Generationally high raw materials prices and soaring distribution costs are reshaping the strategies of soft drinks suppliers and bottlers in 2022. In response, the global soft drinks industry will continue to creatively explore flexible price/packaging mixes, likely introducing new, smaller-sized bottles and cans, affordable multipacks and alternative formats, such as package-free, returnable and countertop systems. A broad, adaptable packaging mix across channels allows costs to be passed on, while maintaining affordability both for the consumer and retail customers.

Price increase negotiations with retailers are made somewhat easier by strong brand power and low private label penetration in key categories, but some tension is expected in 2022-2023, particularly in discounter-centric markets in Western Europe, where the private label presence is stronger and temporary delisting is more common. Price/channel strategy will be equally important – while off-trade price increases were the focus in 2021, the recovery of the on-trade channel could also see price increases over the short-term outlook.

Raw materials costs are a primary inflation driver in soft drinks

Primary packaging materials are a significant source of the increasing cost of goods sold for brands and bottlers, with higher prices for plastic resin over the last 12 months (spiking in 2021), and low availability/high prices for recycled PET as European producers increase orders to meet new targets after the EU Plastics Directive took effect in July 2021, despite capacity challenges.

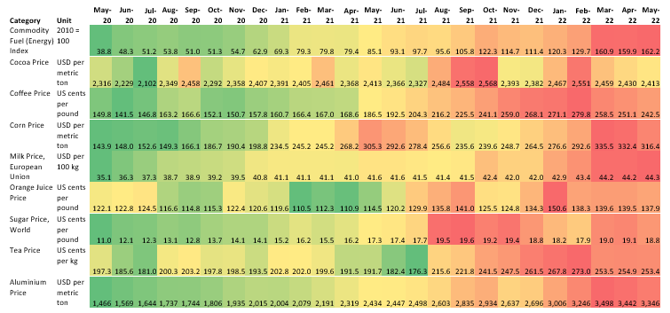

Industry Impact: Rising Prices of Commodities May 2020 – May 2022

Source: Euromonitor International from World Bank, NTO Nederland and Intercontinental Exchange (ICE)

Sky-high global aluminium prices impact brewers and soft drinks bottlers due to demand for metal cans, with double-digit increases also recorded in fibre/paperboard secondary packaging materials. Sugar prices spiked during summer 2021, but have since moderated. Coffee, tea, corn and orange juice concentrate prices reached record highs in early 2022.

