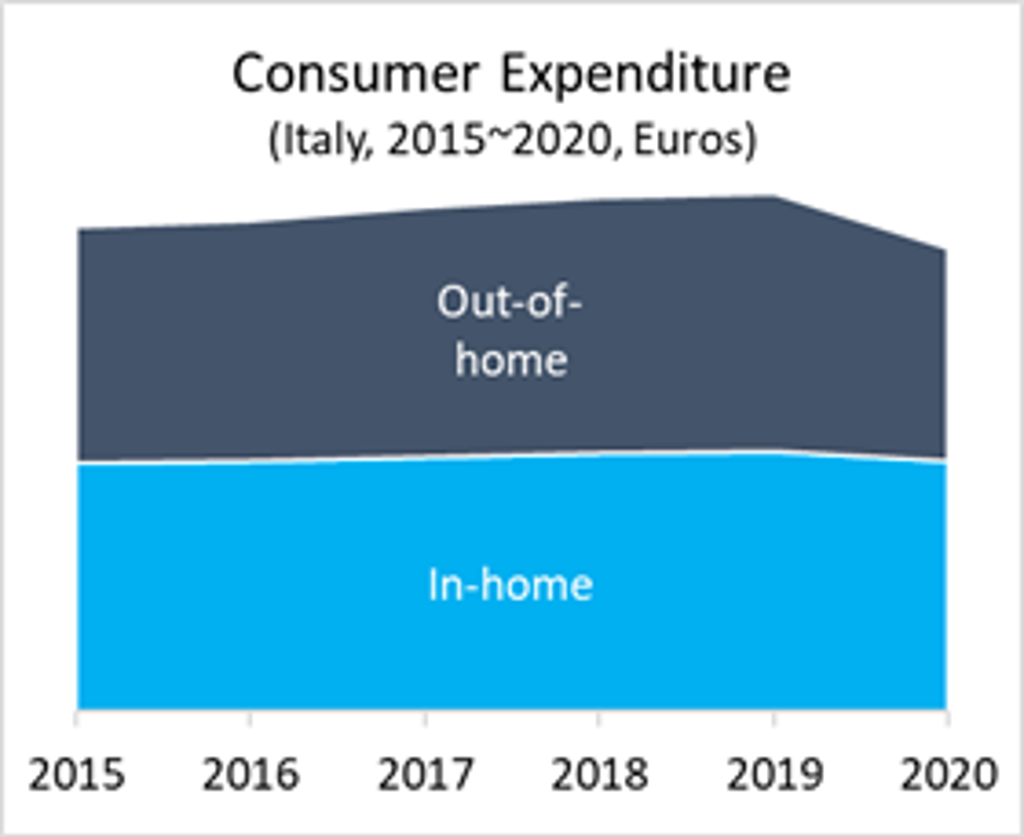

Suffering some of the worst forms of disruption in the early stages of the COVID-19 pandemic, consumer expenditure patterns in Italy were among the worst hit in Europe. Out-of-home expenditure fell in 2020 across the world, driven by closed hospitality, constrained socialising, and leisure options plus all the restrictions on travel. That decline was 9% globally and 18% in Italy - this part of the picture was in keeping with developed economies and especially other nations in Western Europe.

What stands out as unusual for Italy was what happened to in-home spending. Items such as food and drink, tobacco and alcohol and household goods on both global and European levels grew 2-4%, with clear links for out-of-home spending on hospitality and restaurants moving to become in-home consumption instead. Italy went against that pattern, with in-home spending also declining by 4%; in Western Europe, this was a trend shared only with Spain. Amid that harsh backdrop, there were some islands of optimism, with exceptions to the decline found in paint (up 15%), and barbeques (up 11%), and growth seen in tools and almost all aspects of gardening (up 4%) as discretionary spending moved from other priorities towards improving the home.

The macroeconomic situation has since rebounded, and 2021 numbers look positive, from Italy’s GDP forecast up 6% after a successful vaccine roll-out, and with new-build houses and renovations back to strong growth (according to ANCE). Within this improved situation, home improvement and gardening are also helped along (beyond common factors shared across Europe) by the Italian government’s “Superbonus” stimulus programme.

