Positioning Snacks for Success in a Post-Pandemic World

A version of this article originally appeared in the digital edition of Candy & Snack Today

By Jared Koerten

Coronavirus reframes snacking occasions

The Coronavirus (COVID-19) pandemic has transformed snacking. Portability, on-the-go and social occasions were disrupted by quarantine orders and distancing efforts. Sales in emerging markets – which are uniquely dependent on out-of-home occasions – and in categories like snack bars, mints and gum, all struggled with these shifts. At the same time, categories like savoury snacks, cookies or ice cream saw sales surge as stuck-at-home consumers turned to snacks for comfort and indulgence or for family movie nights.

The pandemic also intensified consumers’ focus on health and wellness within snacks. Given the increased risk that obesity, diabetes and other health conditions pose with COVID-19, people made diet a focal point during the pandemic. In 2021, 50.8% of respondents in Euromonitor International’s global Health and Nutrition Survey rated their current dietary habits as “healthy” or “extremely healthy”. This represents a 7.2 percentage point increase over 2019 – a surge evident across all regions, income groups and generations – as healthy eating became a priority during the pandemic.

Manufacturers innovate with health claims

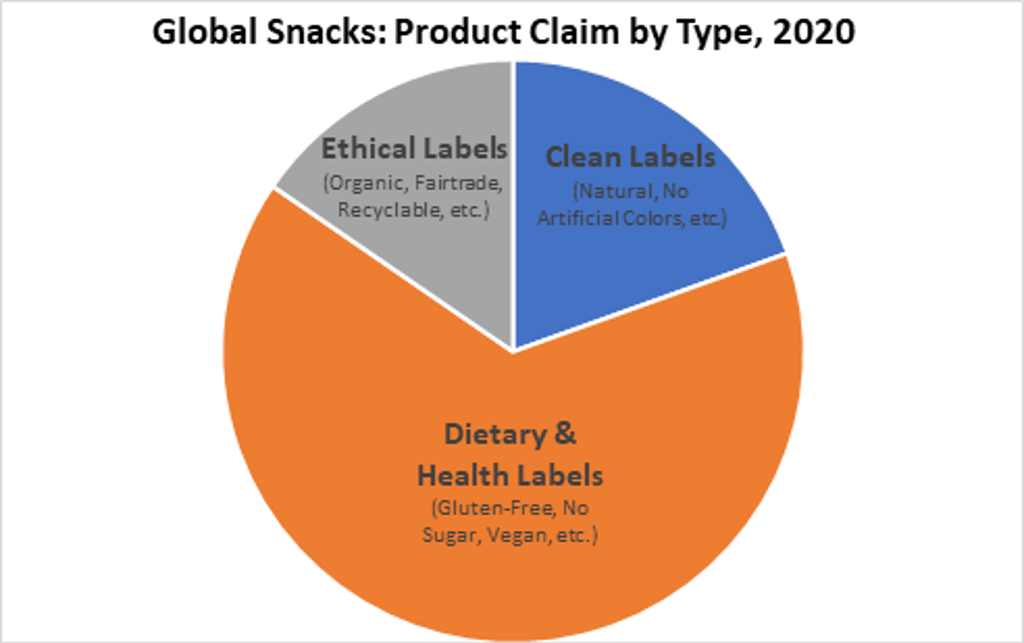

Manufacturers responded to this demand for healthier snacks with a flurry of health and wellness innovation in 2020. Euromonitor’s Product Claims and Positioning database – which monitors the prevalence of product claims on tens of millions of SKUs across the world’s top 40 e-commerce markets – shows that nearly two-thirds of all product claims across global snack categories were related to dietary and health labels in 2020.

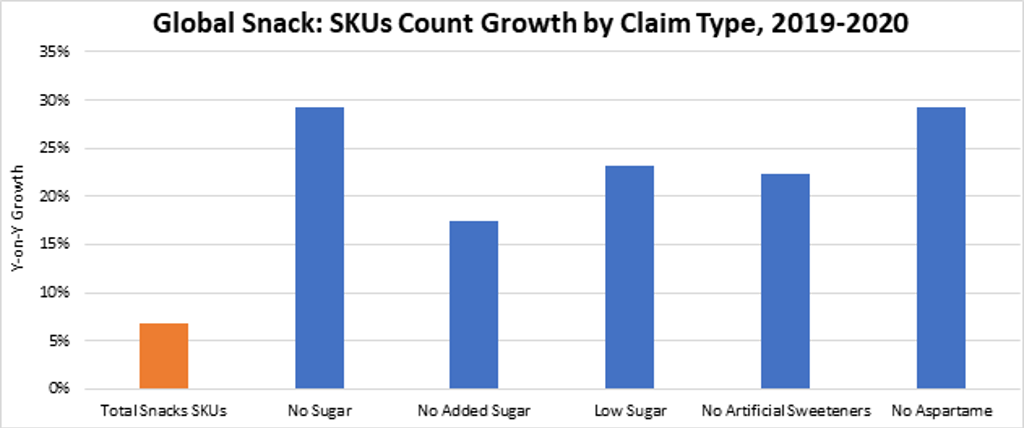

COVID-19 has helped dietary and health claims surge from this already large base. In fact, the number of SKUs with dietary and health claims within the global snacks market jumped by 12.4% between 2019 and 2020.

The rise of “permissible indulgence”

Consumers’ increasing health consciousness was complemented by a jump in stress and uncertainty surrounding the pandemic. These trends worked together to make the idea of “permissible indulgence” more important than ever as people sought to treat themselves with snacks that also met their dietary and health objectives.

Sugar reduction was a key frontier within permissible indulgence. In 2021, 37.4% of respondents in Euromonitor’s Health and Nutrition Survey looked for food and drinks with “limited sugar or no added sugar” – an increase of nearly two percentage points from 2020. Global sales of reduced sugar chocolate confectionery grew by more than 10% in 2020. And Euromonitor’s Product Claims and Positioning database saw a surge in the number of global product claims in snacks related to sugar reduction. These claims also show that people do not want to swap sugar for artificial sweeteners like aspartame.

Clean label products were another component of permissible indulgence trends in 2020. “Free-from” and “natural” claims continued to dominate the list of preferred food attributes in Euromonitor’s Health and Nutrition Survey in 2021. And despite growing from a large base, the number of snack SKUs with claims like “No Artificial Preservatives,” “Natural,” and “No Artificial Colors” jumped by 18%, 15% and 17%, respectively, in 2020.

Emerging claim frontiers in snacks

While sugar reduction and clean label are relatively well-established trends within better-for-you snacks, the pandemic also helped foster growth in several other emerging trend areas. Many of these proved to be a direct result of the pandemic, given fundamental shifts in consumer values that are likely to persist.

Immune and gut health is one such trend area, as the pandemic created a surge in demand for immunity-boosting products across food, drinks and dietary supplements. Mental wellbeing is another pandemic-driven emerging trend, with consumers turning to snacks to help reduce stress, improve focus, boost energy levels and manage moods. Finally, special diets are trending in snacks. Between 2019 and 2020, respondents to Euromonitor’s Health and Nutrition survey reported a jump in following high-protein, halal, vegetarian, and intermittent fasting diets. On the product claims slide, keto diets enjoyed tremendous growth as people gravitated toward this high-protein lifestyle.

A healthy outlook

Health and wellness trends will prove to be a major driver of future growth in snacks as COVID-19 has a lasting impact on consumers. Products that offer “permissible indulgence” with less sugar or clean labels will continue to gain share, while new types of functional products will grow to meet consumer needs in more ways. All of this points to a “healthy” outlook for global snacks.