This article is part two to an earlier piece, Inclusive Beauty Drives Innovation.

The beauty industry’s shift towards multicultural beauty in recent years has placed hair care at the crux of a broader conversation of inclusivity. Identifying the unique needs of black consumers – which describes people of African descent and those from the continent – is a crucial first step for companies to better understand and cater for specific consumer segments. Examining the prospects and challenges for consumers with textured hair on the African continent can help hair care players looking to expand their inclusivity and be a valuable lesson for innovation for textured hair everywhere.

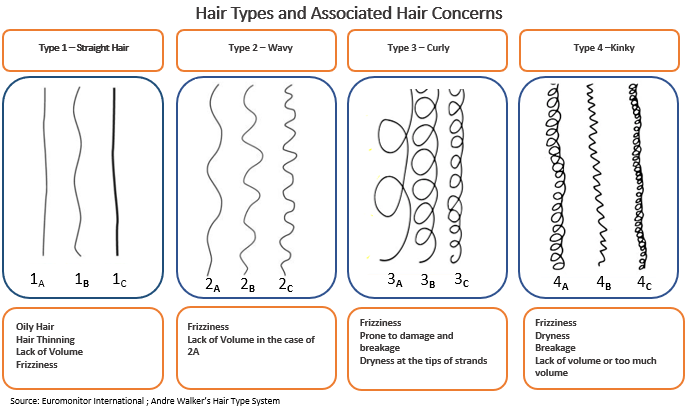

Hair care industry catches up to address the wide spectrum of hair types

According to Euromonitor International’s Beauty Survey 2021, 5% of global respondents reported having kinky or tight coils, while 27% of black or African descent respondents reported having kinky or tight coils. African hair has a unique texture – tight curls prevent the even spread of oils across the hair strands resulting in dry hair, thereby making it prone to breakage. As a result, African hair tends to stay quite short due to the brittleness of the hair strand.

The appeal of natural hair and a more extensive routine

Among black and African descent consumers, two forces are at work. There is the natural hair movement, fuelled by consumers growing increasingly conscious of the effect of the products they use and gravitating away from more artificial substances and towards more natural ingredients. An increasing number of women are returning to their natural hair because they believe it is the healthier option, empowered by embracing one's natural beauty.

At the other end, women who alternate between natural and processed hair, which can include relaxed, braids, weaves, wigs, or coloured hair, comprise a growing segment. The hair regimen varies greatly between women, but the same person may have a different routine depending on her hair style at the time. As a result, Afro-textured hair necessitates the use of a diverse range of products to maintain healthy hair and scalp.

State of play in the Middle East and Africa hair care market

Historically, the hair care market in the Middle East and Africa has been dominated by multinational brands that cater primarily for Type 1 and Type 2 hair. As a result of these unmet needs, black consumers in the region have learnt to care for and style their hair with unbranded ingredients such as shea butter, coconut oil, and castor oil. These ingredients have also been at the forefront of inclusive beauty in hair care since they help address the needs of a wide spectrum of hair types.

Among multinationals, early attempts to capture the hair care market of black and African descent consumers were sometimes ill-conceived (such as introducing new packaging with language that is more specific to black and African descent consumers, but not changing the formulation).

However, in recent years, multinational brands made concerted efforts to launch products catering for black and African descent hair. Godrej and Amka are two major players in African hair care, with popular brands including Black Like Me, Easy Waves, Darling, and Inecto. Their product lines are designed to cater for this hair type and are priced very competitively to make them more accessible to a wider consumer base.

Hair care opportunities through segmentation

In 2021, hair care in the Middle East and Africa grew by 11% in current terms, fuelled by shampoos, and conditioners and treatments, and to a smaller extent, styling agents. Hair care is dominated by the mass segment, which held a 92% share of value sales in 2021. Due to the dominance of mass hair care, there is a scarcity of black and African descent hair-specific brands and products in the premium tiers – which could create a niche space for a premium local or international player.

Formulation renovation is also defining new hair care launches. Vitamin-enhanced products with natural ingredients that consumers recognise are gaining shelf space. For example, brands such as Hask, Mielle, Kaio and OGX now include Biotin in their hair care ranges. Castor oil and shea butter, which were previously used in their natural state and were mostly sold unbranded, are now being sold as branded items. These products have been redesigned to appear more premium, and their visibility has increased as they are now sold online and through major retailers.

Lastly, segmentation is needed. Hair care in the region is currently not differentiated enough to cater for specific hair types, particularly those in Type 4. Consumers are slowly seeing a shift in product claims to differentiate by hair types, particularly in specific messaging for curly hair, but so far, brands are addressing concerns rather than segmenting specifically for kinky and curly hair.

Trust and education at the core of winning the Middle East and African hair care consumer

Hair care players should widen their approach to educating consumers in the region. Sometimes, it can take the form of correcting misinformation. In South Africa, for example, the use of dishwashing soap is a popular shampoo option, based on the widespread belief of efficacy and price accessibility. However, its formulation can damage hair and lead to more serious issues among black and African descent consumers. In other ways, consumer education should include connecting with hairdressers in the informal sector and offering experiences or making information available about the suitability of products, based on hair type, to assist consumers in the selection process.

Hair care players should focus on building trust with black consumers in the region. This can be accomplished by collaborating with influencers and by using more inclusive marketing language. Industry players should recognise that this segment of the population has learnt to find solutions when an appropriate hair product is not available on the market. It will take more than elaborate packaging with a brown logo to entice them.

For more in-depth analysis, read our report Hair Care in South Africa