High and rising inflation is hurting global consumers, who are seeing prices rise across all categories of goods and services as a result of supply chain bottlenecks and disruptions caused by the Coronavirus (COVID-19) pandemic. Higher energy and commodity prices triggered by the war in Ukraine and sanctions on Russia further add to the already high price pressures.

With inflation front of mind for consumers and companies alike, it is important to understand how inflation affects households differently according to their income types and spending habits. Such insights – based on Euromonitor International’s proprietary Consumer Price Index built for specific income types – are powerful, because they reflect more accurately the experience of inflation for different households, and thereby help businesses successfully navigate the consumer landscape with targeted pricing strategies in order to boost their profitability and drive growth.

Inflation is not necessarily higher for poorer households, due to differences in spending patterns

To determine the inflation rates for households of different income types, we developed a Consumer Price Index for each decile (from 1 to 10, with decile 1 representing the poorest 10% of households in a country) based on their general pattern of spending. The main idea is that households of different income levels have different spending patterns, so the actual inflation rate for them may differ from headline inflation at a national level. We did this, first of all, by determining the spending patterns of different deciles using Euromonitor’s unique data on consumer expenditure by income. Then, using indices of item prices (which are indicative of price inflation in different consumer spending categories), we calculated a weighted average of price indices of all spending categories for each decile – the result is the Consumer Price Index (or the inflation rate) for each decile.

Looking at the 2021 Consumer Price Index for each decile in a number of selected countries (including the US, UK, Germany and Brazil), we found a mixed picture:

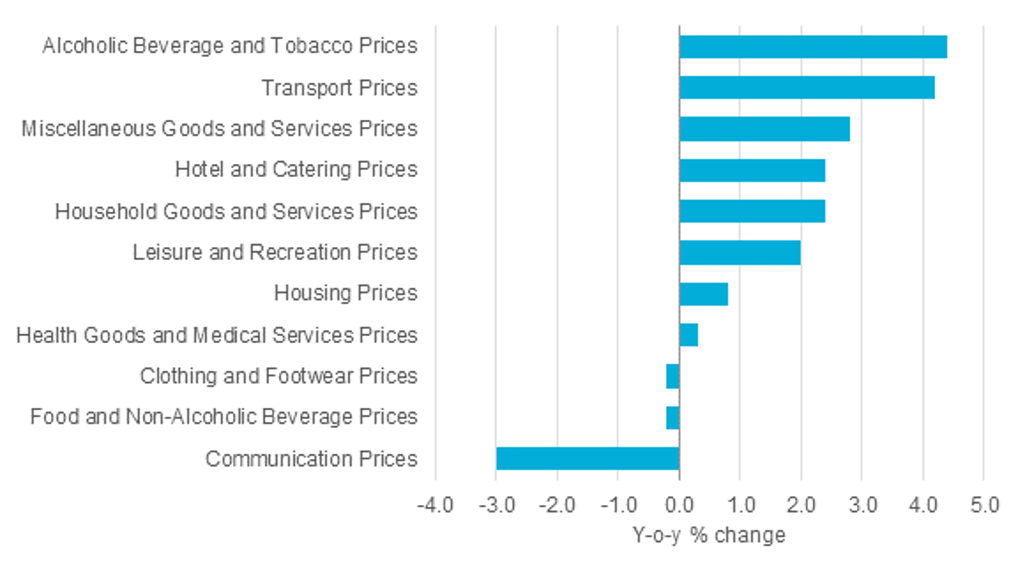

- In the UK and Germany, inflation rates were higher for higher-income households. In the UK for example, the cost of living in 2021 rose by 1.6% year-on-year for the poorest households (decile 1), 2.0% for those in the middle of the income distribution (decile 5), and 2.2% for the richest households (decile 10). In these countries, wealthier households spend a significantly larger proportion of their expenditure on petrol and discretionary items such as restaurant meals and holidays. Meanwhile, transport, hotels and catering, and other discretionary categories recorded faster price rises than the non-discretionary categories of food and housing in 2021, resulting in higher inflation rates for higher-income households.

