Last September, internet-based technology and cultural enterprise, Tencent announced plans to enable merchant transactions to take place with Hong Kong dollars across Chinese mainland, through the Hong Kong version of WeChat Pay. This makes Tencent the first Chinese company in settling bills in cities like Shenzhen through Hong Kong dollar and hence further facilitating the development of cross-border digital commerce in the Greater Bay Area (GBA).

Indeed, the notion that digital commerce is enormous in GBA is nothing new. Industry observers believe that proximity payments -payments made in proximity settings, such as contactless payments by different cards at 7-Eleven- reached USD18 billion while remote purchases -payments made in remote settings like online purchases of grocery goods- exceeded USD118 billion in the region for 2018. The GBA accounts for almost a seventh of proximity payments and a tenth of remote purchases in the total market size of China, Hong Kong and Macau combined.

Given this, it may seem natural for one to perceive that both cities in the Guangdong region and in Hong Kong should be on the same page in terms of digital commerce. This might be the case for proximity payments as there is a high tendency for consumers across the Sham Chun River to pay with Octopus cards in Hong Kong, or scan mobile QR codes in Guangzhou. Nevertheless, when taking a closer look at remote purchases, a comparison between mainland cities and Hong Kong clearly illustrates a difference.

Hong Kong’s underdevelopment in digital commerce

E-commerce has expanded massively in mainland China while it has struggled to enhance its significance in Hong Kong. According to Euromonitor International, the proportion of e-commerce over total retailing transactions in mainland China jumped from 6% in 2013 to 24% in 2018 in value terms. Hong Kong’s share has remained more static, slightly increasing from 3% in 2013 to 4% in 2018. Therefore, it is not surprising to see suppliers of remote digital commerce thrive in mainland cities but not in Hong Kong.

Digital platforms have been ubiquitous in GBA cities on the Chinese mainland, in terms of numbers of providers and usage volume. The popularity of GBA consumers using Dianping.com and Meituan to make appointments and pay for services like haircuts is a good example. Meanwhile, there is a lack of strong supply and demand for remote digital commerce in Hong Kong.

While Hong Kong is undoubtedly lagging behind its counterparts in Guangdong in digital commerce, this can also represent a unique opportunity for businesses.

Source: Euromonitor International

The opportunity

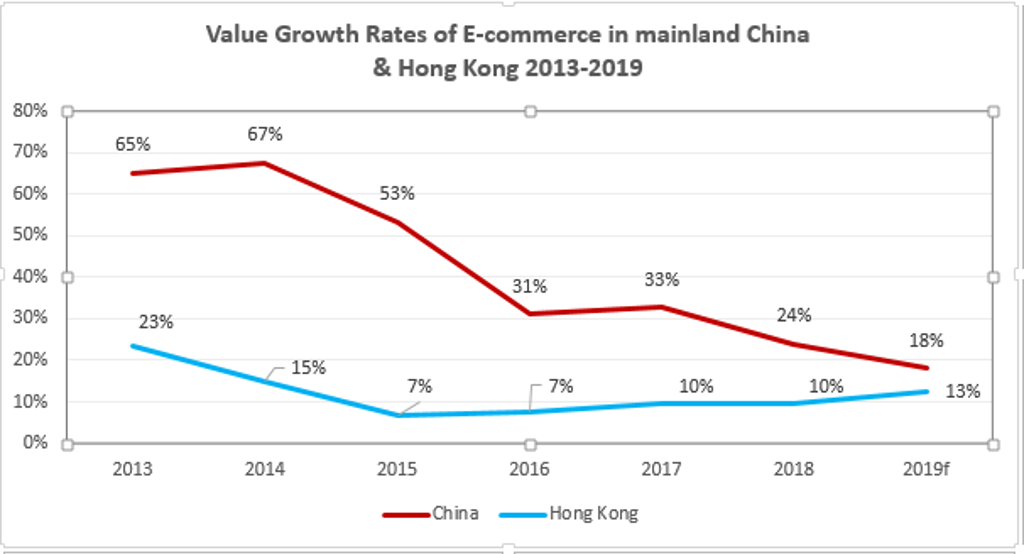

On the one hand, in total value terms, growth of e-commerce has started picking up again in Hong Kong. According to Euromonitor, the value growth rate of e-commerce has gradually risen since 2015 in the territory. At the same time, despite its massive expansions, e-commerce has abruptly slowed down in mainland China over the same period.

With an uptrend in the city and a downward movement of growth rates in the country, it is likely that Hong Kong will catch up with the red dragon soon in terms of growth speed. Different opportunities will emerge as e-commerce develops more quickly in the city.

On the other hand, in per capita terms, consumers in Hong Kong are underspending on digital commerce, presenting a gap in the market to be filled. Compared with its fellows in Guangdong, Hong Kong is a wealthier society with a higher disposable income, yet its proportion of digital commerce spending to disposable income is lower on a per capita basis.

In fact, industry experts believe that based on the current income level, Hong Kongers are underspending by more than a twentieth vis-à-vis their counterparts in Guangdong. Leveraging this unmet gap in the market will identify more opportunities for business growth.

As a result, Hong Kong consumers deserve attention again as businesses are focusing on GBA. The question here is what industries in the territory hold the greatest potential for companies to expand in digital commerce?

Sectors with explosive growth potential

One of such is retailing. Since Hong Kong consumers still shop mostly at offline stores, now is the right time to actively launch O2O integrations to upsell customers with better shopping experiences. On the mainland, when consumers go shopping offline at Fresh Hema, the physical grocery banner of Alibaba in Shenzhen, they can scan the QR codes of SKUs online for detailed product information, for making orders and for payments. Hema is so successful that Alibaba aims to open 2,000 stores under the banner by 2022.

In Hong Kong, Circle K initiated its CRM programme ‘OK Stamp It’ to allow its members to shop offline while accumulating membership points and enjoying discounts with its online app. It has proven itself a great success as it has attracted a large number of members and driven sales for the company. Given O2O retail is getting more prevalent, more such stores should be set up to cater to the growing demands of consumers in town.

Another one is transport. Hong Kong is currently investing in digital payments for public transport such as the MTR (underground system) in order to catch up with its Guangdong rivals in the GBA which are the forerunners in this area. For example, direct QR code payments were already enabled at all stations on the Guangzhou Metro in 2018 while Hong Kong MTR will only be doing so with Alipay HK by mid-2020.

Likewise, there are discussions about enhancing payment systems on buses and minibuses in the territory. As the city is developing its digital payment infrastructures and systems, investment opportunities will present themselves to companies.

Without a doubt, Hong Kong is taking a slower pace in digital commerce compared with its peers in Guangdong. Nonetheless, this also creates a unique opportunity for businesses. Those who can seize the chance and score in this open goal are set to be the top scorers.

Fresh Hema supermarket in Shenzhen, Source: Euromonitor International