The diversification efforts made by beverage companies are increasingly far-reaching. Occasions rather than category loyalty now govern consumers’ choice of drink, so it is only logical that leading players are moving in the same direction.

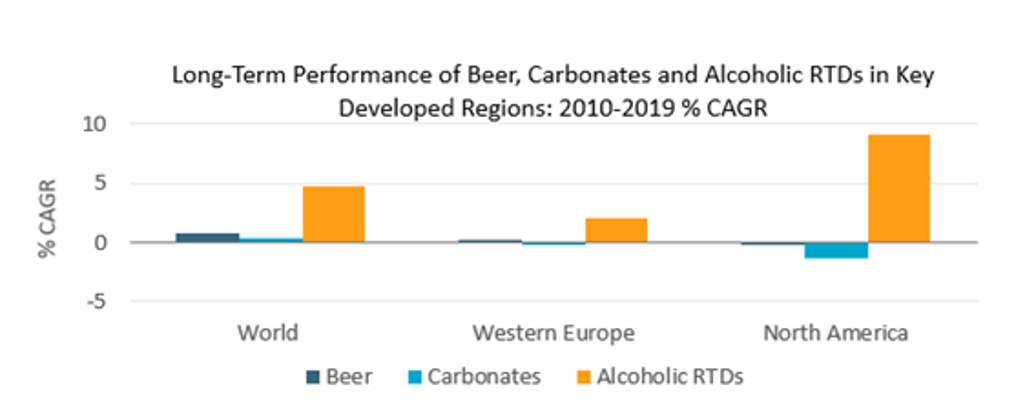

Spurred on by stagnation in key developed markets, international brewers are prioritising expansion outside of beer through value-generating opportunities offered by spirits, RTDs and the non-alcoholic sector. At the same time, leading soft drinks producers are exploring opportunities in alcohol.

Diversification drives wave of activity

Involvement in a diverse range of products will help beverage companies to gain a more comprehensive understanding of consumers’ drinking behaviour. An initial learning period is required to reach this point. Gaps in expertise are being mainly addressed through acquisitions and partnerships.

A wave of significant cross-category corporate activity has taken place over the last year. Heineken’s acquisition of Distell – including wine and spirits brands – announced in late 2021, is an obvious example. Suntory and Boston Beer have formed a US partnership, with plans to extend Sauza tequila into RTDs and Truly hard seltzer into spirits. In early 2022, Monster announced its acquisition of US brewer CANarchy.

Category lines continue to blur

The lines separating different drinks have been eroding for some time. Evolving tastes are favouring products that cannot easily be slotted into rigidly-defined categories.

Within alcohol, the ongoing popularity of RTDs is attracting attention from all sides, bringing together brands spanning various categories. Non-alcoholic beer, spirits and wine are competing with adult soft drinks in the no/low sector, while there is considerable interest in alcoholic versions of tea and kombucha.

The beverage format’s longstanding association with functionality is opening the door to non-alcoholic brands advertising mood-enhancing benefits – relaxation or improved sociability. So far, it is predominately small, independent start-ups that are exploring this field. This is understandable, given the still emerging status of such products and major corporations’ requirements for regulatory clarity. Developments are undoubtedly being followed closely.

Expected disruption from cannabis drinks is also relevant here. Partnerships between cannabis companies and drinks producers have benefits on both sides; drinks need to expand their consumer appeal, while cannabis players are looking to move into beverages. Therefore, access to an established infrastructure can help to fast-track progress.

Branching out will become increasingly common

Of course, these patterns do not apply universally – there can be advantages in maintaining a narrow focus, as in the case of some high-end spirits players. Jumping into the unknown too readily also carries the risk of facing overinflated expectations based on short-term indicators. Due diligence and taking the time to understand the full context is essential.

Nevertheless, the resilience and versatility offered by a broad portfolio covering a range of categories and price points is rarely more apparent than in times of crisis, which has been recently brought into sharp focus. Cross-category ambitions are climbing the agenda. Diversification efforts will add to already intense competition in key premium segments, further boosting the appeal of broad expansion opportunities. Total beverage companies represent the future for the top tiers of the competitive drinks landscape.

For further insight, read our report Competitor Strategies in Alcoholic Drinks