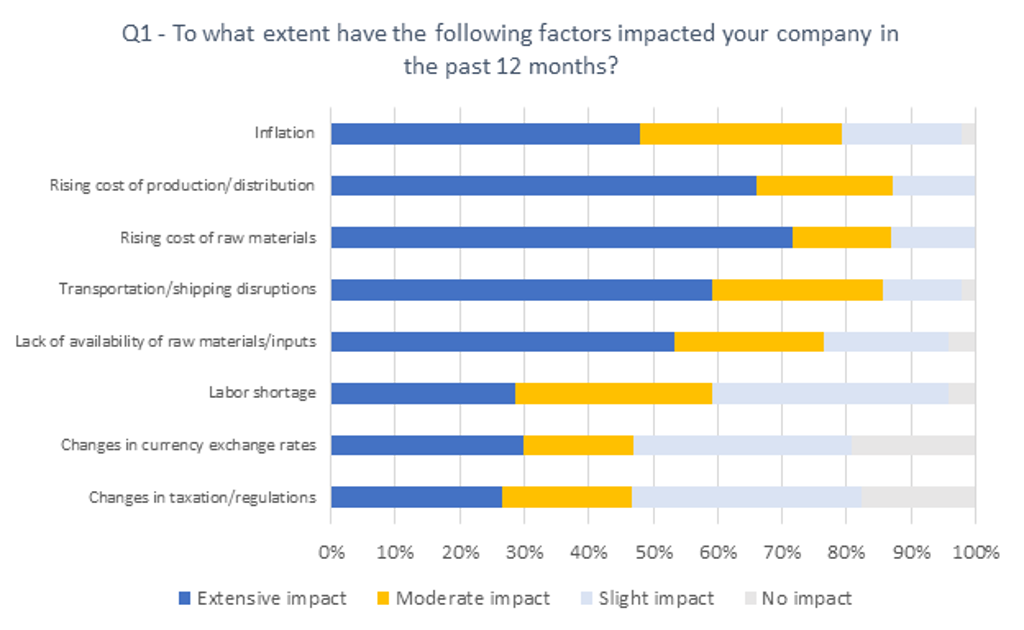

Production and transport costs are also among the highest concerns of soft drinks industry leaders

Almost 80% of respondents to Euromonitor International’s April 2022 survey of industry leaders in non-alcoholic drinks reported that inflation was having an extensive or moderate impact on business operations over the last 12 months. Rising costs of production and distribution and the rising cost of raw materials were both reported as having a similarly significant impact on beverage operations and profitability in 2022. Transportation and logistical costs were also primary factors impacting beverage respondents, while labour shortages were relatively less impactful within the industry sample.

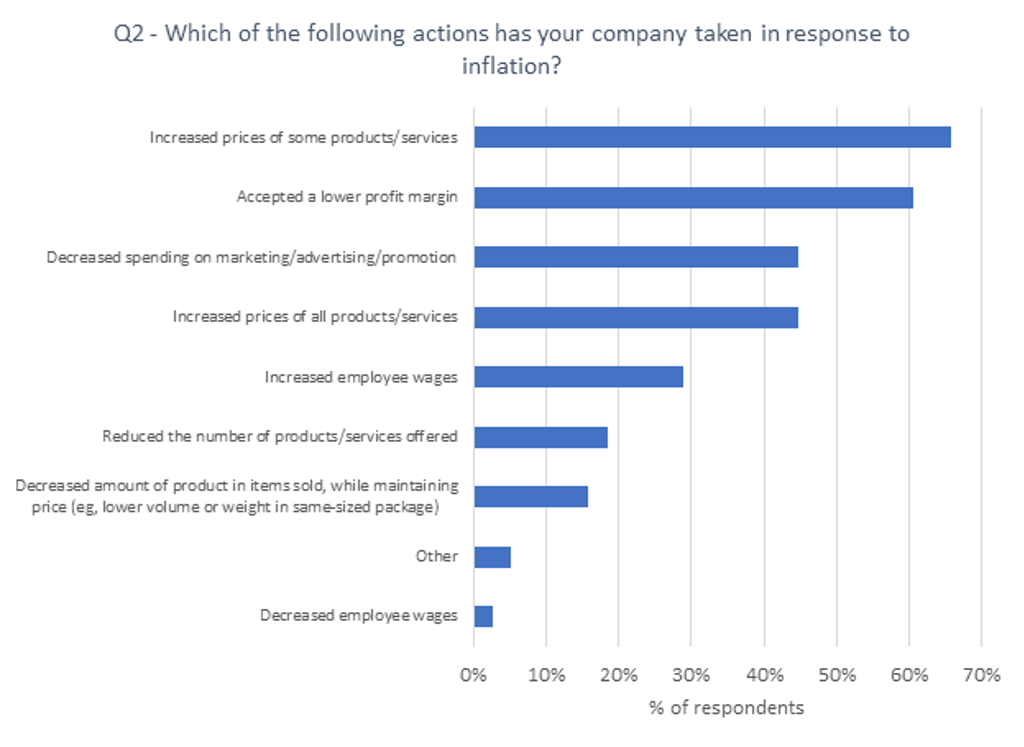

Industry leaders: Raising prices, accepting lower margins, cutting promotional spend

Within Euromonitor International’s Voice of the Industry: Non-Alcoholic Drinks Survey, April 2022, two-thirds of global respondents indicated that they had already increased the prices of some products or services in response to inflation, with 45% indicating that pricing on all products and services had been impacted over the last 12 months.

