As evident throughout Western Europe, 2021 saw the UK beauty and personal care market suffer the sustained impact of home seclusion in the first half of the year, with recovery in the second half of the year, following the easing of COVID-19 restrictions. In the UK, this saw a return to growth for sun care (20% in 2021), fragrances (11%), and colour cosmetics (3%).

Now, as cost of living concerns rise, value creation has suddenly become a defining feature of the UK beauty industry, with digital engagement and phygital reality offering brands unique ways to connect with target consumers. Demand for sustainability remains high, with regulation leading change, while heightened awareness of mental wellbeing is seeing a focus on products with ties to emotional wellness.

Value creation in the cost of living crisis

Concerns of inflation, energy costs and rapid increases in the cost of living are rising fast in the UK. Consumers want added value across beauty and personal care, prompting brands to leverage different pricing tiers, while also adding value through functionality and hybridity.

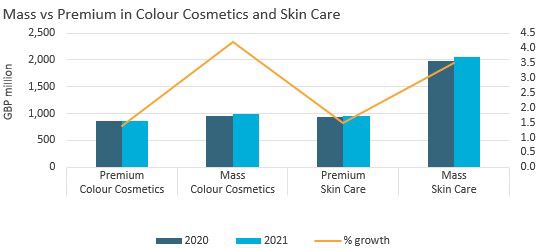

Leveraging pricing tiers: Skin care and colour cosmetics are seeing mass products compete directly with premium. Ingredient focus and perceived efficacy are driving this in skin care, through brands such as Olay and CeraVe, while decreased discretionary spending is driving the trend in colour cosmetics.

Value through functionality: As consumers price down, brands need to add value in alternative ways, such as through increased functionality. Hair care is seeing added value through a focus on ingredients and scalp care, while increased safety and efficacy claims are seeing consumers price up in categories such as baby and child-specific products and sun care.

Value in hybridity: Rising costs are prompting consumers to slimline their beauty routines, giving rise to hybrid products, particularly combining skin care benefits with colour cosmetics. Avon, for example, launched its Anew Revival Serum Lipstick in 2021, acting as a lipstick with added AHAs to retexturise lips.

Sustainability

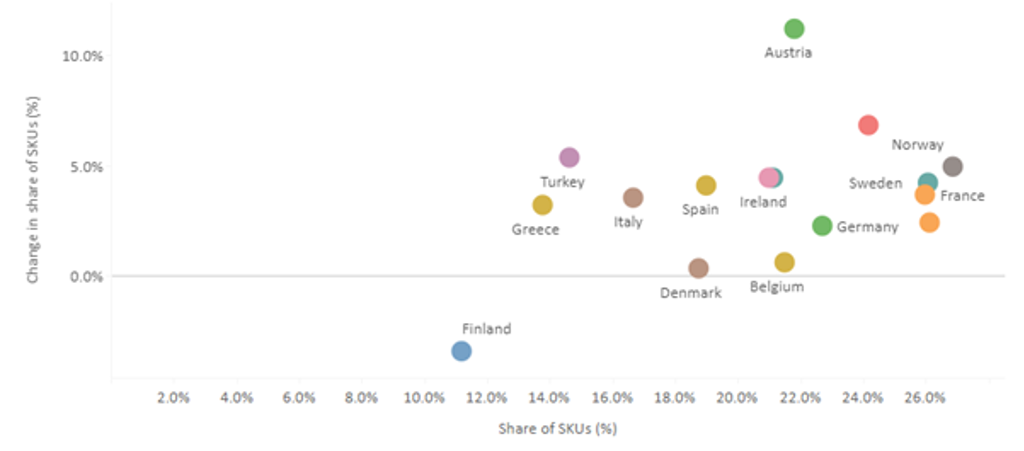

According to Euromonitor’s Sustainable Living Claims Tracker, the UK’s beauty and personal care industry is one of the top markets in Western Europe for sustainable claims, alongside Norway, Sweden and France, with these claims present in 26% of SKUs. Tracked sustainability claims grew a further 2% in the UK in 2021.

Sustainable Claims in Beauty and Personal Care 2021

Historically, fragrances and colour cosmetics have seen lower levels of sustainable innovation, with small pack sizes, mixed materials and a desire to maintain luxury aesthetics limiting this. However, heightened demand saw L’Oréal launch its first carbon-neutral fragrance, Armani My Way, while colour cosmetics refills are ubiquitous in the luxury sector.

Regulation is further set to impact sustainability in the UK, with the Plastic Packaging Tax coming into effect on 1 April 2022, to target companies who use less than 30% recycled materials in their packaging, although the UK is not necessarily leading Western Europe in terms of sustainability, with the EU introducing a Single-Use Plastics Directive in July 2021. Further incentivisation will likely come from the EcoBeautyScore consortium formed by Henkel, L'Oréal, LVMH, Natura&Co and Unilever in 2021, which will enable like for like comparison of the sustainability of products.

Digital engagement and phygital reality

E-commerce in the UK represents 18% of total beauty sales, making it the largest e-commerce market for beauty in Western Europe. Brands have to consider this when they engage, communicate and sell to consumers. Virtual reality is a key way for brands to engage consumers, by utilising social media and gaming to create immersive interaction, such as MAC’s use of AR filters on Snapchat and virtual make-up looks on Sims 4.

Digitalisation further facilitates personalisation in beauty through quizzes, as utilised by Marc Jacobs through its re(Marc)able campaign, which helps consumers find the right fragrance for a gift recipient, while online consultations can further personalise services.

As lockdown has eased, brands have had to balance the return to in-store retail with the ongoing momentum of demand for e-commerce. Virtual try-on from the likes of ModiFace became key within colour cosmetics, as make-up testers were no longer present on shelves, while Amazon Salon facilitates purchases through the e-commerce channel within the store.

Emotional wellness

Consumer awareness and engagement in managing mental health is rising, with stress and anxiety “moderately to severely” impacting 69% of UK respondents in Euromonitor’s Voice of the Consumer: Health & Nutrition Survey in 2022 – an increase of three percentage points from pre-pandemic levels in 2019. In turn, consumers are looking for holistic ways to manage this, with the purpose of beauty shifting away from ideas of glamour, towards feeling good about oneself and self-expression, with the regimen of beauty often treated as a meditative practice.

Fragrance-led categories – fragrances, hair care and bath and shower – offer opportunity, with functional fragrance and essential oils often utilised for mood enhancing and stress reducing properties. Evocative, nostalgic fragrances are proving key, seeing Britney Spears fragrance grow by 18% in 2021, as the brand aligns with growing Y2K trends and seemingly simpler times.

Further Insight

Innovation across value creation, sustainability, digital engagement and emotional wellness can be expected to drive growth over the coming years. These key trends have a global resonance, as evident with carbon-negative beauty in the US, or social commerce in China.

Read more: Analyses and key data findings on beauty and personal care covering 100 research countries are now available here.