As global consumers face geopolitical uncertainty and challenges posed by rising living costs, insights into worldwide income and expenditure trends become critical to corporate strategy planning. Euromonitor International has identified the top five trends to help companies predict the purchasing power potential and spending patterns of the most important consumer segments.

1. Shifting to cautious and conscious spending

Global disposable household income growth is dwindling below the inflation rate, making consumers even more price-conscious than before. According to the Euromonitor International Voice of the Consumer: Lifestyles Survey, in 2023, 43.8% of respondents prioritised “finding bargains”, putting this shopping preference well ahead of the others.

However, the shift from conspicuous to conscious and selective consumption does not stop on price-savviness. Consumers are searching for wide-ranging values, such as quality, social and environmental responsibility, durability and authenticity, to complement their purchases.

To remain relevant, businesses must find ways to offer both affordability and value to consumers. Putting the consumer at the heart of the business and moving away from a product-centric approach to a consumer-centric strategy is essential and includes aligning with consumer values and prioritising loyalty through transparency, partnerships and innovative solutions.

2. Charting Gen Z’s spending

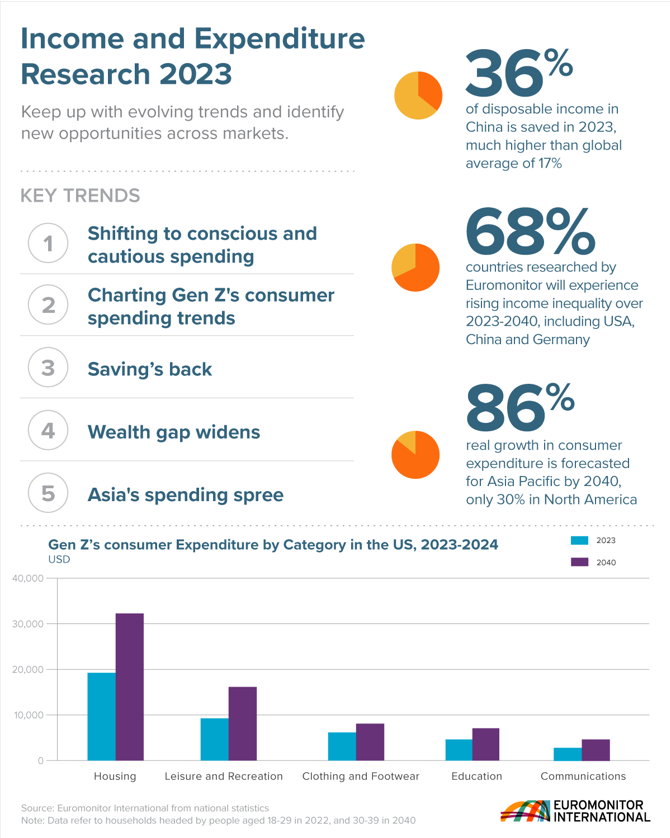

Gen Zs (born between 1995 and 2009) are numerous but not yet wealthy. Still, their cumulative aggregate purchasing power is already substantial and will snowball as more of them join the workforce and advance in their careers. Euromonitor expects that current working Gen Zs (now in their 20s) will witness nearly triple-digit income growth in real terms by 2040 (when they are in their late 30s and early 40s).

Having lived through a few highly influential socioeconomic events, such as the Great Recession and COVID-19 pandemic and being exposed to increasing living costs amidst timid income growth, Gen Zs have a different worldview and priorities than preceding generations.

For starters, Gen Z possess significantly lower purchasing power than baby boomers or millennials at the same age, not only because they are at the beginning of their careers, but also due to the record-high accommodation prices. According to the Euromonitor International Voice of the Consumer: Lifestyles Survey 2023, 28% of Gen Z planned to increase their spending on accommodation in the coming year – the move that significantly limits their budget allocations for discretionary items.

Health, particularly mental health, represents another major spending category for Gen Z. According to Euromonitor's Voice of the Consumer: Health and Nutrition Survey in 2023, over three in five Gen Z individuals report experiencing moderate to extreme stress levels that lead to mental health issues. Due to the holistic health focus in post-pandemic reality and digital savviness, Euromonitor expects Gen Z to more than quadruple their spending on health goods, particularly health apps and wearable gadgets, over 2022-2040.

3. Saving is en vogue again

Consumers return to the saving mode after the post-pandemic shopping spree in 2021-2022. Geopolitical uncertainty, the lingering risk of recession and the increasing living costs make consumers more stringent with spending and more willing to put money aside for rainy days. In 2023, according to the Euromonitor International Voice of the Consumer: Lifestyles Survey, 44.4% of respondents planned to put more money aside for savings. Over 2022-2024, global savings are to increase by 3% in real terms. Higher financial awareness and inflation also lead to growing demand for financial products and saving instruments.

4. Rising income inequality

Over 2020-2023, income inequality – as measured by the Gini index – deteriorated in nearly two thirds of the countries worldwide. Unfortunately, the pay gap will worsen in the coming decade, impeding post-pandemic recovery, worsening the cost-of-living challenges for lower-income households, and contributing to poverty, social unrest, and instability.

Over 2020-2023, income inequality – as measured by the Gini index – deteriorated in nearly two thirds of the countries worldwide

Source: Euromonitor International

Many companies do not fully appreciate how rising income inequality fundamentally changes their industries and businesses. Besides the social impact, the widening income gap undermines purchasing power and fragments the market, ultimately decreasing market size and profits.

Nonetheless, there are growth opportunities for companies ready to tackle income inequality proactively. Adopting fair and inclusive business practices within the workplace, marketplace, and supply chain and developing a comprehensive CSR strategy that aligns with the company's core values are some strategies worth considering. Please read more in the report Consumer Market Flashpoints: Rising Inequality.

5. Asia's spending spree

Asia Pacific is poised to surpass North America as the world's consumer spending powerhouse by 2031. In the next decade, Asians will account for more than 30% of global consumption. While China, Japan and India secure their positions among the top 10 consumer markets globally, Bangladesh, the Philippines and Vietnam will stand out regionally for the steepest consumer spending growth potential.

Asia's consumer markets are a story of scale and diversity, shifting preferences and behaviours, led by powerful demographic and social forces. Asia will set trends and drive growth in many industries and categories, from beauty and fashion to leisure and technology. Yet, for businesses to succeed, they need to learn the differences and similarities of Asian consumers and tailor their products and solutions to distinct tastes.

Learn more about Income and Expenditure in our Global Income and Expenditure Trends report.

This article was first published in August 2021 and has been updated.