With staple foods continuing to see inflationary pressure due to a number of cost-push and demand-pull drivers, monitoring these categories and their changing daily prices is paramount for staying ahead of the competition. Using Via, Euromonitor International’s e-commerce tracking tool, prices for stock keeping units (SKUs) by product categories and leading players can be easily tracked and compared. In this article we will examine the dried pasta market in Western Europe to understand:

- Which countries are seeing strong price increases online?

- What type of prices are rising fastest?

- How do private label price increases compare to leading players?

Western Europe’s dried pasta prices continue to rise

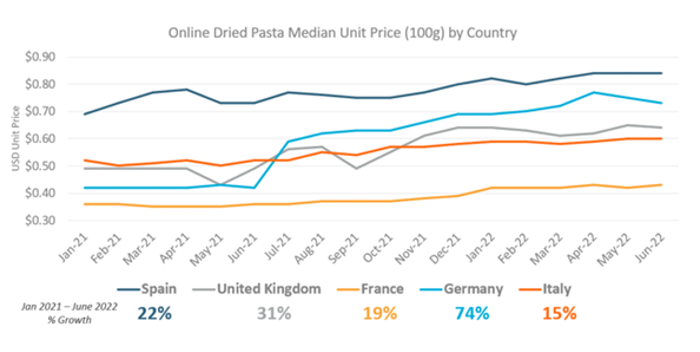

Note: Online Sample: Spain = 3,756 SKUs, UK = 1,664 SKUs, France = 2,810 SKUs, Germany = 3,617 SKUs, Italy = 5,420 SKUs

- Western Europe accounts for nearly a third of the USD23.3 billion global dried pasta market, making it easily the largest region in the world. Understanding how prices are rising in this part of the world with the challenging supply-chain and inflationary drivers provides key insights into the impact these prices are having on consumers struggling to adjust to rising prices.

- In the chart above, we can see the five largest countries in value terms in Western Europe for dried pasta. By standardising all online dried pasta goods to a unit price per 100g, we can clearly gauge which countries have fared better in providing more stable online prices during this time period.

- While Spain, Italy and France managed to see online unit prices for pasta products grow less than 22% during the 18-month time period, the UK and Germany saw drastic increases in online prices. Germany’s prices have risen strongly due to rising commodity costs and supply-chain disruptions due to its proximity to the war in Ukraine. Meanwhile, the UK has also had its share of supply-chain disruptions, but those disruptions have been exacerbated by Brexit-related issues as well as labour shortages due to COVID-19-related restrictions.

Price increases are not all equal

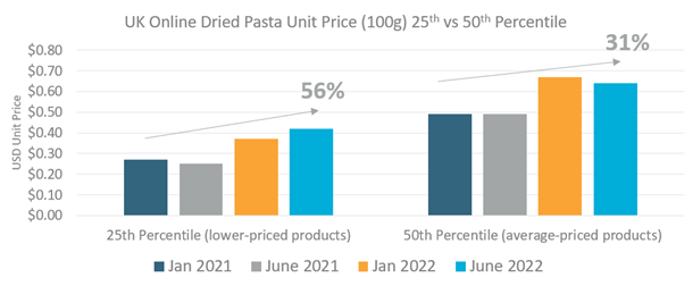

Source: Euromonitor International, Via

Note: Online Sample: UK = 1,664 SKUs

- With inflation, it is important to look at how prices are rising from a variety of perspectives, while median prices show how the midpoint price of a basket of goods are performing, this is not always representative of the prices of products that consumers are purchasing. We can dive into the UK dried pasta market to show how prices at the lower end of the basket of goods being tracked performed. The 25th percentile means that 75% of products are more expensive than this price so this is a good indicator of how lower-priced products are performing with regards to inflation.

- In the above chart, we can see how price increases impacted lower-priced products. These lower-priced dried pasta products rose by 56% over this time period, significantly higher than the 31% price increase for median or “average” prices. Another way to think about this is that despite median prices rising, lower-priced products used to be 45% cheaper than median prices (USD0.27 to USD0.49 per 100g) in January 2021, but because of disproportionate inflationary pressure are now just 34% cheaper (USD0.42 to USD0.64 per 100g) in June 2022. This highlights the need for inflation to be tracked from different price points, especially price points that matter to the consumers companies are targeting and are desperately looking for relief in rising costs.

Private label products driving unit price growth in the UK market

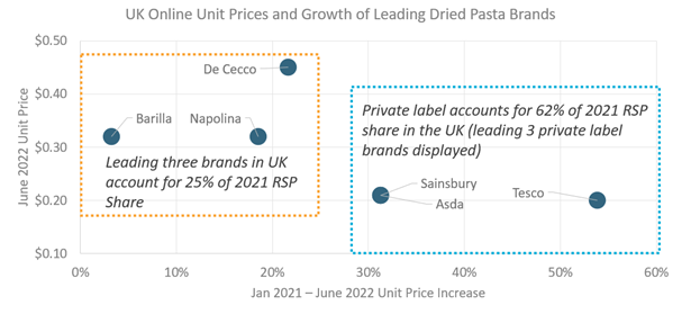

Note: Online Sample, Napolina = 61 SKUs, De Cecco = 100 SKUs, Barilla = 69 SKUs, Sainsbury = 61 SKUs, Asda = 57 SKUs, Tesco = 51 SKUs

- In terms of where these price increases are coming from, analysing the leading brands can provide more insight into which companies are managing price increases better for this online basket of goods.

- In the case of the UK, by utilising Euromonitor International’s Staple Foods system in Passport, we can chart the leading branded dried pasta players against the leading grocery stores’ private label lines. In the UK, the market is dominated by private label consumption, which makes up 62% of total retail sales in the country. We can see that the three largest grocery retailers have all experienced strong unit price increases in their dried pasta lines, which is in stark contrast to the leading branded players Napolina, De Cecco and Barilla, for which median prices rose by less than 22% and prices have been relatively stable.

- Typically during downturns, consumers turn to private label lines to provide some economic relief for their grocery budgets. However, with private label lines seeing strong price increases and the gap between brands and private label lines narrowing, as seen in the UK, competition in this space will intensify and branded players have an opportunity to highlight the quality and values of their brands and make inroads in market share based on sound pricing strategies.

As consumers and companies struggle to adjust to the new cost-push and demand-pull drivers behind inflationary pressures, monitoring online prices for select categories and baskets of goods provides key insights into how price increases are manifesting themselves across categories, companies and pack sizes. Companies need to closely track these changing prices from a variety of perspectives in order to track competition and identify pricing advantages and opportunities.

Learn more about how Via can support your business and help you unlock key strategic and tactical insights with its standardised online product coverage across 80 countries, 1,500 online retailers and 11 consumer goods industries.

Note: Sample based on SKU prices found in Euromonitor International’s e-commerce tracking tool Via with data extracted in June 2022. Please note that due to ongoing improvements to the AI-led product matching of SKUs to categories, supplier, and brands, data and SKU counts can be revised based on system updates.