The Superbonus went active from July 2020, with reimbursement schemes aimed at minimising expenditure for final customers and linking this to tax. The programme supports upgrading Italy’s legacy housing stock which mostly pre-dates any energy-saving technologies or legislation, funding up to 110% of the conversion costs for homes upgraded to modern eco-friendly standards with a cap of EUR100,000, supporting solar panels, heat pumps and other energy-efficient systems, insulation, air conditioning systems, structural reinforcement of homes, and even new doors and windows. In short, the Superbonus funds a list of installations that will impact ceilings, walls, and floors, driving first a need for renovation and secondly a need for redecoration. The scheme organisers report that starting from a depressed market, residential building renovations jumped 500% once the Superbonus was introduced. The Superbonus was originally intended to stop at the end of 2021, but it has been extended in a reduced form and is projected to be a weaker demand driver all the way through to the end of 2023.

This stimulus is only part of the demand driver pushing growth in home improvement and gardening. Homeowners are exhibiting a greater focus on in-home comfort and wellbeing, investing in upgrading their living space. Looking at propensity data from Houzz for 2021, 43% of all homeowners in Italy planned to redecorate in 2021, and 32% were planning larger renovations (which is the largest activity level for that seen in more than four years). Kitchen refurbishments are proving extremely popular, particularly around increasing storage space and airflow, and in the garden the most popular changes have been installing more flower beds, building (and treating) fences and space dividers, and positioning various formats of plant pot (both inside the home and as outdoor decorations). Initial indications are that gardening sales in Italy have been growing more strongly than home improvement in 2021 - a pattern that matches data from other parts of Europe, too.

The home-as-a-priority demand driver has a known horizon, as it is in part funded by (and inflated by) the lack of ability to spend on out-of-home factors such as flights, holidays, hospitality and leisure. When out-of-home spending normalises, this will stop driving home improvement and gardening demand; and we are seeing evidence of that in many countries in the latter part of 2021 but expect to see the full rebalancing of priorities in 2022 (the Omicron variant being a wild card for this in early December 2021).

