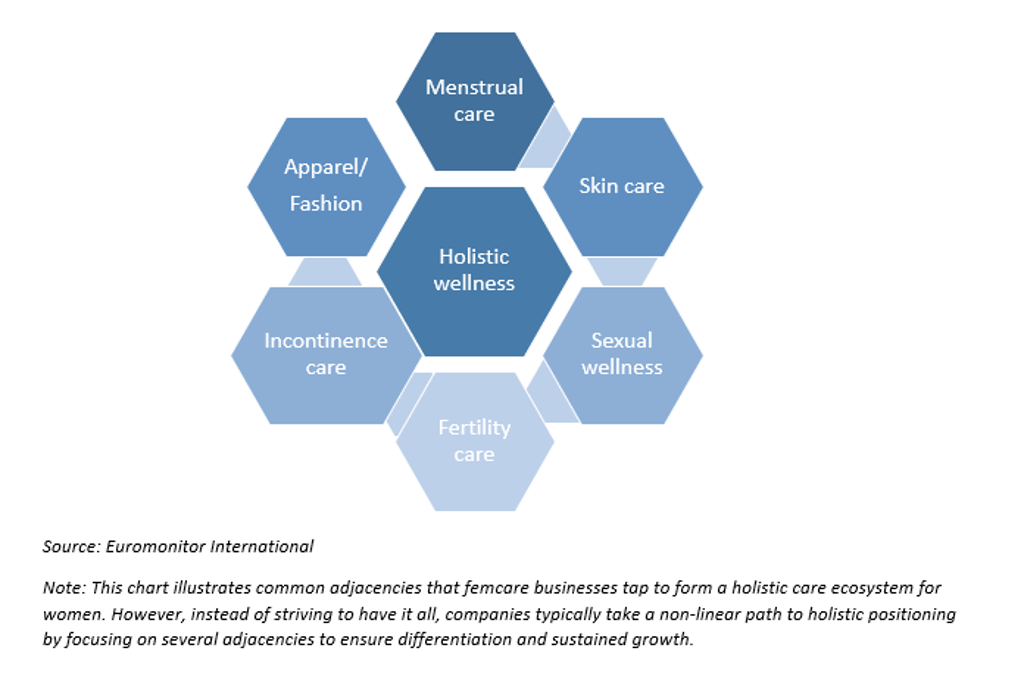

Femcare is increasingly falling into the scope of broader women’s health and beauty, which, to today’s consumer, involves multifaceted concepts indicating not only a healthy mental and physical state, but also a sense of self-recognition and satisfaction, according to Euromonitor International’s Voice of the Consumer Surveys.

The combined effect of growing female empowerment activism, “down-there” de-stigmatisation endeavours, and pandemic-fuelled self-care awareness has contributed to the growing recognition of wellness as an inherently integrated multidimensional whole encompassing skin, body and mind. This recognition has led to accelerated business drive to redefine femcare, a category most commonly referring to disposable sanitary products such as pads, liners and tampons, through a holistic wellness lens in recent years.

Skin care is increasingly treated as a natural extension of the holistic treatment of menstruation, as already explored by femcare brands such as Rael in the US, Blume in Canada and Synk Organic in Australia.

It begins with vulva and vulva skin (ie labia majora and labia minora), which are often associated with pH imbalance and skin barrier dysfunction, and hormone-related issues such as dryness, itchiness, redness, thinning and abnormal odour. These common issues therefore uphold demand for products aimed to clean, sooth, protect and nourish vulva, from wash to wipe, mist, gel, mist and cream, all increasingly popular additions to femcare lines.

Facial skin is another important frontier of skin care owing to not only its association with cycle-related skin issues such as period acne, oily skin, rashes and itch, but also beauty being increasingly treated as an extension of women’s health and a broader ecosystem.

However, ample unmet potential within period skin care exists, given the relative nascency of these products combined with lack of awareness that hormones are at the root of certain skin concerns during menstruation.

Indeed, according to the Euromonitor International Voice of the Consumer Beauty Survey, 26% of women in the 15-44 age group reported an extensive to large impact from menstrual cycle, yet only 11% looked for skin care products suited to their hormonal fluctuations. Due to this knowledge gap, brands are investing in this area, with L'Oréal partnering with period-tracking app Clue and independent beauty brands Amareta, Faace and Typology targeting cycle-related skin sensitivity and outbreaks.

Sexual wellness forms another linchpin to women’s unmet lifecycle need states

Sexual wellness is another logical element to consider for femcare brands, which are already tackling the taboo surrounding vaginas.

US femcare brand LOLA is an early adopter with its 2018 launch of Sex by LOLA, a collection of gynaecologist-approved lubricated condoms, lubricant and cleansing wipes, and further expansion of offerings in 2021 to include fertility-friendly lubricant, pleasure gel, probiotics for vaginal pH balance and urinary tract health, in addition to an ovulation test kit.

The sexual wellness industry in the US in particular has been gaining speed in recent years due to its association with self-care, with retailers such as Ulta Beauty, Bluemercury and Sephora launching sexual wellness ranges alongside beauty and personal care goods, while Reckitt Benckiser acquired US independent feminine sexual wellness brand Queen V for its inclusive Generation Z- and millennial-focused branding, and ph-balanced and gynaecologist-tested products such as intimate wipes, washes and lubricants.

Incontinence care a natural part of femcare taboo-shedding wellness endeavours

Whilst the incidence of incontinence generally increases with age, it can impact all ages due to surgery, pregnancy, childbirth, smoking, cancer treatment and age-agnostic health conditions such as obesity, diabetes, stroke, high blood pressure and neurological disorders.

In 2022, 54% women of the 15-44 age group reported experiencing severe to moderate impact of incontinence, yet 52% of women 15-44 were using menstruation pads/liners for incontinence, according to the Euromonitor International Voice of the Consumer Health and Nutrition Survey. This suggests potential knowledge and awareness gap in product usage and placing femcare brands in a prime position to educate and care.

Companies are typically addressing this adjacent need through either establishing a parallel product line dedicated to bladder leakage, as demonstrated by femcare insurgents such as Rael, Cora and Nannocare in the US, or by launching multitasker format tackling both menstruation and incontinence, as illustrated more commonly by large incumbents such as Kimberly-Clark’s One by Poise, First Quality’s Incognito by Prevail, Laurier by Kao and Sofy by Unicharm.

What is next for businesses?

The holistic shift in the femcare industry has been and will likely continue being spearheaded by a slew of direct-to-consumer brands. By offering products and services that help women achieve optimal care across a continuum of wellness needs from menstruation to skin, sexual health, incontinence as well as mental and gut health, these businesses are increasingly identifying opportunities across the entire female wellness spectrum and positioning themselves as women’s lifelong wellness partners.

The endurance of a more deeply entrenched penchant for wellness and higher expectations of efficacy, convenience and precise care among women will continue to underpin business strategies that further tie femcare with adjacent women’s wellness categories in the years to come, whether it be via innovation, cross-category partnerships or mergers and acquisitions.

While this shift bodes well for new growth opportunities, and businesses eyeing adjacencies and beauty/health players hoping to capitalise on femcare, potential challenges such as high costs, knowledge barriers and brand dilution are worth considering. Deeper understanding of available resources, financial strength and competitive environment will help businesses harness the holistic wellness wave to reinforce existing brand equity and tap complementary avenues of growth.

For further insight and related content, see the reports Value Creation Through Back to Basics in Health and Beauty, The World Market for Retail Disposable Hygiene, Competitor Strategies in Beauty and Personal Care and Top 10 Global Consumer Trends 2022.