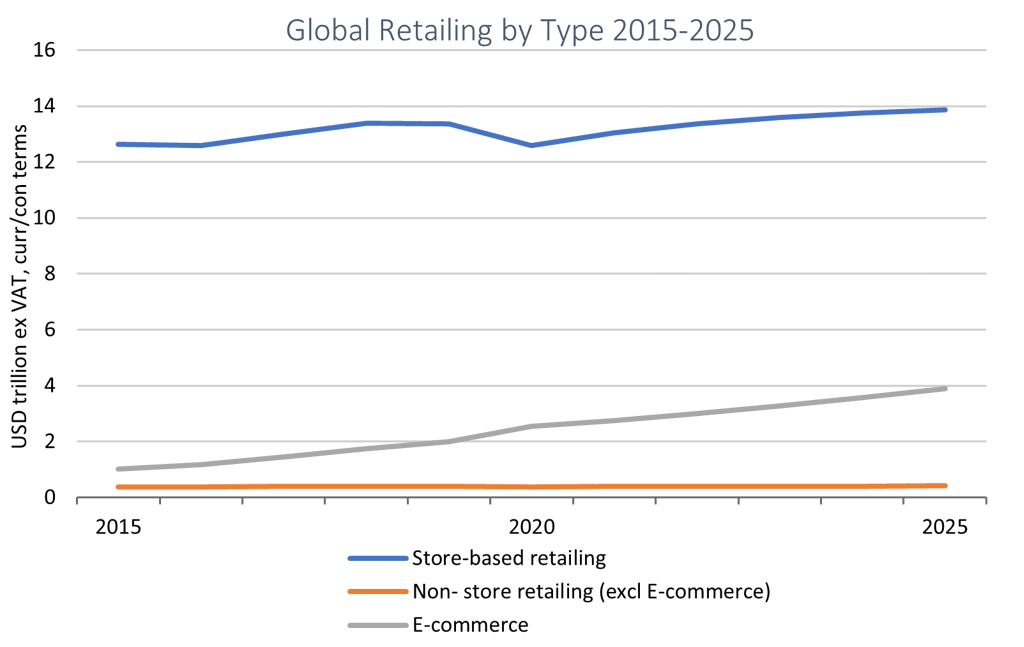

The Coronavirus (COVID-19) pandemic is magnifying the need for retailers to rethink how physical space is used in the future. Although much attention over the last year has been given to the overnight boom in e-commerce and the shift away from stores, physical outlets remain a critical part of the shopping journey. Euromonitor International estimates that, in 2025, 76% of goods will still be bought in-store, although that would mark a reduction from 81% in 2020.

Source: Passport Retailing, 2021 edition

As the world moves into a “new normal”, retailers and brands are focusing on four key areas in order to prepare for what’s next:

Companies reassess physical store space and location

After rapidly adapting to limitations imposed by government regulations amid the pandemic, physical retail is laying the groundwork for transformation. An essential part of this process will be the revision of a vast physical presence. Euromonitor International estimates that more than 135 million square metres of selling space and 1.7 million points of sale were lost globally in 2020 alone. Some 5% of all non-grocery retail stores in Western Europe and North America closed permanently amid the ongoing operational challenges.

The adverse outlook for physical retailing seems is likely to remain, with global operators like Inditex announcing plans in 2020 to close 1,200 stores globally by 2022, to focus on larger flagship outlets. Coffee giant Starbucks is shutting 800 stores, most of them in dense metro centres, due to underperformance in comparison with drive-through locations.

Additionally, with central city locations being hit particularly hard by the pandemic, even iconic high street retailers have been trying to lure consumers back to brick-and-mortar retail by changing the role and location of their stores. Harrods in the UK, for instance, has already made a foray into the suburbs with the launch of H Beauty at Intu Lakeside in Essex and plans to expand the concept mid-2021 at Intu in Milton Keynes, tapping into a more local, younger and domestic consumer base.

