Following slightly accelerated growth in 2020, driven largely by unprecedented demand for disinfecting and antibacterial wipes, global retail disposable hygiene has eased into near pre-pandemic growth patterns, with growing health awareness, enhanced product access and variety, as well as improved disposable incomes in developing markets being the key drivers.

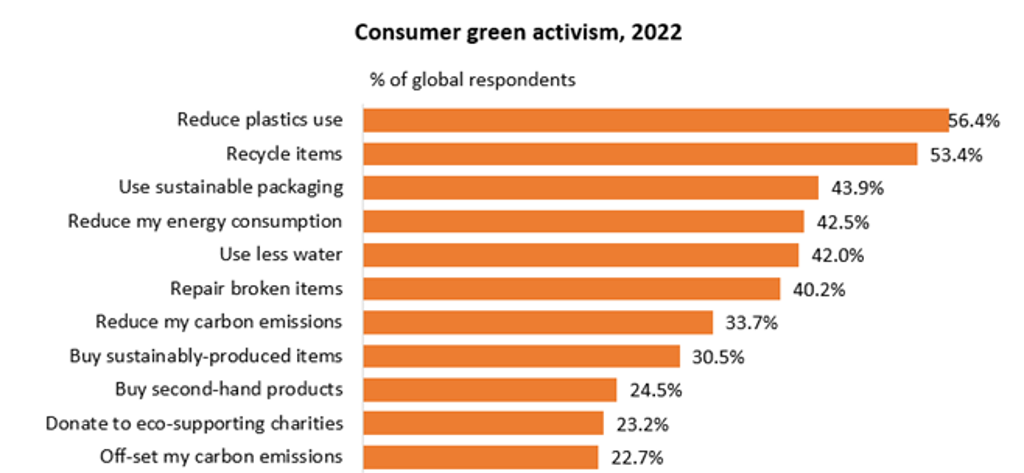

As the world evolves past the pandemic-defined reality and into a “new normal”, what the future of disposable hygiene holds demands a closer examination of the top five trends, which include efficacy-value hybridity, clean wellness, sustainable consumerism, holistic care and personalisation. These trends have been developing for some time and fuelled by the pandemic, will further shape industry directions and business goals.

Efficacy-value hybridity

While grappling with the new reality of paying more for each unit of disposable hygiene products (per nappy/diaper or sanitary towel), consumers are adopting a stripped-back approach, focusing more on trusted and efficacious products that offer greater value for their money. In fact, in Euromonitor International’s Voice of the Industry: Lifestyles survey, fielded in November 2021, more than half of global professionals across industries said “value for money” was the most valuable attribute consumers seek from their offerings. Companies aiming for near-term margin recovery and longer-term share gains must understand such consumer sentiments and foster perceptions of higher quality.

Pandemic-reinforced health and wellness awareness has accelerated the rise of clean ingredients as the new default, as consumers increasingly associate plant-derived, non-toxic ingredients with health and, in many cases, sustainability.

Clean wellness

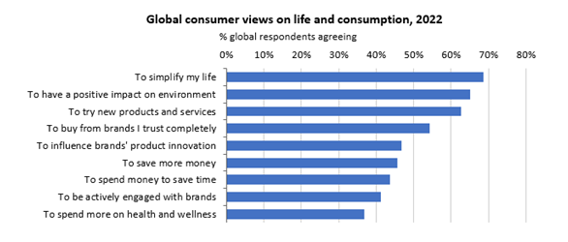

In retail disposable hygiene, clean claims such as “hypoallergenic”, “natural”, “no alcohol”, and “no parabens” have witnessed strong growth in the number of claim-associated SKUs on e-commerce platforms since pre-pandemic, according to Euromonitor International’s Product Claims and Positioning system. However, the development of the clean trend remains uneven across hygiene categories, signalling growth potential offered by “white spaces”.

For example, wipes accounted for a significant share of the absolute increase in clean claims over 2019-2020, such as “no alcohol” and “natural”, while retail adult incontinence appeared lagging in clean claims penetration, which can partly be attributed to technical barriers in balancing functionality such as absorbency with the usage of plant-derived ingredients.

