The rising cost of goods and inflation have cast uncertainty on the recovery that the beauty and personal care industry experienced in 2021, after a challenging 2020. Global beauty and personal care increased by 7% in current terms in 2021. Leading this growth was skin care, which continues to be viewed as a long-term investment in one’s health. Self-care and emotional wellness narratives are also extending to other categories, particularly fragrances, in which consumers are seeking products that enhance mood and create feelings of comfort and nostalgia. In addition, the beauty industry is heavily investing in digital engagement and beauty tech. However, price sensitivity due to market volatility will heighten the demand for multifunctional and affordable beauty and personal care from 2022 onwards, while the costs of goods will experience volatility in this high inflationary period.

Pricing pressure and volatility expected to worsen in 2022

The global economy remains constrained by the ongoing negative effects of the pandemic, including recent Omicron-driven waves of infection, major supply bottlenecks, and high commodity and energy prices. Labour shortages and disrupted production, coupled with rising energy and commodity prices, put upward pressures on prices. In addition, the impact of sanctions placed on Russia, beginning in February 2022, and any impact on countries that placed sanctions, has not been factored into the latest research update at the time of reporting. However, the rising cost of fast-moving consumer goods was already a hurdle for global consumers in 2021, and these difficulties are likely to continue in 2022.

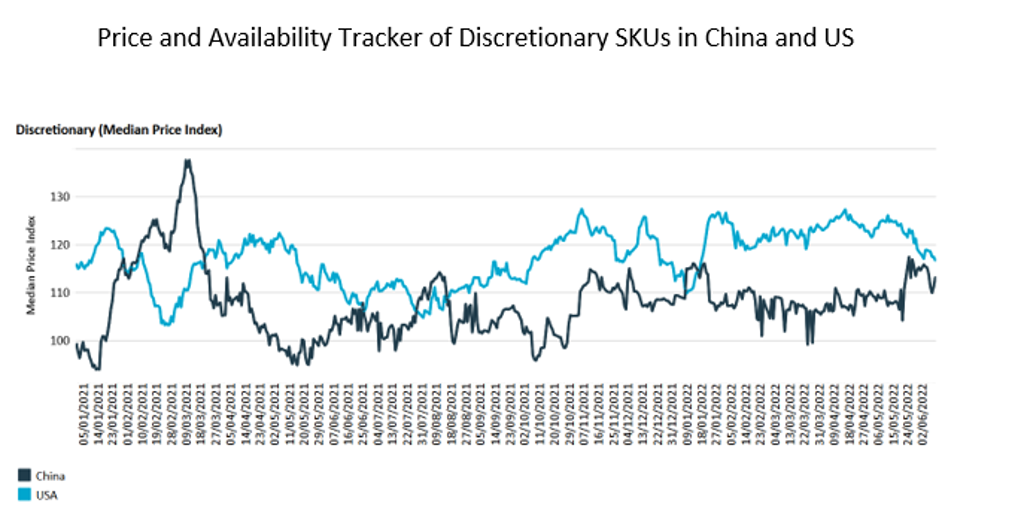

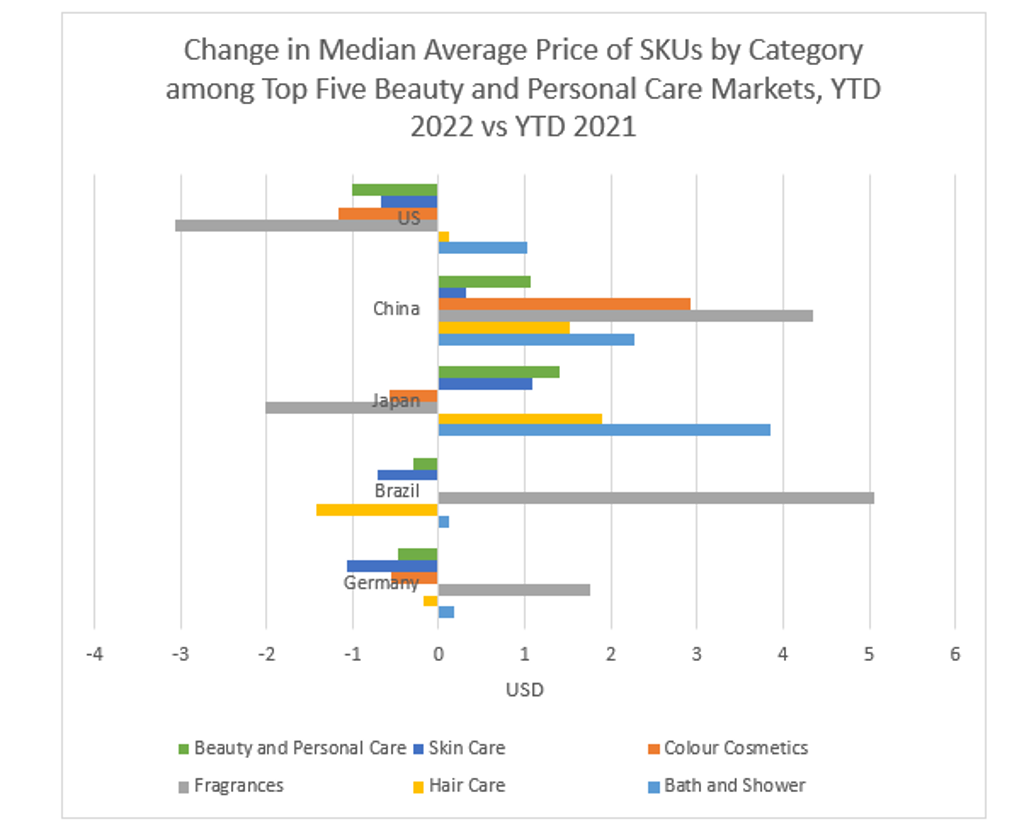

The extent of price rises will vary by category and country. Euromonitor analysed online SKUs in selected beauty and personal care categories in the top five beauty and personal care markets, comparing the change in median average prices from 1 January to 25 May 2022 against the prior year. In China, price increases in the median average price were tracked in the top six beauty and personal care categories. Continued supply chain disruptions, rising energy prices, and lockdowns in dozens of Chinese cities from March to May 2022 are contributing to rising inflation and rising unit prices, exacerbated by China’s pivotal role in the global beauty and personal care supply chain in manufacturing, packaging and ingredients. Average median prices of fragrances increased notably in China and Brazil. Combined with disruption from the war in Ukraine, a country whose top export is seed oils, which are integral to many beauty and personal care formulations, pricing pressures are expected to worsen in 2022 onward, and contribute to growing consumer price sensitivity. Beauty players may need to revisit their profit margins, which will impact unit prices and pack sizes, while also striving to maintain customer loyalty.

Product and price hybridity to target price sensitivity

