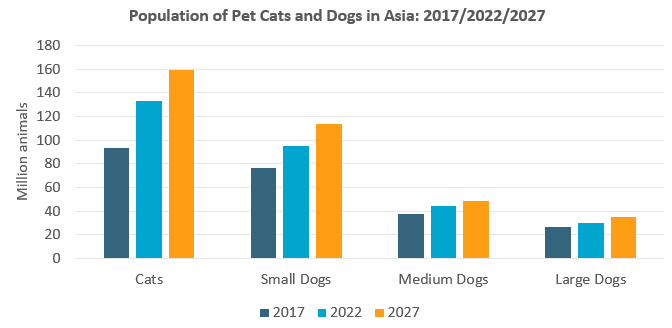

The Asian pet care market has developed rapidly on the back of evolving pet ownership. The growth of smaller pets, whilst on the rise pre-pandemic, escalated from 2020 due to home seclusion, when people tended to turn to the comfort of pets to accompany them at home. In fact, between 2017 and 2022, 59 million cats and small dogs were added to Asia’s pet population – the primary driver of sales of pet food. This demographic shift points to the need to review companies’ approach when developing cat and dog food.

Feline health

The largest contributing market is China, where the cat population multiplied by 143% within the five years 2017-2022, causing the pet cat population to surpass that of dogs in 2021. Beyond China, although figures for pet cats are not as significant, the rise of pet cats has no doubt been massive – Indonesia’s pet cat population grew at a 16% CAGR over 2017-2022, with India and South Korea following close behind at 15% and 13% respectively. By contrast, the growth of medium and large dogs remained relatively flat, with the large dog population having shrunk in markets such as Hong Kong, China, Taiwan and Japan.

Source: Euromonitor International Pet Care

Note: Small dogs – up to 20lbs or 9kg; Medium dogs – 20-50lbs or 9-23kg; Large dogs – over 50lbs or 23kg

The growth of pet cats is partially being driven by urbanisation and the shrinking size of homes in cities, alongside the growth of dual-income households and the preference for more independent pets. Despite the need – or perhaps given the need – to balance work and personal facets of life at home with an increasingly hybrid lifestyle, pet owners scrutinise the ingredients of pet food and seek convenient options to cater to their pets’ individual health needs and issues. The new wave of cat owners in markets such as China, Indonesia and South Korea will require specialised products that can fulfil these needs.

High protein

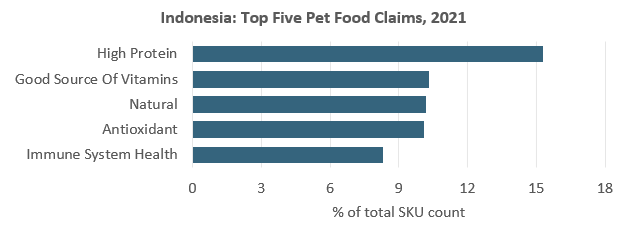

Natural, high protein and grain-free were among the key pet food claims across Asia in 2021, in terms of percentage of SKUs tracked via online platforms. The potential of key claims should be driven by emerging markets such as Indonesia and Thailand, as these are rapidly growing markets with already significant sales in 2022. Cat and dog food in Thailand, for example, is worth USD1.4 billion in 2022, and is forecast to grow at a CAGR of 7% up to 2027. More impressively, Indonesia is expected to be the fastest growing market for cat and dog food globally, with a CAGR of 19% between 2022 and 2027, and in 2022 is predicted to total USD511 million.

Source: Euromonitor International Product Claims and Positioning; n=16,121

Hence, key claims related to nutrition and positioning, such as “good source of vitamins” and “immune system health” are expected to be important, alongside high protein. Product launches that have been observed in Asia in 2022 include dry cat food whose protein content comprises fish and insects, as more niche and unique sources.

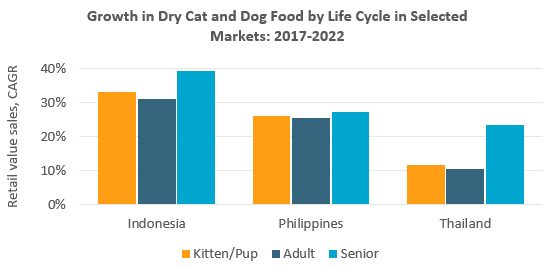

Senior pets

Segmentation of cat and dog food is expected, as pet owners increasingly seek products that are more customised to their pets’ individual needs. Life stage nutrition, as a key theme within human food, wherein food products are created customised to age segments, also applies to cat and dog food as a way of addressing specific health concerns. The senior age segment has notably seen the strongest growth in retail value sales between 2017 and 2022 in Indonesia, the Philippines and Thailand, for instance.

In Japan, where the innovation environment for older consumers in human food is relatively more developed than in other parts of Asia, such advances also benefit pet food. Marukan, for example, has developed AIM30, a new dry cat food which utilises a protein that helps to identify and destroy dead cells and other debris contributing to kidney failure. Consequently, the company claims that the product could potentially increase life expectancy, and primarily targets senior pet cats.

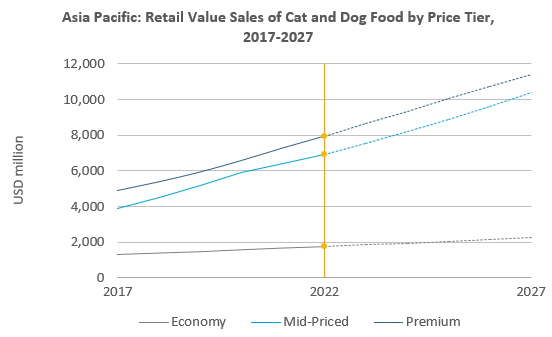

What is the impact? Value-added health claims boost premium segment in Asia

The mid-priced segment remains the largest contributor to retail volumes of cat and dog food in Asia – in fact, by 2027 this is expected to account for 57% of total sales. However, this is largely because mid-priced represents the mainstream price tier in more mature markets such as South Korea, while the economy segment is important to emerging markets, including India and the Philippines. Economy will no doubt play an important role in lower-income communities suffering from inflationary pressures; in fact, in Malaysia the growth of economy cat and dog food is expected to outpace mid-priced between 2022 and 2027.

However, undoubtedly, higher prices drive value growth, which propels premium pet food forward as the largest segment in retail value terms, cementing the importance of encouraging pet owners to trade up.

The shift is not only expected to manifest in developed markets, but also in leading emerging markets such as Indonesia and Thailand. Products that address rising health concerns and justify greater spending, therefore, are predicted to have a long-lasting place in the market and drive the future of cat and dog food in the region overall. To be a part of, and possibly a leader in this space, manufacturers must work towards educating pet owners and emphasising key health claims that will trigger the interest of pet owners, as outlined above.

For a deep dive into this topic, read our report, World Market for Pet Care