Sustained hybrid-working is a long-term small boost to home and garden demand

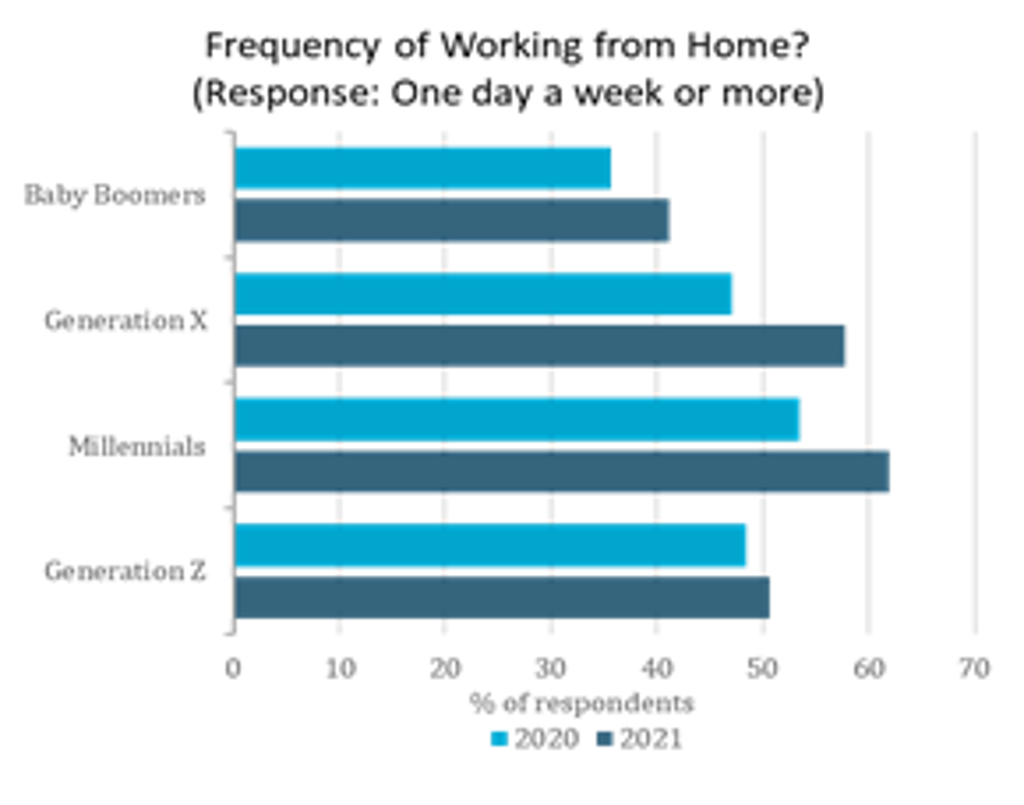

The decade leading up to 2020 saw steady but gradual growth in the number of workers spending at least some of their week working from home. This was enabled by advances in videoconferencing and cloud computing and led by demand for flexible working policies from functions such as finance, law, technology support and professional services. Conditions imposed by the pandemic markedly accelerated this trend, initially with closed facilities, but leading to a fundamental change in the willingness of workers to come to offices, and a change in the efficiency and cost of workspaces due to social distancing. Data from Euromonitor’s Consumer Lifestyles survey show a notable rise in the proportion of respondents working at least one day from home between 2020 and 2021, with the largest increases coming from the Generation X and Millennial cohorts. This is a trend in global data and not just in Italy.

Working from home is clearly an enduring feature of the labour market. Industry experts suggest that over half of polled workers in the US and the UK intend to continue to work from home for at least half of their week. In Italy, research by the Politecnico di Milano in 2021 showed that 81% of large companies and 51% of SMEs expected to maintain smart working policies in the future. Google mobility data in the final quarter of 2021 suggest that commuting and footfall in workplaces remain subdued in Italy (down 10-20% across regions), especially in cities.

Acting against this are efforts by those with a material interest in drawing consumers back into urban centres and, more importantly, bringing their spending back into shops, offices and restaurants. Many business owners have also been keener to see employees back in offices than those employees were keen to be there. A major labour shortage has created an employees’ market, matching a sharp rise in how much importance job seekers place on work-from-home policies and health and hygiene policies when judging potential employers, a factor seen in Euromonitor’s Lifestyles survey data for 2021, and forcing multiple large employers to visibly soften their stance on returning to offices.

In 2020 and through 2021, newly home-bound workers initially scrambled to convert living spaces into home offices; home seclusion during the pandemic contributed to a distinct spike in sales growth across the home and garden industry. One of the first products to benefit from this trend was, unsurprisingly, home office furniture. The category had seen steady historic growth at a 2% CAGR between 2014 and 2019. However, global retail sales expanded by USD1,817 million in 2020, surging by 9%. Much of this early spending was driven by necessity, with consumers picking up whatever furniture was available to fulfil immediate functional needs and fitting it wherever it would go in the home, with less consideration given to aesthetics. Longer term, this has manifested with built-in offices appearing in many different locations in the home, with Pinterest and other sites seeing an explosion in ideas and solutions, and multi-function products emerging to fit offices into bedrooms, kitchens, cupboards and closets. This also drove a great need for more integrated storage and space flexibility solutions, and the increase in home occupancy was also felt in products such as flooring, where noise insulation rose in importance when adults and children all need to live (and work) inside the four walls.

Working from home has been the start point for many shopping journeys across the category, and this is lasting beyond initial desk investments, redecorations and disruptions over living space. An increased duration spent in proximity to the home and garden creates greater dissatisfaction with form and function, with new priorities bringing previously unfelt or ignored flaws into stark focus - this is another factor visibly adding to the background increase in demand for renovation and decoration products and services, not just in Italy but across Europe and the US. Given the resistance to back-to-the-office policy and the new rise in hybrid policy adoption, this is a smaller demand driver that is expected to boost home and garden industry sales for the foreseeable future.