Sustainable consumerism

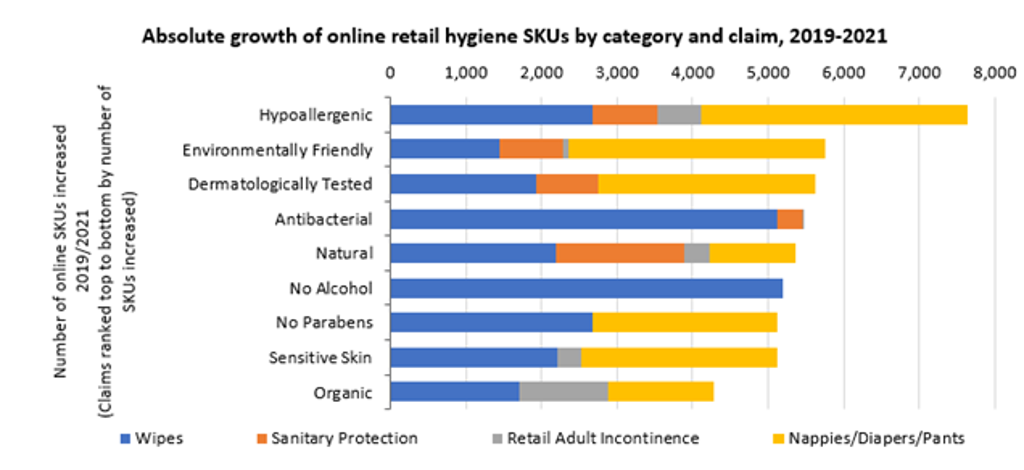

Growing consumer demand for purposeful living and environmental stewardship as key components linked to better health and wellbeing will continue shaping brand strategy.

When it comes to consumers’ sustainability actions, reducing the use of plastics, recycling and using sustainable packaging are among the top priorities, according to Euromonitor International’s Voice of the Consumer: Lifestyles survey, fielded in January and February 2022.

Source: Euromonitor International’s Voice of the Consumer: Lifestyles survey, fielded in January and February 2022

Also, in the context of sustainability, reusable hygiene products such as washable period and incontinence underwear have been gaining traction, especially among millennials and generation Z. While commonly considered as disruptors to disposable hygiene products, they also offer synergy opportunities for businesses looking to expand their sustainability branding and diversify their product portfolios, as manifested in Kimberly-Clark’s majority acquisition of THINX and Essity’s purchase of Modi Bodi and Knix.

Holistic care

Consumer shifts and tech enhancements bolster expectations for hygiene stewardship that targets a diversifying audience’s life occasions beyond the regular routines and supports individuals’ health throughout their entire lifecycle.

Such a shift to viewing health and wellness in a broader sense has led to category blurring, particularly within, and adjacent to, personal hygiene, which is reflected in the rise of multitaskers and the proliferation of wellness- or lifestyle-centric brand positioning. The latter has largely been trumpeted by insurgents such as holistic period care brand Rael and feminine and reproductive care brand LOLA, while also increasingly recognised by leading multinationals including Kimberly-Clark and Essity.

Moving forward, the shift will continue informing new product development and synergies across categories, particularly in terms of menstruation, incontinence, beauty and skin care.

Personalisation

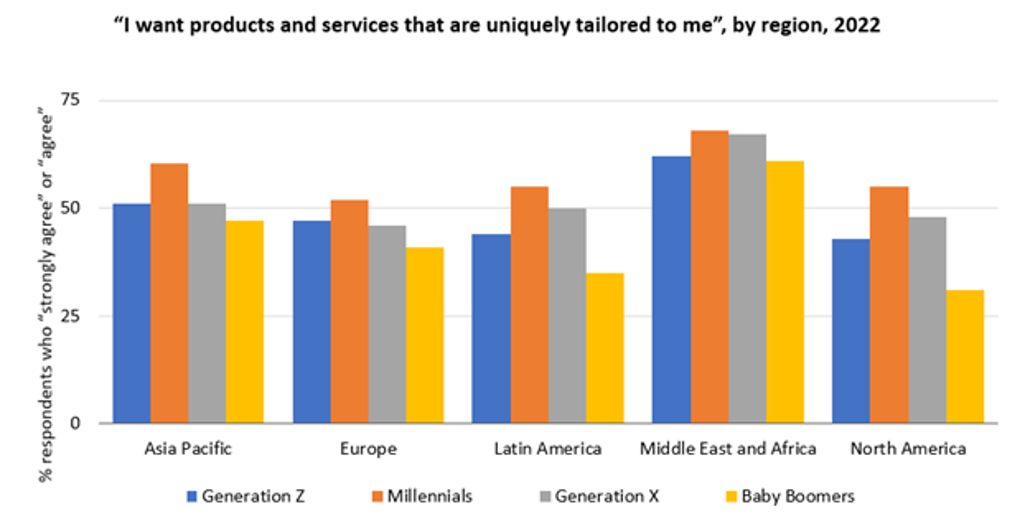

As consumers adopt a more proactive and holistic approach to personal health and wellness, they are increasingly expecting a wider spectrum of customisation. The rise of digital business models such as subscription services, and smart wearable technologies feed into the personalisation trend.

The subscription model, which allows consumers to tailor product bundles, packaging and delivery frequency to their liking, has gained popularity, with 29% of global consumers currently using subscription services in 2022, up from 23% in 2019, according to Euromonitor International’s Voice of the Consumer: Lifestyles survey. Convenience is ranked as the top driver.

Meanwhile, the growing adoption of digital devices and the growing expectations of convenience and accuracy in personal care are among the key drivers of smart sensors. These products are typically used alongside absorbent incontinence products and are designed to provide real-time and predictive product changing advice based on each user’s urinary patterns. Although such products are still in the early stages of development and more commonly deployed in institutions, their retail potential will be further explored as the shift to at-home care gains momentum.

For further insight, please read our reports, Evolution of Incontinence Management Amid Lifestyle Shifts, and, World Market for Retail Disposable Hygiene