After decades of low inflation, economies, companies, and consumers worldwide are struggling in 2022 to cope with higher prices and the rising cost of living. The term “cost-of-living crisis” is often used to refer to the situation many of us are living through, but what does this mean, why is it happening, and how does it impact companies and consumers? Insight and clarity on these questions can provide some pointers that help businesses strategise and plan ahead – for example, whether consumers can absorb price increases, or whether businesses need to focus more on basic offers.

“Inflation” and “cost-of-living crisis” are not the same thing

The terms “inflation” and “cost-of-living crisis” are sometimes used interchangeably, but it is important to distinguish between the two:

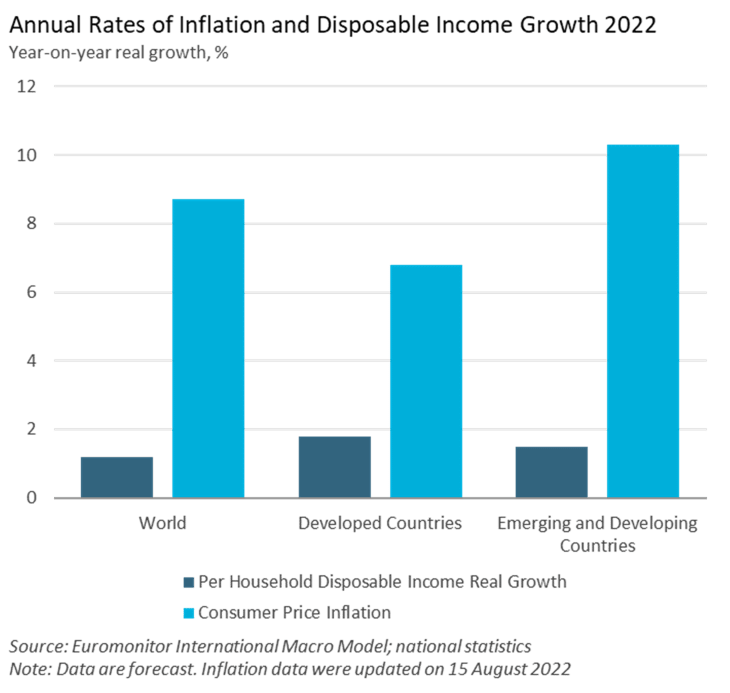

- Inflation generally refers to a situation when prices as a whole are going up, and that includes prices of labour (i.e., wages and salaries).

- Cost-of-living crisis, on the other hand, refers to a situation where the prices of labour (and therefore household disposable incomes) are not rising in line with the prices of essentials such as food, housing and energy. In this situation, households are worse-off in real terms. The description of the cost of living as a “crisis” insinuates a situation where living standards are being squeezed to a point that people cannot afford the standard of living and/or the food, fuel and housing that they were accustomed to, due to sharply rising prices and stagnant wages.

How did it all begin?

Soaring prices started off with a substantial rise in demand in 2021 and early 2022, following the impact of the COVID-19 pandemic, when households across major economies were free to release their pent-up demand. Enormous stimulus programmes in place to counter pandemic-related lockdowns – such as the USD1.9 trillion spending package launched in the US in March 2021 – contributed to driving up aggregate demand significantly. However, firms were not ready to deal with the surge in demand, having laid off staff and cut back on investment. The spread of the Delta variant of COVID-19 in late 2021 caused further production delays and supply issues. This is a situation commonly described as “too much money chasing too few goods”. In addition, there were global supply chain shortages and disruptions from continued lockdowns in China (causing a severe shortage of containers). Inflation in late 2021 was a combination of demand-pull (excessive demand) and cost-push (rising costs).

Russia’s invasion of Ukraine in February 2022 caused a further supply shock, as well as giving rise to changes to the global energy and commodity markets. This ultimately resulted in increased fuel and food prices in many countries. Other factors, including China’s continuing zero-COVID policy and extreme weather events (heavy rainfall, flooding, and droughts) around the world in 2022 have also impacted agricultural outputs, as well as pushing up freight costs.