60% of respondents indicated that they intended to accept lower profit margins during this period, while only 18% reported attempting to reduce the number of products or services offered in response to price inflation.

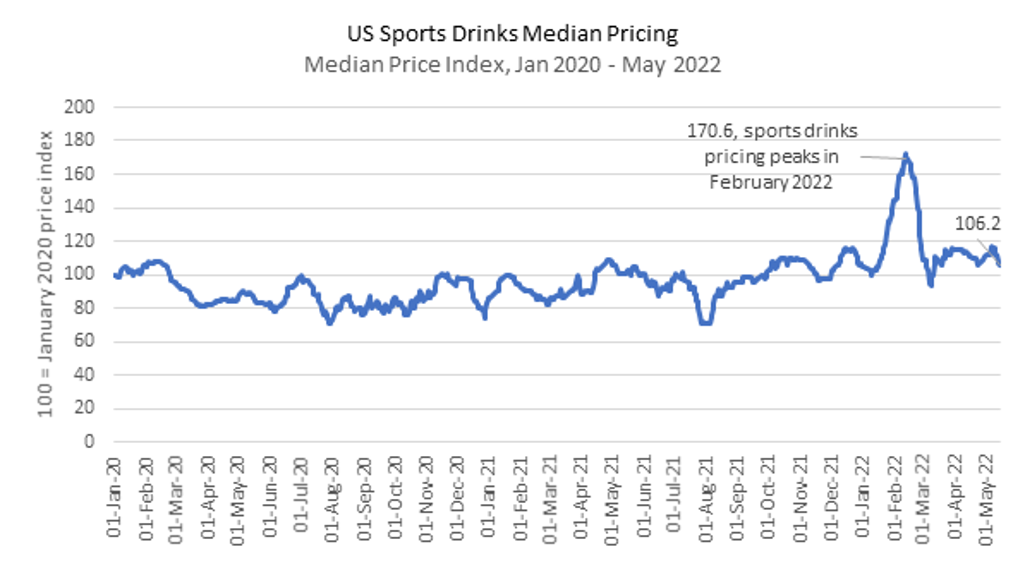

Case study: record price growth in US sports drinks

The sports drinks category in the US represents an excellent example of the pricing challenges faced by the wider industry over the last 12-24 months. Gatorade, the leading brand of sports drinks in the US, was particularly impacted by supply chain issues in 2020/2021, with reported shortages in PET packaging materials and production issues leading to national out-of-stocks for some popular flavours. According to Euromonitor International’s median pricing index, the prices of sports drinks in the US increased to a peak of 70.6% above 2020 indexed prices for a short period in February 2022 across online channels.

A large mix of SKU options for popular brands affords PepsiCo and its competitors pricing flexibility at appropriate seasonal times and across different channels/occasions. In the US, standard single-sized 32oz/946ml bottles of leading sports drinks brand Gatorade experienced a price increase entering the high-volume summer season, while SKU prices decreased (presumably through discounting) in future consumption/multipack options – a segment in which volumes have remained high. Gatorade has also experimented with a newer 28oz curved PET bottle. While multiple SKUs are utilised simultaneously in the US market depending on the channel, the 28oz unit has replaced 32oz options in some retailers in 2021/2022.

Looking to post-pandemic on-trade recovery to boost margins

A period of high inflation is not expected to impact the pace of new product innovation, with leading producers planning new launches. New brand extensions and products can be expected to focus on profitable immediate consumption and small-format pack sizes, with multipacks and larger-format SKUs facing the sharpest increases in unit price in the short term.

As pandemic restrictions are eased in many regions, higher rates of consumer mobility in 2022 will also bolster away-from-home consumption, a highly profitable business segment for suppliers, that will support profitability even as inflation drives COGS higher.

For more information on inflation in the soft drinks industry, explore the report World Market for Drinks.