Millennials becoming novice DIYers is increasing the size of the DIY market

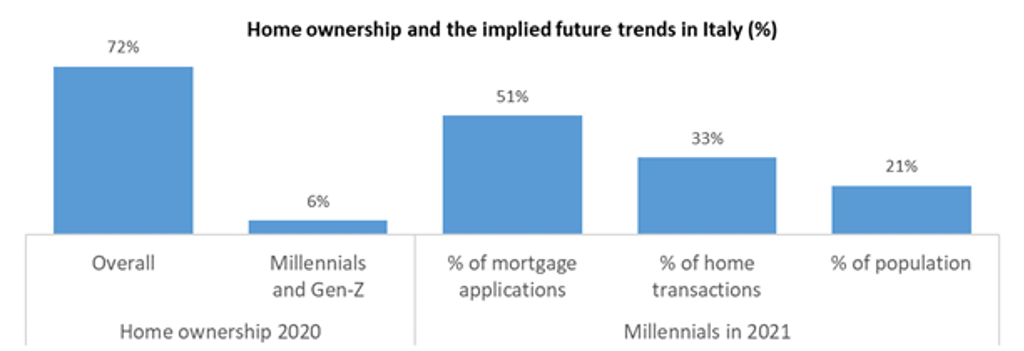

Millennials during the pandemic have been making visible efforts to exit both from family homes for the first time, and to exit rental accommodation to have a sanctuary of their own. Moving home is linked to homeowners making up to 50% more shopping journeys for home improvement and gardening needs in the year of the move versus their average patterns. Millennials are disproportionately visible as drivers in the data both for house moves and for decoration and renovation intentions triggered by moving home, which has led to a widely reported increase in Millennial shoppers walking through the door of do-it-yourself (DIY) retail and garden centres.

This phenomenon is visible in Italy but not limited to that country - indeed this is a visible change reported across North America, multiple countries in Western Europe and Australasia. Key to this development is the impact that home seclusion had on urban Millennial consumers, especially with young families, when this is a cohort characterised historically by lower participation in the market for home improvement and gardening, often viewing the home in slightly utilitarian terms as a place for rest and basic personal administration with most meaningful events taking place outside. Starting from lockdown behaviours but accelerating through 2021, Millennials have been engaging with DIY skills and patterns of spending more aligned with the generations before them, linked to this increase in home as the priority, but also a visible shift in attaining the life stage of home ownership. Millennials bring with them a strong growth uplift to the DIY and gardening industries, and the big question industry stakeholders are asking is simple - will this growth prove to be a temporary or permanent shift?