Plunging confidence and eroded discretionary spending potential

Consumer confidence indices in key economies plunged in Q2 and Q3 2022 as a result of the weaker economic outlook, rising cost of living, and uncertainty in energy and commodity markets. As we enter Q4, with mounting economic pessimism taking hold across the world, consumer confidence in many economies remains low – not far off the levels registered during the pandemic lockdowns of 2020.

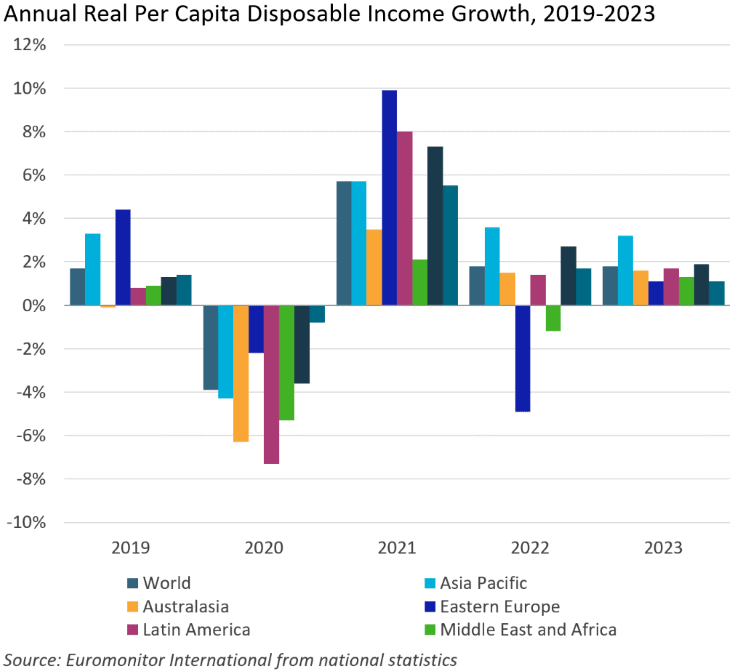

As a result, consumer spending growth in many key economies is set to decline, or even enter negative territory, in 2022. In the UK, for example, consumer expenditure, which accounts for around 58% of GDP, is expected to fall by 0.3% year-on-year in real terms in 2022, from 5.7% real growth recorded in 2021. With central banks in many countries trying to combat high inflation, rising interest rates put further pressure on household finances, as they push up the costs of mortgages (that is, the cost of housing – an essential spending category) and erode discretionary spending power. Meanwhile, real income gains are expected to slow across all regions, with Eastern Europe and Middle East and Africa set to experience real declines in 2022.

The cost-of-living crisis affects all consumers, but the lowest-earning cohorts are the worst affected, since they have limited ability to down-trade, as well as limited room to cut back on discretionary spending. In the northern hemisphere, as the winter months are approaching, many low-income consumers are being forced to make tough choices between heating and eating.

Increasing prices, decreasing volumes, and streamlining portfolios are top strategies

The cost-of-living crisis will also adversely impact businesses. As well as negotiating the difficulties that come with consumers having weaker purchasing power, businesses will face higher operating costs due to soaring energy and materials prices, employees’ demand for higher wages, and interest rate hikes leading to the rising cost of credit. Nearly nine in 10 retail professionals reported inflation having a moderate to extensive impact on their company’s operations over the last 12 months, according to Euromonitor International’s Voice of the Industry: Retailing survey (fielded in June 2022).

Many companies are passing on part of the increases in operational costs to consumers, while also accepting lower profit margins themselves. Others are using shrinkflation (that is, smaller packages) and skimpflation (maintaining the same size and brand, but reformatting the ingredients, and often sacrificing the quality) to retain consumers; yet the latter might be perceived as much more deceitful than the former. Focusing on core products and SKUs that contribute the most to sales – typically, value-priced and premium tier products – is another top strategy.

For further insight on how companies cater to different consumer segments, purchase our report, Navigating the Cost-of-Living Crisis.

Check out Euromonitor International’s other analysis to learn more about: