The low volume growth prospects expected in baby food call for innovation from brands to sustain value growth, and therefore premiumisation will continue to be crucial to win in the baby food space. In this vein, meeting parents’ demands around clean label, functionality and convenience are essential to succeed, given the challenging and competitive environment.

Clean label and functionality at the top of parents’ agenda

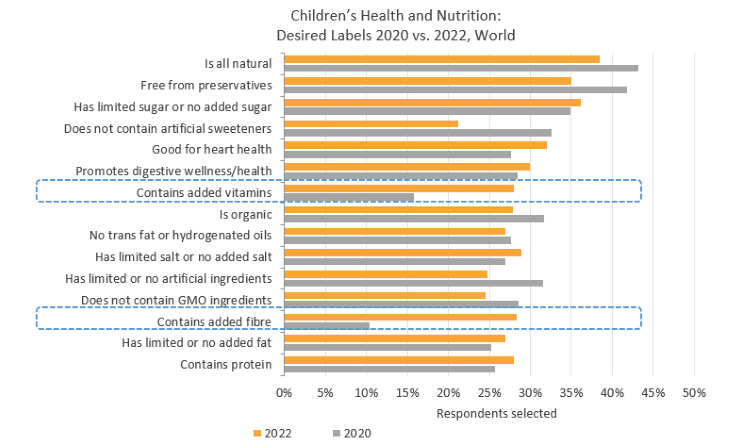

Clean label offerings continue to be a top priority for parents, who mostly look for “all natural” and “free from preservatives” claims. Limiting sugar intake is also key and has grown in importance for parents globally. It is increasingly known that regular consumption of sugar above the recommended level means high calorie intake that, if not burnt, is stored as fat. This can lead to weight gain, and if sustained, in time can contribute to becoming overweight or obese.

Good and balanced nutrition has also significantly grown in importance for parents. Between 2020 and 2022, added vitamins and fibre are the desired labels that have grown the most globally, hence they are must-have features in any innovation to hit shelves in the baby food aisle. In this context, Nestlé-owned SMA launched a new multigrain cereal range under its Little Steps brand in the UK in August 2022, made with cereals and fruits, containing no added sugars, and fortified with vitamins C and D, iron and calcium. Despite the multigrain content (e.g., oats, barley) there is no on-pack fibre claim, which could be an interesting one to add, given its increased demand.

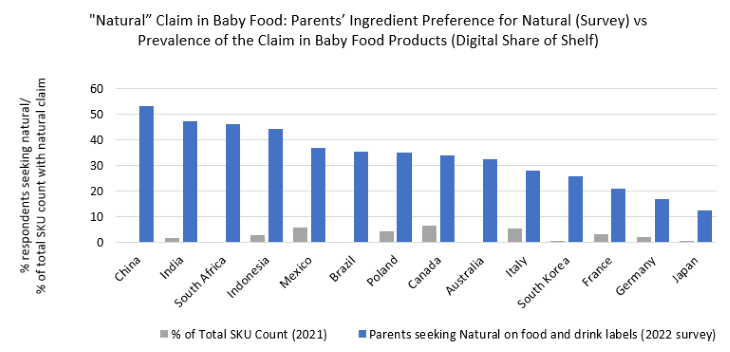

As the top clean label claims desired by parents in baby food are “natural” and “free from preservatives”, it shows that there are opportunities for companies to make better use of these claims across markets. There is a significant gap between parents’ desires and the presence of these claims in products, especially with the usage of “natural”, considering that there is limited or non-existent regulation for this claim.

In connection with the natural movement, organic accounts for a very significant opportunity in the baby food space. Analysing the claims landscape in online retailers, it remains the most available attribute in baby food across most regions, and is especially widespread in Western Europe and North America. European markets such as Switzerland, Germany and Austria show even higher penetration, with over 60% of baby food being certified organic. Other interesting attributes that represent must-haves in baby food include “probiotics” in Asia Pacific, “no GMO” in North America, and “gluten-free” in Western Europe.

