that improves their market penetration.

Spotlight on regional integration

COVID-19 reiterates the need for regional integration, with supply chain disruptions during the early stages of the pandemic necessitating increased local sourcing. As the global market reopens, such strategies have since evolved to become part of businesses' sustainability plans. The trend also placed the ratification of the African Continental Free Trade Area (AfCFTA) in the spotlight, to meet the demand of the regional market. In the meantime, regional blocs are accelerating their integration efforts, with the Kenya Association of Travel Agents, for instance, partnering with Rwanda to create a regional tourism platform. Likewise, as air transport continues to be restrained by low travel demand, with the sector expected to reach less than 60% of its 2019 level in 2021 across the sub-Saharan Africa region, initiatives such as the African Union's Trusted Travel Pass, developed in collaboration with Africa's Centers for Disease Control and Prevention, are paving the way for The Single African Air Transport Market (SAATM).

A new path for digitalised services

During the pandemic, social media became a key point of contact for businesses and consumers across sub-Saharan Africa. The shift towards digitalised services has also reduced operating costs in sectors such as travel agencies, with smaller operators leveraging the capabilities of platforms such as TripAdvisor to remain relevant. On the other hand, countries such as South Africa that implemented stricter lockdown policies, resulting in increased home seclusion, saw an increase in new e-commerce users across the mid-income consumer group. The shift also encourages chained retailers to accelerate the adoption of omnichannel approaches. Additionally, operators such as Copia are bridging the digital divide by expanding the last mile to an intermediary model that targets lower-income groups in Uganda. The strategy is also gaining traction in emerging countries such as Cameroon, where online offerings are being repositioned as remittance services. Moreover, the pandemic is also boosting demand for mobile money services. As a result, mobile money subscribers in sub-Saharan Africa reached 500 million people in 2020. The trend is supported by leading telecommunication companies and Fintech, which are paving the way for a mobile app culture.

Socioeconomic dynamics to support persisting growth

According to traditional economic theories, every recession is followed by an initial recovery and an early upswing, all of which are characterised by increased spending confidence. Prior to the pandemic, sub-Saharan Africa was already fertile ground for opportunities, with the region set to represent up to 14% of the world population by 2030. This implies that the pandemic merely reshaped business strategies to better serve households, a trend that is likely to boost growth prospects even further in retailing, travel, and consumer foodservice over the forecast period. Nonetheless, recent civil unrest in countries such as Ethiopia may have an effect on such performances.

To learn more, see Exploring Opportunities in Services and Payments in the New Normal in Sub-Saharan Africa.