The latest consumer electronics research showed that retail value sales are projected to register a 4% CAGR over the forecast period worldwide, despite inflationary pressure and global supply chain constraints causing havoc globally. What follows are some of the key trends that are impacting consumers’ behaviour and sales of consumer electronics:

- Increasing prices

- Market leaders putting a stranglehold on competition

- Investing in new technologies

Increasing prices

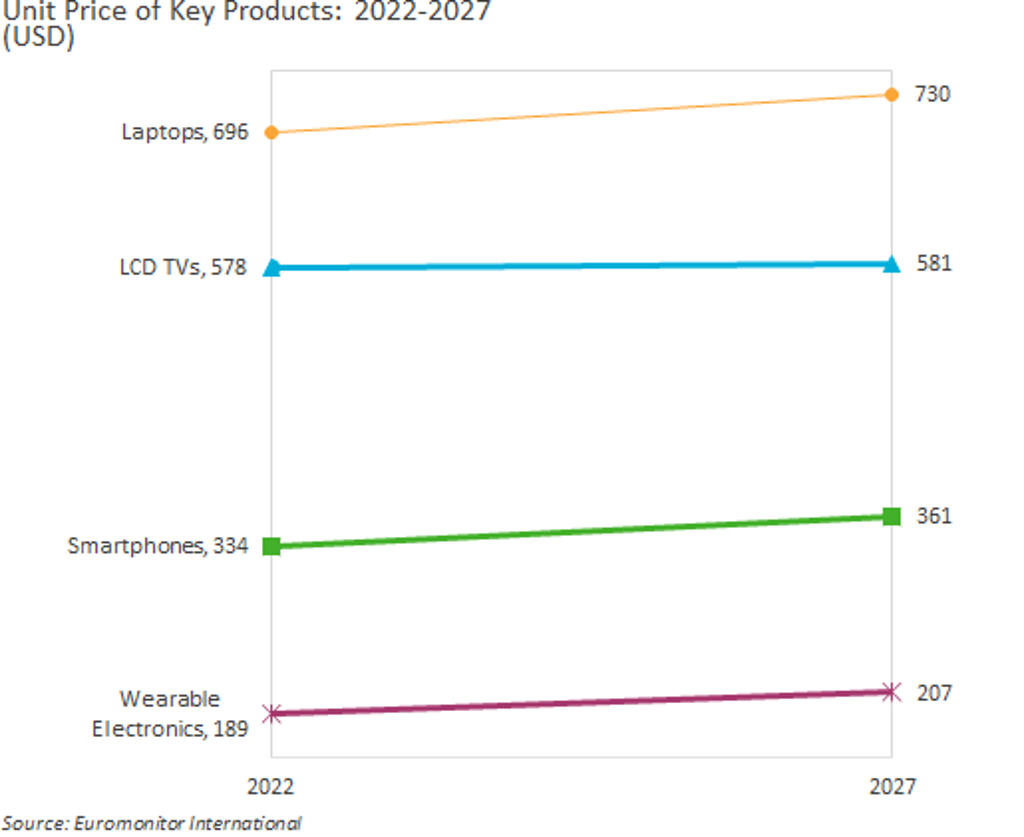

Shortages of components and higher production costs (due to inflation) are forcing manufacturers to increase prices, shifting the cost increment to consumers. With sales stagnating, most manufacturers are also trying to move up the value chain and focus on increasing their revenue and margins by focusing on mid-range and higher-end models rather than entry-level models with lower margins, which is another factor driving the general increase in average selling prices.

Smartphone manufacturers are throwing in additional storage and RAM, while TV manufacturers are banking on the newly developed mini-LED backlit technology and OLED TVs as differentiators, leading to higher product and retail prices. The rollout of 5G will also accelerate the launch of new smartphones with 5G support and drive up prices.

Market leaders putting a stranglehold on competition

Market leaders such as Samsung and Apple increased their market shares during the pandemic, and will continue to grow over the forecast period. As leading companies sell more products, they gain more influence over their suppliers due to economies of scale. Being key customers of component suppliers and OEM suppliers, these large companies have early access to newer technologies and priority allocations during shortages.

As these market leaders manage to obtain more components for their own usage than other smaller competitors, such as Sony or Panasonic, this allows their production to be less impacted by supply chain constraints. As these companies grow, their revenues increase, allowing more money to be pumped back into R&D. With large budgets for R&D, companies such as Samsung, Apple and Xiaomi can develop products with more unique selling points – thereby selling even more products.

Investing in new technologies

Cloud, artificial intelligence (AI) and the Internet of Things are the top three technologies in which companies are planning to invest over the next five years, based on Euromonitor International’s Voice of The Industry: Digital survey. Usage of AI can vary, from analytics to predicting demand and price movements, to customer engagement and technical troubleshooting. Companies are also investing heavily in ecosystems to ensure interoperability between their products and products from other companies. The interest in the metaverse (partly triggered by Facebook’s bullish outlook) is attracting investments in AR/VR.

Investment in cloud technology is set to continue, given its wider use cases. As digital connectivity, remote working and digital commerce continue to gain strength, companies are investing in various cloud service models, such as SaaS (Software as a Service) and PaaS (Platform as a Service). Smart assistants in wireless speakers, headphones and smart wearables will also increase traction and drive engagements with users.

For further insight, read our report, World Market for Consumer Electronics