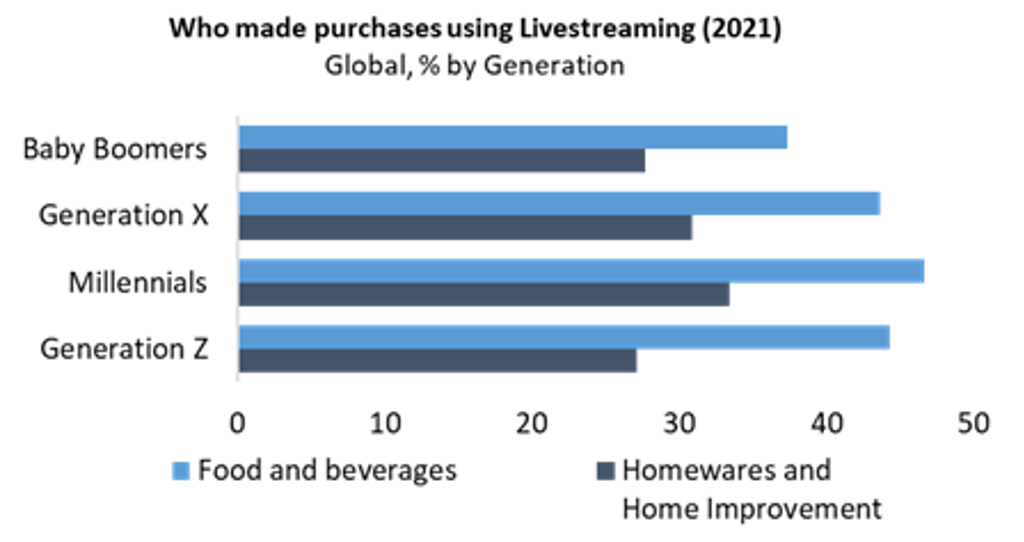

This shift is already being felt in technology adoption in the e-commerce shopping journey. When we look at Euromonitor’s Digital survey data across 2020/2021, we see Millennials consistently feature prominently, from use of augmented reality and 3D rendering tools (to visualise products at home pre-purchase) to purchases made by livestreaming that serve as both inspiration and a confidence builder for what is possible. Particularly in user-generated content (UGC), there is a loud call for better content for Millennials that is yet to be fully met by brands. Inspiring confidence, giving ideas and demonstrating the art of the possible for those with novice skills are the main needs UGC fulfils, and peer-to-peer proof of success and good outcomes is a potent part of this. Home and garden is catching up on industries such as apparel, but UGC has been a loud pain point in multiple countries, with explosions of activity on Pinterest and other image and idea sharing forums during 2020 into 2021. Influencer marketing is also playing a more involved role, but as with UGC, the emphasis is on relatable and authentic materials and voices.

This Millennial DIY and gardening growth came as a surprise to many in the industry, with Millennials historically more associated with the appeal of do-it-for-me (DIFM) services, avoiding DIY retail in greater numbers than the cohorts before them. The services pipeline for home improvement, particularly around decorating and renovating, has been over-capacity since the second half of 2020, starting with triggers linked to the housing stimulus but increasing through 2021. Even now in the final quarter of 2021, there are still reports of tradesmen unable to take on new work for the next six to 12 months, and this is not limited to Italy and the impacts of the Superbonus - far from it, we have had similar reports of this service waiting list phenomenon in the US, the UK, Germany and Australia. If you have urgent jobs needed at home, and you are told you need to wait more than half a year before you can get help, Millennials, just like everyone else, choose to turn to the DIY industry as enthusiastic novices seeking support, mentoring and inspiration. It is time for a tired stereotype to be put to rest…Millennials are now driving the growth of the DIY market.

New product responses have begun to appear in the European market in 2021, including the “Success Kits” concept being pioneered by Wolfcraft in Germany. Retail research taught the brand that this incoming wave of novice DIYers worried about:

- Which tools are ideal for the job?

- Methods to perform basic tasks that existing training materials seem to take for granted as easy or obvious.

- How to judge accurate volumes for any consumable you will need to complete the mission (packaging on this tends to be misleading or inadequate if lacking experience to judge for oneself).

- How much preparation a task will require (in time and effort).

More than anything, DIY novices worry about accidentally harming their home, or (during the pandemic at least) needing to come back to the store because they missed something or got something wrong. The stepping-stone mission for Wolfcraft’s Success Kits was clearly to remove those anxieties for the flooring task, breaking it into bite- sized stages and supporting each stage with everything needed (materials, tools, and mentoring content - printed for in-store, and in the box, and online).

A great deal of thought is going into brand and retail strategy in 2021/2022 around this Millennial growth trend, based on how to retain these shoppers inside the industry for the long term. Efforts include exploring how to mentor novices and convert them in shopping journeys for more complex projects as they improve towards becoming intermediate DIYers, chasing the inevitable increase in basket size linked to that well-tested journey. Most of all, brands need to get better at serving this segment with authenticity and without condescension - the role of user-generated content in this area cannot be over-stated for its relevance, resonance and value creation potential. This factor is driving a widely-held belief across many voices in the industry that growth rates post-pandemic will run ahead of the 2015-2020 growth rate pre-pandemic; this is the strongest visible reason for optimism going into 2022.

An escalating wave of inflation approaches, following the wave of disruption

In the worst moments of the initial lockdown when brands were looking at sales rates of -40%, -60% and even -80% down year-on-year and month-on-month, the reaction was obvious - and wrong once the nature of demand as both postponed and boosted (as opposed to lost and deflated) became visible. Inventories were depleted to increase liquidity, orders were cancelled and forecasts reduced, for parts as well as finished goods. This was not limited to home and garden; this was the narrative across almost all industries. This created the initial shortages when demand began to surge.

