Consumer health sales are expected to have risen considerably in 2021, as the global economy recovers, and some aspects of consumer behaviour revert to pre-pandemic norms. According to Euromonitor International’s Voice of the Industry: Consumer Health survey (March 2021), only a small percentage of industry professionals indicated negative growth in their respective categories. This is in line with Euromonitor International’s latest Consumer Health research, which indicates that the industry will grow by 2.9% in 2021. As consumer behaviour moves closer to pre-pandemic norms (especially around distancing, travelling and activity), both industry professionals and Euromonitor International project modest positive growth between 2021 and 2025.

Note: As part of Euromonitor International’s products to offer a complete picture of the commercial environment, we invited professionals within consumer health to participate in our annual Voice of the Industry series to better understand trends and innovations within the industry. The survey was fielded in March 2021 and includes responses from more than 220 key stakeholders across 37 countries that participated.

Non-immunity categories expected to resume growth

While COVID-19 has left the consumer health industry largely reactive, this period has upended traditional winners and losers, with products outside of general health and wellness, and immunity claims losing popularity as the pandemic remains central to consumers’ daily lives. However, consumers have returned to non-immunity functionality over time, focusing instead on products that engage with larger lifestyle and nutritional goals.

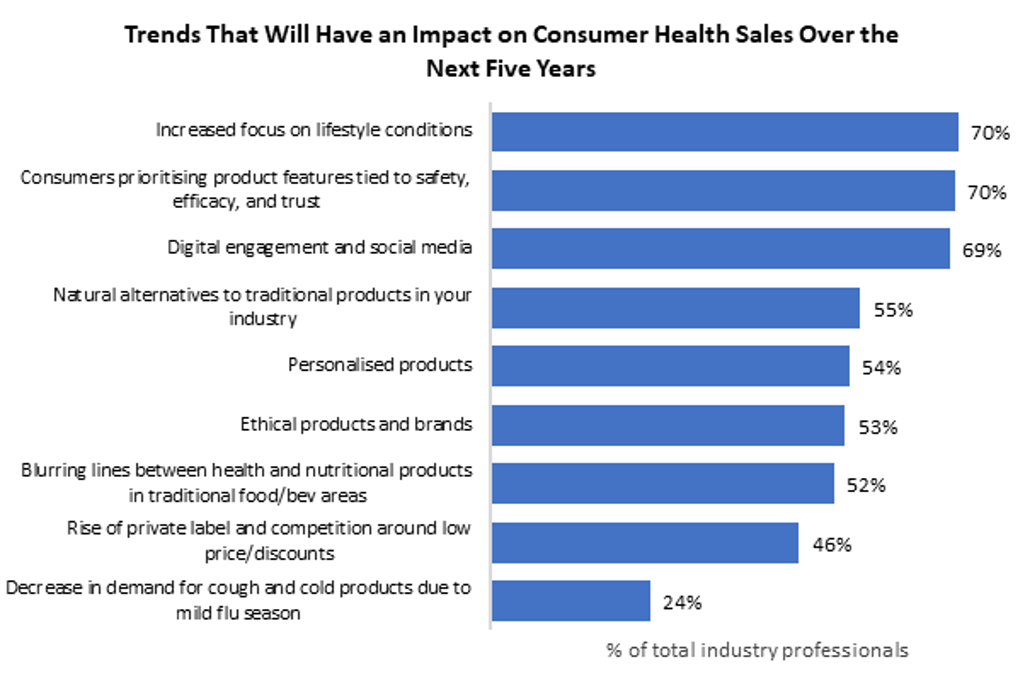

Euromonitor International’s Voice of the Industry survey catches that trend and reveals “increased focus on lifestyle conditions”, “customers prioritising product features tied to safety, efficacy, and trust” and “digital engagement and social media” as the three leading trends that will impact consumer health sales across the next five years. The pandemic has influenced how consumers have shifted their attitudes towards healthcare, and therefore consumer health players will need to follow suit to serve these changing needs in order to set themselves up for growth before the threat of the pandemic wanes.

Non-immunity ingredients within vitamin and dietary supplements will likely see a return to growth, as focus areas previously booming (beauty, energy, digestion, stress, cognition) return with vigour. In line with results from industry professionals in this survey, Euromonitor International also expects sports nutrition to benefit, as latent demand around working out and exercising returns.

An example of a consumer health player investing in lifestyle categories such as sleep and stress is Bayer AG. In response to heightened stress amongst consumers due to the pandemic, the German multinational pharmaceutical company introduced Calmalaif, a new herbal quadruple combination relaxation tablet that is intended to help address typical stress and insomnia complaints. In addition to established passionflower and valerian properties, this tablet also contains hawthorn and black nettle, a combination that is new to the market.

In addition, the pandemic has reset how many consumers feel about their general health and wellbeing. Consumer health players across the value chain have an opportunity to engage and better support consumers to ensure that are able to continue to shop from their preferred channel, engage with and educate them via social media platforms and most importantly, focus on product ranges that fit consumers’ lifestyle condition and provide features that are tied to safety, efficacy, and trust. For example, leading Chinese supplement company By-Health is introducing ingredient traceability certification on new products to ensure authenticity to increase confidence when consumers purchase its products. Companies within consumer health that are able to live up to these new higher standards may not only satisfy their customers, but also be best positioned to retain and increase their consumer base as the pandemic recedes.

For further insight, take a look at the briefing Voice of The Industry: Consumer Health