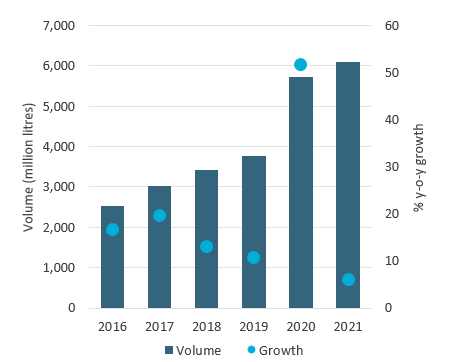

Players within the alcoholic drinks industry will be pleased to consign many pandemic-era adjustments to the past, but the rise of e-commerce is an exception. Brands are exploring the array of emerging opportunities in the digital space now that its importance to the industry is fully apparent. Understandably, online sales growth of alcoholic drinks was more moderate in 2021, but importantly, volumes remained considerably above pre-pandemic levels – up by 61% on 2019. Venturing into the virtual world of the metaverse is the next step along the path of digital transformation.

Global Alcoholic Drinks E-Commerce: Volume and % Year-on-Year Growth, 2016-2021

Source: Euromonitor International

An immersive approach to engagement

In 2022, Bacardi’s Angel’s Envy bourbon promoted the opening of its expanded production facility in Kentucky with a pop-up distillery in Decentraland, a 3D virtual world. Jose Cuervo tequila also established a distillery on the platform. Many producers opted to retain aspects of the online engagement strategies that were initially introduced during lockdown alongside the return of in-person interaction. The more immersive approach offered by virtual reality could enhance these initiatives without detracting from the core educational and experiential elements that drive appeal.

Sponsorship arrangements can boost the virtual visibility of alcohol brands; high-profile festivals or sports events provide an attractive testing ground. Pernod Ricard’s 2022 Absolut.Land aimed to take elements of the festival experience to the metaverse, linked to Absolut’s long-term sponsorship of Coachella festival. Visitors’ avatars could explore various spaces, interact with others, create virtual drinks, and order physical cocktails for home delivery in the real world.

Released in 2022, Heineken Silver has been formulated to taste less bitter than the brand’s standard version in an effort to appeal to younger (legal drinking age) adults. It also has a marginally lower alcohol content. Heineken Silver was initially introduced in the metaverse, and launch events for the physical beer referenced its virtual origins, looking to underscore its modern positioning and increase appeal among target demographics.

It is important that digital efforts align with broader brand positioning to genuinely add value for relevant consumers. Providing a consistent, quality experience across touch points will be crucial to avoiding the risk of reputational damage.

The future awaits?

The credible commercial benefits of the metaverse are significant. Immersive content could help brands to foster closer relationships with consumers and reach a wider audience than is achievable through traditional channels alone.

However, numerous issues with the metaverse and related NFTs and blockchain technology still need to be resolved – privacy, ease and equality of access, the regulatory landscape, and environmental impacts, to name just a few. Details concerning the shape that the metaverse will eventually take are still up for debate. It is likely to be several years before all considerations are addressed and a complete picture emerges.

The pandemic brought the importance of real-life connections and events into sharp relief, which may hinder uptake of virtual reality. In Euromonitor International’s Voice of the Consumer: Lifestyles Survey (fielded January to February 2022), just 49% of global respondents declared they “agree” or “strongly agree” with the statement: “I value online virtual experiences”. This compares to a figure of 76% for: “I value real world experiences”.

Developments to date represent just the first hints of metaverse potential, and the magnitude of possible disruption to the operating landscape means that early exploration is only logical for alcoholic drinks brands – to an extent. This should, however, form part of a comprehensive phygital strategy, reflecting ongoing erosion of the lines separating the virtual and the tangible worlds. A future in which people spend most of their lives working, shopping, and socialising as avatars remains a fast approaching but still distant prospect.

Learn more about the evolving environment of the alcoholic drinks industry by reading our report, Competitior Strategies in Alcoholic Drinks