Amid volatility, consumers globally are demanding more multifunctionality and price hybridity – features that tend to thrive during periods of uncertainty, such as the Global Financial Crisis of 2008-2009. Because of the rising cost of both discretionary and essential items over the past two years, consumers globally want brands that deliver the best value and optimal benefits. Multifunctionality is a key part of this response, coming in the form of hybrid items that combine benefits or multiple steps in one product. US-based Ilia Beauty’s Super Serum Skin tint, which has been instrumental in the brand’s growth, culminating in its 2022 acquisition by Famille C Venture, is one of many in the colour cosmetics category with skin and sun care benefits.

Multi-benefit products are another opportunity for beauty players. The global focus on health and safety heightened consumer demand for products that focus on skin health, leading to the “skinification” of formulae in a wide variety of categories, such as hair care (eg, super-premium Dr. Barbara Sturm Super Anti-Aging Shampoo), hand sanitisers (eg, clean beauty-focused BeautyCounter’s Hand Savior Radiance Boosting Serum + Hand Sanitizer), and deodorants (eg, Dead Sea-sourced Ahava’s Magnesium Rich Deodorant made with “skin friendly ingredients”).

Strategies for beauty players to address the challenges ahead

The global beauty and personal care industry is predicted to grow by a 3% CAGR over 2021-2026, but there are certainly challenges ahead that will once again test its resilience. Beauty players can reframe these as opportunities in a variety of ways:

- To address consumers’ price sensitivity, beauty and personal care players should highlight any product multifunctionality or pricing accessibility features. Actions may also include streamlining SKUs, focusing on best-selling “hero” items, or rolling-out limited-edition collaborations.

- In anticipation of prolonged disruption to business environments, players should also consider reallocating resources to fast-growing channels, such as e-commerce.

- Beauty players may also consider expanding into emotional wellness categories while consumers are experiencing high levels of stress.

- In the context of rising demand for value and substantiated efficacy, players should consider focusing on clinical, science-backed beauty and ingredients.

- Lastly, beauty and personal care players should “lean in” to digitalisation trends. Euromonitor International’s Voice of the Industry: Beauty and Personal Care survey found that in 2021, the majority of beauty and personal care respondents (78%) rated digital engagement as having the largest impact on beauty and personal care sales, solidifying digitalisation as a fixture in beauty and personal care globally. Players should consider experimenting with multiple aspects of beauty tech (eg diagnostic tools, AR/AI/VR, phygital reality, personalisation services), while also determining the best ways to incorporate digital strategies into the in-store experience.

For further insight see the latest report - World Market For Beauty and Personal Care.