As the discourse around female empowerment and gender inclusivity widens and greater awareness of women’s health brings further advancements in quality access and provision, implications for business across the entire value chain are gaining traction. Furthermore, a focus on precision health and personalisation, alongside the concept of self-care becoming increasingly entrenched in consumer lifestyles, is solidifying prospects in this space.

While the greater onus for further research, education and access is linked to the medical field, a number of tangible growth pockets and white spaces exist in consumer products and services. Reducing the stigma around previously taboo topics, such as menstrual care, menopausal health and sexual wellness, is accelerating consumer demand for more open and positive conversations but also for more targeted solutions that cater for women’s unique health needs. This is not only evident in the realm of medical treatments but also in prevention-oriented propositions and assistive care to support certain medical conditions.

Apart from commercialising certain opportunities, bringing female health into focus helps not only align with societal expectations of raising awareness and providing care, but also drives further investment in critically under-researched health issues and solutions. By extension, it fosters a purpose-driven corporate stance and brand messaging.

Identifying gaps across the women’s wellness solutions spectrum

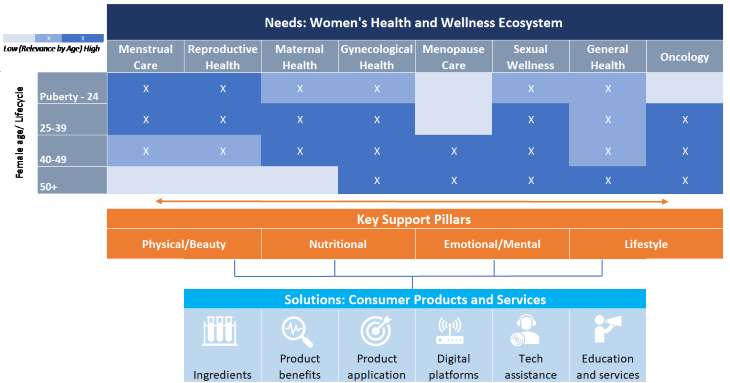

Access and specific solutions to women’s health should consider the entire spectrum of needs with a holistic outlook which factors in physical, nutritional, mental and lifestyle support pillars.

Based on Euromonitor International’s Health and Nutrition survey, over half of global female consumers state they are moderately or extremely concerned about women’s health issues, such as menopause, menstruation and fertility when considering their overall health. While 40% of respondents seek medical advice to treat or prevent associated conditions, around one third opt for supplementation in their diet or seek natural and traditional remedies respectively. One quarter look to other lifestyle factors, such as physical activity and exercise as an alternative.

Taking a closer look at the 40-59 global female age group, most relevant for menopausal health, there is an even greater proportion that prefers vitamins and dietary supplements over taking prescription medicine, such as HRT. Indeed, at USD2.5 billion sales globally, women’s health supplements have experienced one of the most dynamic levels of growth in 2022 (+9% in value) among all dietary supplements, only to be superseded by those positioned for mood/relaxation and sexual health, two other equally important components when it comes to treating issues associated with (peri) menopause.

There are divided views and a great degree of ambiguity regarding the efficacy and outcomes of both hormonal and non-hormonal treatments. More importantly, however, with challenges in diagnosis of menopause still widely prevalent, the key focus should be on holistic symptom management through nutritional and lifestyle guidance to optimise general health and on providing appropriate solutions that target related concerns and improve certain conditions. Exploring the combination of nutritional supplementation and food fortification with soy isoflavones, for example, (arguably known to mitigate symptoms of hot flushes), with phytoestrogen-based skin care to address hormonal ageing concern (such as loss of skin elasticity and collagen), could serve as one such gut-skin health axis proposition in menopausal care.

Equally, when observing earlier life stages and the associated relevance of menstrual care and reproductive health, the importance of greater education, better cycle management and improved experiences along the journey, becomes prominent. According to Euromonitor International’s Health and Nutrition survey, comfort levels with health-related technology, such as app-based services and tech-driven personalised products, are significantly higher among the 30-44 aged female cohort compared to older counterparts. As such, digital and at-home tech-enabled solutions such as period trackers, hormonal profile and fertility testing kits could provide more tailored guidance, support and education around symptoms and symptom management through the lens of physical, emotional and lifestyle factors.

Business action to untap potential

Over the last few years, there has been a proliferation of multiple women-centred and women-founded health start-ups and substantial venture capital investment in this space.

From high-tech devices to address menopausal concerns (Joylux) and pleasure serums to enhance sexual wellness (Vella), to period-proof underwear (Thinx) and at-home hormonal tracking and support (Inne and Phenology), embracing women’s wellness through a range of solutions is becoming a firm commercial proposition for small and major brands alike.

While activity by large consumer goods corporates has been patchy, there is significant market potential and innovation to be explored, not only by pure-play healthcare and pharma companies but also those in the beauty, wellness, feminine hygiene and nutritional domain.

Key recommendations for business:

- Identify target market in the context of appropriate category adjacencies and in alignment with existing business portfolios to sustain brand equity

- Expand reach through cross-industry partnerships, tech investment and start-up funding

- Instil a holistic self-care mindset and consider multiple need-state dimensions across the physical, nutritional and emotional spectrum

- Leverage medical expertise and adopt a science-first approach for trusted credibility and clinical efficacy

- Foster inclusivity in the form of improved product and service delivery, addressing under-served communities and price point accessibility

- Embed emotional connection and empathy as part of brand messaging and create spaces which allow for education and shared community experiences

As research and dialogue around women’s health advances, and the range of solutions and the competitive landscape diversify, the scope to reinvent, innovate and disrupt in traditional business spaces and beyond is taking on new and broader dimensions.

For further insight and related content, see the article Rethinking Femcare Amid Holistic Wellness Movement and report Exploring Women’s Health: Breaking Taboos in Menopause.