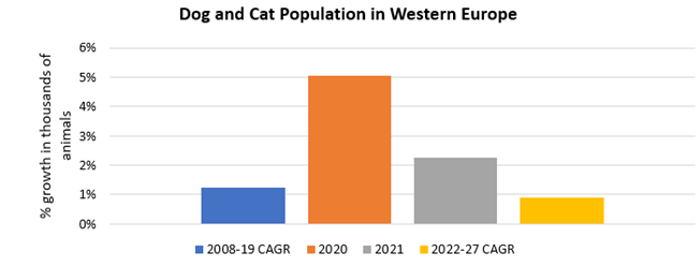

In 2020, the pet population in Western Europe increased substantially. More time spent at home as a result of home seclusion resulted in more adoptions, as people had more time to look after pets. In 2021 and 2022 growth in the pet population continues at a slower pace, driven by new lifestyles such as remote working. This has allowed more bonding between humans and pets, therefore reinforcing the humanisation trend. According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey, 71% of pet owners globally consider pets as members of the family. This is leading to greater concern for pet health and has therefore increased the demand for pet healthcare.

Increasing offer of pet products that focus on preventive health

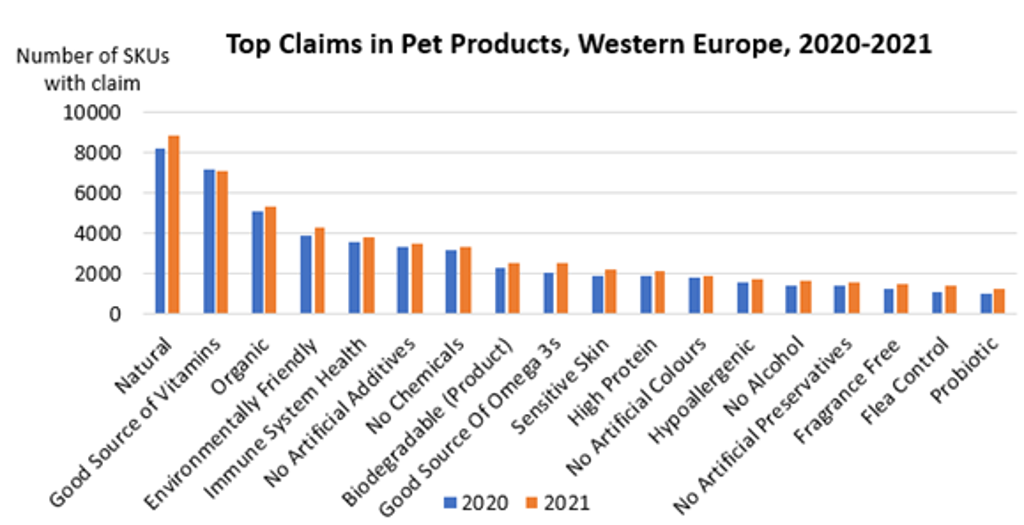

Just as consumers are generally seeking more health functionality from their own food, pet owners have also acquired more knowledge of pet health and favour preventive health and early detection of illnesses. Pet product claims such as natural, organic, immune system health, and good source of omega 3 grew in Western Europe between 2020 and 2021, according to Euromonitor’s Product Claims and Positioning data. Products such as pet supplements are gaining attention, as these address nutritional deficiencies and support pet health. Companies are tapping into this trend with new launches. For example, the French start-up Truffe & Moustache launched a premium natural pet supplement for digestive and urinary comfort. In order to offer added convenience and a human-like product proposition, it is distributed through a unique mill dispenser system, similar to a pepper grinder, and is ground on top of the animal’s food.

Studies from the Banfield pet hospital in the US have shown that on average pets are living longer. As pets get older and their metabolism slows with age, pet healthcare, particularly supplements, holds interesting potential for further dynamic value growth to 2027 in addressing the nutritional needs of senior animals. Companies that offer pet food are incorporating pet supplements in their portfolios, as this is a growing market. For instance, in the UK, Harringtons recently launched new supplements for dogs that are made from natural ingredients and contain vitamins C and E, manganese and hyaluronic acid, which are available in the form of chews and tablets.

Humanisation expands possibilities in pet products and fuels premiumisation

As owners consider their pets as family members, they want to adapt spaces to their pets’ needs. After IKEA introduced its LURVIG range of pet furniture in 2017, it launched items such as a cat house that fits in a shelving unit, and scratching mats that help to protect surfaces. IKEA is adding value to its pet products and is transforming the home to make it inclusive for humans and pets. Pet clothing is also gaining attention. Owners like to dress their pets on special occasions such as Halloween and Christmas, and enjoy sharing photos on social media with their friends. The offer in this segment has increased in terms of premium products. In Italy, for example, Luxpets offers designer clothes for dogs and cats from brands such as Versace, Fay and Barbour.

Sustainable claims on products such as pet toys and cat litter also increasingly resonate among pet owners. According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey 2022, in Europe, 67% of respondents who are pet owners are worried about climate change, and 30% buy sustainably produced items. An example of an industry response is Sanicat, which in 2021 launched plant-based cat litter made from natural and recycled materials certified as biodegradable and compostable.

Perceived added value is key during inflationary times

In 2022, prices have increased substantially as a result of supply chain issues such as higher energy, commodity and labour costs. Euromonitor International’s macroeconomic scenarios illustrate the prospect of an economic slowdown in 2022 due to inflationary pressures as the cost of living continues to increase. This is also impacting pet products, as owners are spending more compared with the previous year.

In challenging economic periods such as 2009 and 2020, pet care proved to be a resilient industry. Humanisation is causing pet care to be considered high on pet owners‘ spending priorities, and will likely lead to budget cuts being made elsewhere first. For pet owners, pet expenses are a key part of the household budget rather than a discretionary expense. Even in tough times for some pet owners, the emotional benefit of caring for a pet outweighs the financial cost, and they are keen to spend. However, as the economic context encourages pet owners to increasingly focus on the price point, mid-priced to premium brands should ensure they strike a balance between perceived value and affordability. New ways to connect with consumers and brand loyalty are also essential for industry players to remain competitive. E-commerce deals and value retailers will become more and more relevant to pet owners aiming to cut costs.

Conclusion

The humanisation trend is driving sales of pet products in Western Europe, as owners treat their pets as children, buying them items that support their wellbeing. The higher emphasis on preventive health since the start of the pandemic is also present in the pet industry, benefiting areas such as pet healthcare. Sustainability is also an important trend in pet products, with owners looking for brands that are aligned with their values. During the forecast period perceived added value will be crucial as consumers face tough decisions, given the increase in the cost of living.

For more discussion, read our report, World Market for Pet Care.