Year-on-Year Change in Item Prices in the UK: 2021

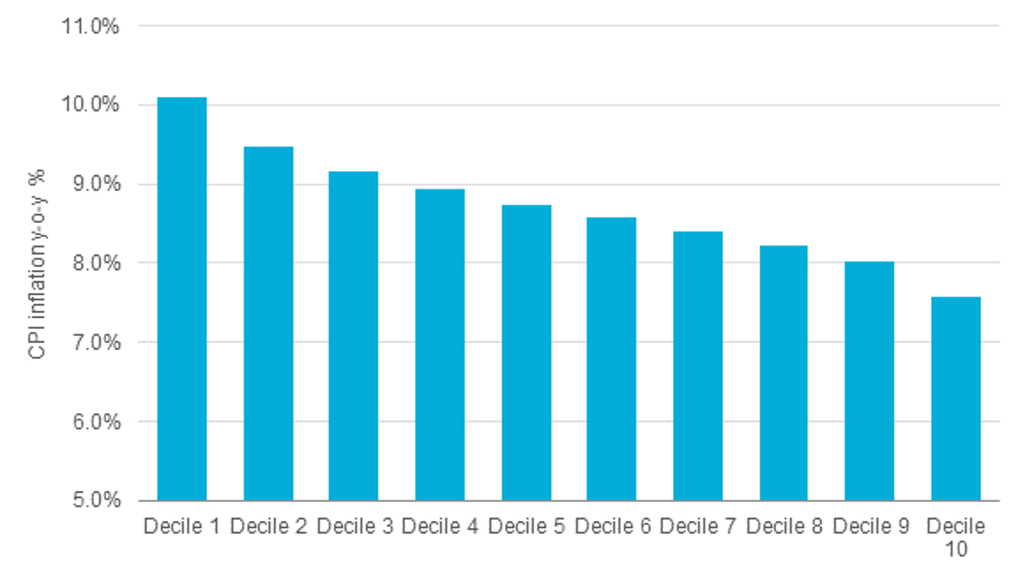

- The opposite is true in the case of the US and Brazil. In Brazil, for example, the inflation rate for the poorest households was 2.5 percentage points higher than that of decile 10 in 2021. Given that food, non-alcoholic beverages, and housing altogether absorbed 64.7% of decile 1’s expenditure in 2021, poorer Brazilian households felt the impact of inflation much harder due to the soaring costs of essentials. In 2021, prices of food and non-alcoholic beverages in Brazil increased by 13.8% year-on-year, compared with a 6.3% rise in prices of hotels and catering.

Inflation Rates for Households Across the Income Distribution in Brazil: 2021

Yet, the experience of inflation is ultimately harder for poorer households

When inflation rates are calculated based on price indices of essential items only (food and non-alcoholic beverages, and housing), a different picture emerged across all countries:

- Lower-income households experienced slightly higher inflation, because poorer households devote a larger share of their spending to non-discretionary categories. In the UK for example, food and housing price inflation in 2021 was 0.64% for decile 1 and a weaker 0.6% for decile 10.

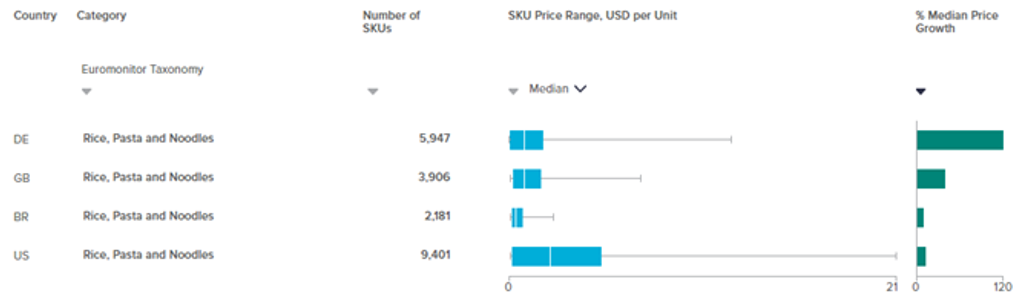

- Nevertheless, the difference in inflation for necessities is still very small and underestimates the real impact of the rising cost of living on poorer households. In the UK, where food and non-alcoholic beverage prices declined by 0.2% overall in 2021, the median online price of rice, pasta and noodles actually rose by 40.5% in the year ended 31 December 2021, according to Euromonitor International’s e-commerce tracking tool Via. In Germany, median online prices of the 5,947 SKUs monitored by Via in this category increased by an even larger 120% during the same period. As rice, pasta and noodles are staple foods, it is hard for low-income households to avoid being hit by this massive price increase. With Ukraine and Russia being major exporters of wheat, prices of wheat-based products are set to rise even further in 2022 and possibly beyond, hitting the poorest consumers hardest.

Median Price Growth of Rice, Pasta and Noodles in Selected Markets: 2021

Note: “Selected markets” in this graph refers to the US, Brazil, UK and Germany; Median price covers the period from 1 January 2021 to 31 December 2021.

- Finally, in all the countries examined in this article, the poorest households experienced far weaker income gains than the richest households. In the US in 2021, the annual real growth in household disposable income was 8.4% for decile 10, compared with 6.0% for decile 1. When taking into account low-income households’ spending pattern (in which food absorbs a larger share of their outlay) and their weaker income gains, the impact of the rising cost of living is disproportionately harder for lower-income households.

What does it mean for businesses?

Continuing supply chain disruptions, rising labour costs, and risks of a prolonged war in Ukraine leading to further sanctions and even an escalation into a Russia-NATO conflict, means that global consumer price inflation is likely to reach 7.5% in 2022 and 6.4% in 2023, according to Euromonitor International’s latest projections. In comparison, annual global inflation averaged 3.8% during the 2001-2019 period.

High and persistent inflationary pressures call for effective pricing management. However, many companies react to inflationary pressures with broad-brush price increases – a strategy that can erode consumer trust, lead to volume losses and hurt the bottom line.

When building a pricing strategy during inflation, instead of making broad-brush price increases, it would be more effective for businesses to pass on cost increases through products bought by consumers who could absorb them, while remaining competitive on value items. Targeted pricing strategies such as this are anchored in consumer-centric thinking and an emphasis on value. They can help companies demonstrate sensitivity to the fact that poorer households are hit harder by the cost of living crisis, and thereby achieve better consumer retention and volume growth.

For further insight, read our article, War in Ukraine Heightens Inflation Risks and Challenges the Global Economy.