Alongside this, shipping costs increased dramatically in line with how much of the world’s logistics infrastructure ended up out of place; according to research by McKinsey, by the summer of 2021, the average rate for shipping a 40-foot container from China to Europe or North America was as much as six times greater than it was at the start of 2019. While higher demand for consumer goods was a partial contributor to this, the most significant driver was an acute lack of shipping capacity caused by congestion at major global ports, particularly in the US. As containers were shipped to the US and Europe, an acute shortage of long-haul truck drivers, railway workers and longshoremen developed in these markets, due to illness from COVID-19 itself and the impact of quarantine procedures that made many workers unavailable for significant periods of time.

Exacerbated by the conditions of the pandemic, this vicious cycle of shortages and congestion was made possible by the fundamental structural vulnerability of global supply chains based loosely around just-in-time principles. With a minimum of spare capacity for inventory held throughout the supply chain (and even depleted in the first actions of the crisis), even minor delays in shipping time and regional shortages of capacity had major knock-on effects. Just-in-time has in far too many cases given way to “build what you have parts for today”, with all the inefficiencies implied.

The initial impact has been stock-outs and product waiting lists. In the first half of 2021, disruptions to global supply had only a moderate impact on the retail prices paid by consumers; however much stronger inflationary pressures are making their way through the chain. According to data from the United Nations Conference on Trade and Development, rising costs of sea freight in 2021 raised average import costs by as much as 11% and caused a direct 1.5% increase in prices. According to a press release from the Chinese government, materials costs in October 2021 used in national production increased 23% year-on-year for metals, 25% year-on-year for plastics, with even wood and textiles up close to 10% year-on-year; add in the rising cost of labour and energy. In Q1 2021, the base materials inflation rate from Chinese production was 3%, it reached 11% in Q2, 13% by Q3, and it now sits at 18% so far in Q4.

Through 2021, the bulk of inflation has been resisted in retail negotiations, shared, absorbed, and pushed further up the supply chain, with cost-saving actions made as emergency plans in 2020 helping to offset the initial pressures. Smaller buyers in Italy, particularly private SMEs, typically reduced their own margins instead of passing these earlier price increases along to retailers, possibly worried about inflation driving an inevitable rise in private label as part of the effort to control margins. However, this is quickly becoming unsustainable given the scale of what is passing through the value chain. Multiple cycles of retail price increases are visible from the second half of 2021, with some brands now talking about further price increases needed next year.

Looking ahead

Home improvement has historically been nearly flat in Italy at -0.2% CAGR 2015-2020, reduced by the performance in 2020, while gardening grew at a modest 1.5% CAGR over the same period 2015-2020.

Demand drivers in 2021 have created a solid uplift for the year. Some of those drivers such as the movement of discretionary spending from out-of-home to in-home priorities will spike for 2021 and tail off during 2022 as out-of-home spending increases (especially when accompanied by energy cost increases for consumers). The home stimulus package of Superbonus is impacting 2021, but this has a time limit for potency in the short term, and it will come to a complete end in the longer term, not impacting beyond 2023.

The biggest trend so far to come out of 2021 is the demographic shift with more Millennials physically increasing the size of the home improvement and gardening markets, and this looks to be a lasting and significant industry-changing event consistent across multiple countries which creates a pressure to increase the forward forecast by multiple percentage points. With DIFM pipelines still blocked up months ahead and with evidence that Millennials are emotionally engaging in home improvement and gardening and will stay active in the market beyond the pressures of 2021, there is reason for significant optimism.

That said, inflation and the broader implications to the consumer’s baseline cost of living are widely expected to be a limiting factor that need to strongly temper that optimism looking into 2022. This revolves around the industry’s ongoing ability to service that improved level of demand amidst shortages, the supply chain’s ability (and willingness) to absorb rather than pass forward cost pressures, and around the consumer’s ongoing propensity to use rather than save discretionary spend, impacted by a perfect storm of rising costs on so many aspects of day-to-day life.

In 2021 the extreme drivers for home and garden market growth overcame extreme drivers of disruption…but that latter force is tangibly stronger as we move into 2022.

For further insight, please see our reports, Competitor Strategies in Home and Garden, and World Market for Home Improvement and Gardening.

Nick Stene is the Global Head of home and garden; he is based in London and oversees all global research. Miles Agbanrin is a Consultant specialising in home and garden industry research, also based in London. Sara Rovai is a freelance research analyst focused on home and technology research for Euromonitor in Italy.