Physical stores reimagined

But with the death of stores that are in the wrong format, the wrong size or in the wrong location, comes the birth of fresh new thinking. Over the past 12 months, we have seen retailers across the board changing their strategies and experimenting more with pop-up, store-within-a-store and even mobile or “shop-on-wheels” concepts.

Swarovski used the lockdown to refine its brand image and product portfolio, relaunching with a higher-end lifestyle positioning in 2021. That included the opening of 28 temporary Instant Wonder stores, all of which host live and digital events.

Swarovski was the world’s ninth-largest jewellery retailer in 2019, but its market share in personal accessories has only grown marginally since 2016, amid intense competition from costume jewellery brands and fast fashion giants. As part of wider plans to reposition itself higher up the luxury tier of jewellery, it launched the first of its Instant Wonder pop-ups in Milan in February 2021, providing consumers with a more premium multi-sensory shopping experience.

Pop-up stores of this ilk will become even more important in allowing retailers to introduce more creative, brand-focused and experience-led spaces while allowing them to sign more flexible, short-term lease agreements.

Photo Source: Swarovski’s Facebook page – first Instant Wonder store in Milan, Feb 2021

Set to officially launch in the spring of 2021, Grocery Neighbour is an innovative concept being trialled in Canada that is designed to deliver the store directly to consumers’ doors – no online ordering, no delivery costs. The entire store is in the form of a truck with two doors – one to enter and one to exit – creating a mobile grocery store that comes to you. The concept is neighbourhood-centric, meaning that each truck can evolve its proposition to only carry the products demanded by people living in a particular area.

A number of post-pandemic trends could work in Grocery Neighbour’s favour. Despite the boom in online grocery shopping, many older consumers still struggle with e-commerce but may not want to return to supermarkets or convenience stores. Moreover, according to Euromonitor International’s COVID-19 Voice of the Industry Survey conducted in November 2020, almost 70% of consumers expect to work from home more frequently even after the pandemic has dissipated.

As consumers flee big cities, localised, neighbourhood-specific solutions of this ilk are likely to gain traction. Grocery Neighbour aims to expand aggressively outside of Toronto, with CEO Frank Sinopoli eyeing as many as 1,000 trucks within the next five years.

Photo Source: Grocery Neighbour

Physical retail as a support vehicle for further e-commerce gains

Although the pandemic has driven polarising performance for online and offline retail value sales, physical retailers have also been tackling the increased pressure on their supply chains by better leveraging stores to fulfil online orders.

Some retailers have had success converting their shops to dark stores, which are essentially warehouses that can be used to facilitate click-and-collect services. This has been particularly important in highly densely populated areas in the cities, as retailers needed to find ways to improve their operational efficiency and speed of delivery. For instance, in Spain, El Corte Ingles converted a Bricor DIY store into a dark store to help support online food orders and improve its ability to fulfil them in just 10 days.

Moving forward, local micro-fulfilment centres will become increasingly popular as an extension to existing stores, not just in Europe, but globally. The world’s biggest grocer Walmart has already signalled its intention in this area, with plans to roll out local fulfilment centres at dozens of stores in the US in 2021.

Key lessons for retailers

● The rapid uptake of e-commerce in 2020 means physical retail will have to re-examine its size, location and role moving forward. Physical retail must become multi-dimensional, with stores simultaneously operating as selling spaces, fulfilment centres, engagement areas and branding vehicles.

● COVID-19 pushed companies of all types to look for new digital sales channels and unusual partnerships to buoy revenue. These will persist and managing a suite of channels will become the norm for retailers moving forward. However, although the look, location, role and feel of brick-and-mortar stores are evolving, store-based retailing will remain the largest and most important channel globally over the next five years. Therefore, omnichannel, rather than just e-commerce, will drive growth and recovery for retailers beyond the pandemic.

● The suburbs and smaller cities offer huge opportunities for retailers. Such locations are well-positioned to capitalise on the influx of shoppers already fleeing big cities, spurring growth in smaller metropolitan areas at a fraction of the cost.