Sustainable Beverage Packaging in Vietnam: The Present and the Future

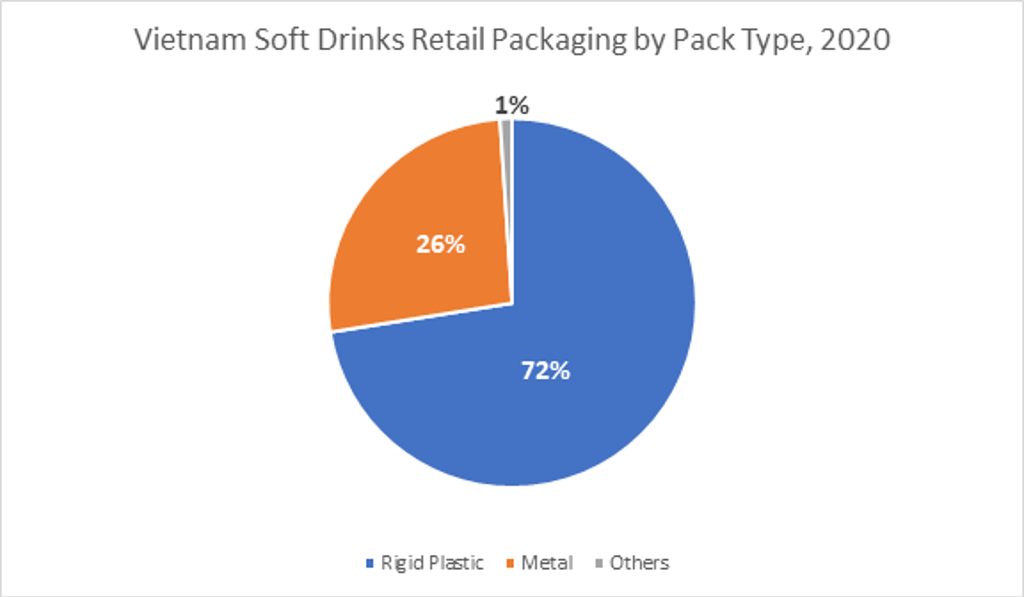

Concern for sustainability has been on the rise among Vietnamese consumers in recent years, buoyed by increased awareness and concern for the environment. While attitudes towards sustainability still may not be as strong as compared to Western Europe, an increase in prominence of sustainable beverage packaging in Vietnam is reflective of the growing sustainability trend. Within Vietnam, 72% of soft drinks retail unit packaging came in the form of rigid plastic in 2020, most commonly in PET bottles, with major applications including bottled water, carbonates, and RTD tea. This makes plastic a key focus for those keen to develop sustainable beverage packaging in Vietnam.

Global players drive sustainable beverage packaging in Vietnam

The sustainable beverage packaging scene in Vietnam is currently driven mainly by global beverage giants such as Coca-Cola, PepsiCo and Nestlé. These companies all have global sustainability targets for their packaging, and tend to have greater resources for investing in the research and development of sustainable packaging, and stronger bargaining power in sourcing partners and materials, globally. A key strategy for them often involves introducing sustainable beverage packaging format types in Western Europe first, and then replicating this across other regions, through joint regional rollouts. An example is Coca-Cola’s introduction of Sprite in more-recyclable clear PET packaging instead of the usual green colour, across Southeast Asia from 2020, including Vietnam in 2021.

The overall focus of sustainable beverage packaging in Vietnam in recent times appears to focus on areas such as the use of recycled PET bottles and plastic straw reduction. In the area of recycled packaging, Coca-Cola Vietnam launched its Dasani bottled water brand in 100% rPET in late 2020, while Nestlé’s local subsidiary, La Vie, started using 50% rPET bottled water for its 700ml pack size. Nestlé and La Vie plan to make their packaging 100% recyclable or reusable by 2025.

Plastic straws’ fifth place ranking in terms of number of items collected globally from the Ocean Conservancy’s 2020 International Clean-up report has shone a light on the issue of disposing of single use plastics, particularly smaller items, like plastic straws. Nestlé has been among the strongest advocates for plastic straw alternatives in Vietnam. Its Nesvita 5 Beans brand introduced paper straws as a replacement for plastic straws in 2020, while Milo was introduced in the same year in liquid cartons with a cap closure, eliminating the need for plastic straws.

Amidst sustainability efforts by predominantly international players in Vietnam, local players have started to gain prominence in introducing sustainable beverage packaging too. Winking Seal Beer Co, more commonly known for its craft beer, launched bottled water in a metal can in Vietnam. Similarly, Vinamilk has been active in plastic reduction and removal since 2019 in its yoghurt category, where it removed plastic spoons from its spoonable yoghurt and plastic straws from its drinking yoghurt.

What we can expect in Vietnam moving ahead

According to Euromonitor International’s 2021 Voice of the Industry Sustainability Survey, 79% of food and beverage companies surveyed globally expect to invest in the development of sustainable products. These forward-looking sustainability investment plans are expected to have a ripple effect on Vietnam, too. To have a sneak preview of the sustainable beverage packaging situation in Vietnam over the next few years, we can take a look at early adopter regions, such as Western Europe. Over in Western Europe, Coca-Cola bottles its entire portfolio of locally produced beverage brands in Sweden, Netherlands and Norway with 100% rPET, while PepsiCo has committed to sell only 100% rPET in nine European countries by 2022. These happenings in Europe point towards global players possibly looking at expanding 100% rPET bottles across their beverage portfolio in Vietnam in the coming years.

Vietnamese consumers will be crucial stakeholders in driving sustainable beverage packaging in Vietnam in the years ahead. The younger generation Z and millennials tend to have the strongest feelings towards the sustainability cause. These two generations will make up an increased proportion of the Vietnamese consumer base in the coming years. Brands will need to cater towards the wants of these two generations through the adoption of stronger company sustainability policies, including the area of sustainable beverage packaging.