Plant-based: A growing opportunity in the baby food aisle

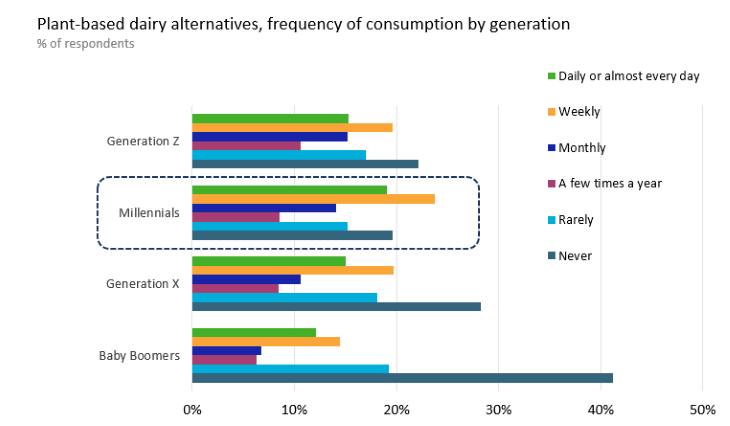

The plant-based space is another emerging trend in baby food, due to the rise of flexitarian consumers in Western markets. Millennials, which is the consumer segment that represents the bulk of new parents, is also the generation that consumes plant-based dairy more regularly. And, considering that nearly 40% of consumers choose these alternatives “to feel healthier”, the habit is likely to be passed onto their offspring.

In milk formula, however, plant-based alternatives remain a niche. The main issue is the need to mimic breast milk, which remains a challenge using plant-based ingredients. Also, there are still fears amongst many parents that these alternatives are not complete enough from a nutrition perspective. Therefore, it is essential to target the right consumer base for these products, who tend to be vegan parents, and those whose babies have an allergy or intolerance and have seen better digestion with such alternatives. Plant-based ingredients that are not considered highly allergenic or are rarely associated with allergies, such as oats (if gluten-free certified), pea, rice, coconut or chickpeas, enjoy a key advantage to target children with allergies. In the milk formula space, there are interesting opportunities for milks targeted towards children aged over 12 months, as there are not the same requirements to replicate breast milk. Besides, innovation is seeing seen with plant-based ingredients in prepared baby food and baby snacks.

E-commerce continues its upward trajectory in baby food

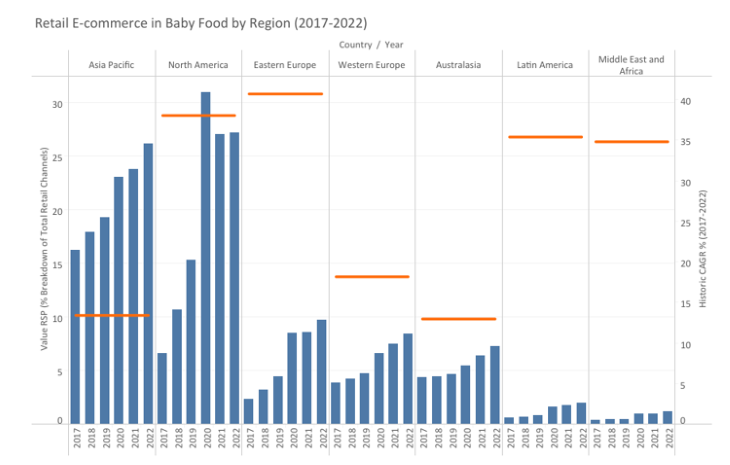

While grocery retailers remain the most important for the distribution of baby food globally (44% share of overall retail sales), e-commerce continues its strong growth in 2022, after a record increase in 2020.

In 2022, online channels are set to account for 20% of retail sales globally for baby food, seeing a doubling of share since 2017. This is also well above the average for dairy products, where e-commerce is only set to account for a 3.5% share of global retail sales in 2022.

Driven by Asia Pacific and North America, especially South Korea, China and the US, opportunities abound as the habit of buying online continues. The rest of the regions are playing catch-up, and interesting opportunities are springing up in Europe and Australasia. In line with this demand, more baby food manufacturers are strengthening their online presence and launching DTC models. An example is the New Zealand subsidiary of Heinz, Wattie’s, that launched a subscription and gifting service for its baby pouches in August 2022.

Key recommendations for baby food manufacturers

Clean label related claims and low sugar content are must-have attributes in baby food products, as these are at the top of parents’ priorities. In addition, there is room to make better use of the “all natural” claim, as there is limited or non-existent regulation for this claim and it is currently underused in baby food. Plant-based offerings should also be brought into focus, particularly innovations in milk formula for children aged over 12 months, prepared baby food and baby snacks.

Finally, it will be crucial to target the new generation of tech-savvy parents with online models. Convenience and discounts on subscription-based programmes for recurring purchases are the key drivers leading the trend.

Learn more about the key trends driving baby food in the full report, Children's Food: A Playground of Opportunity.