The Coronavirus (COVID-19) pandemic has caused drastic travel restrictions and non-essential business closures, driving seismic shifts in how and where consumers spend their money. During the height of the outbreaks, consumers had no choice but to turn to the digital channel as brick-and-mortar stores and restaurants closed. These shifts have brought several consumers online for the first time and have caused existing e-commerce users to increase their online shopping frequency.

In order to understand the degree to which connected consumers have shifted towards the digital channel during the COVID-19 pandemic, Euromonitor International has analysed results from two global consumer surveys with a fielding difference of nine weeks between early January to late March.

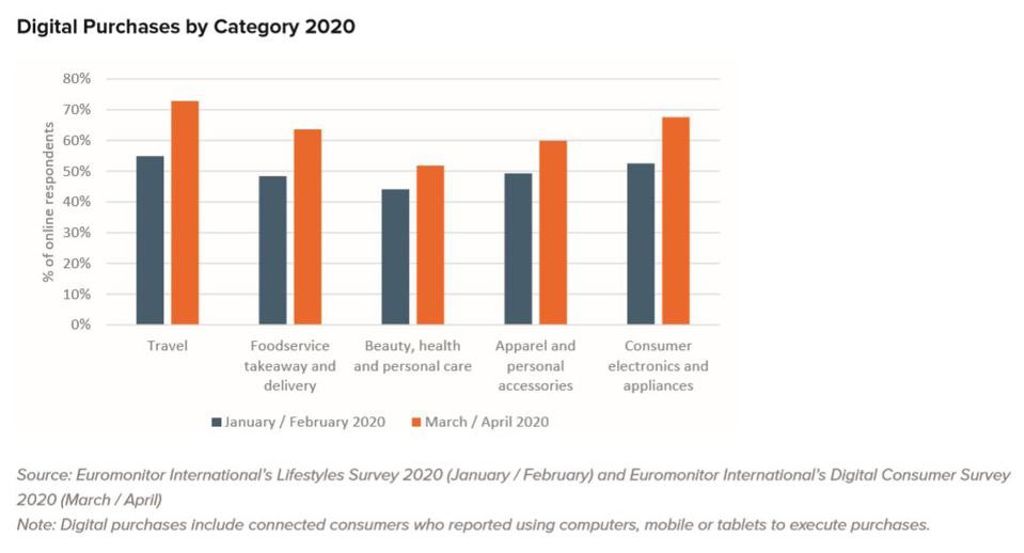

Nearly every category highlighted in the chart below recorded a double-digit increase in the percentage of connected consumers making digital purchases between the two fielding timeframes. The only exception was beauty, health and personal care purchases, jumping eight percentage points. In contrast, the percentage of connected consumers purchasing electronics and appliances, foodservice and travel online grew by twice as many points.

Foodservice takeaway and delivery posted one of the strongest increases, from 48% of connected consumers to 64% purchasing digitally between fielding timeframes, due to dine-in closures around the world, which forced operators and consumers to migrate online. The consumer electronics and appliances category also received a digital boost as shut-in consumers bought products for home offices, remote learning and entertainment.

Consumers shop online for broader range of goods and services

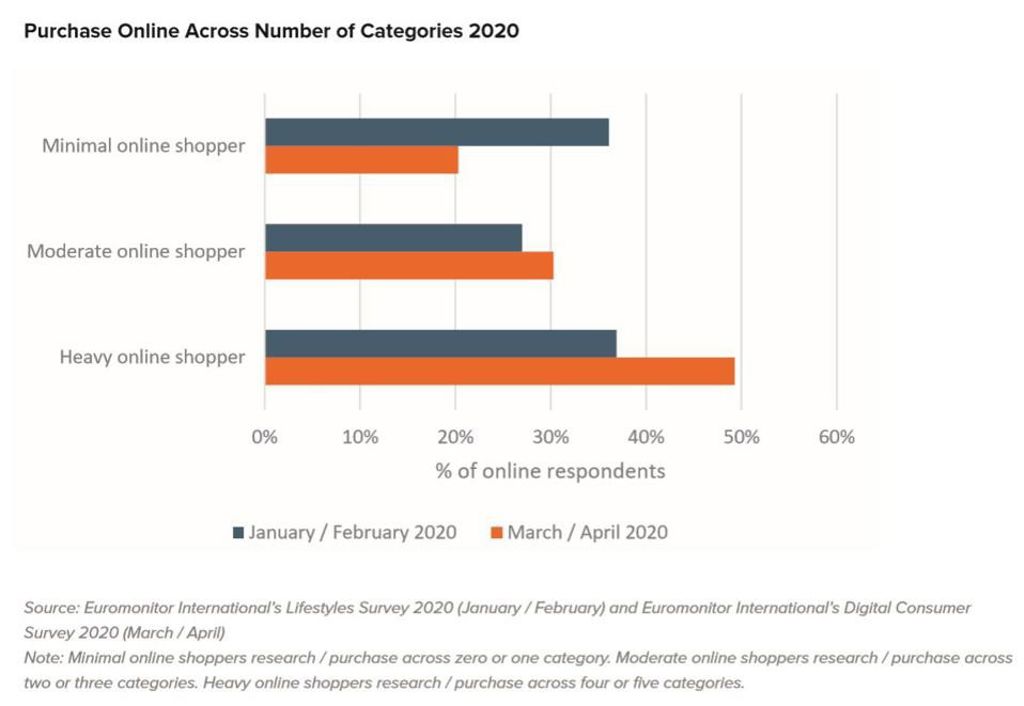

Besides shopping more in already-familiar categories, consumers are turning to e-commerce across a broader range of products and services. The percentage of minimal online shoppers, connected consumers who did not use digital or only used digital to shop for one category, dropped significantly during the research and purchase steps in the consumer journey between fielding timeframes.

There was a sharp rise in the number of categories that shoppers researched and purchased online. 60% of connected consumers were heavy online shoppers during the research step in March, exploring four to five categories online, up from 42% in early 2020. Nearly 50% of shoppers purchased products and services across more than three categories, a 12 percentage point increase.

In early 2020, minimal online shoppers and heavy online shoppers were evenly split during the purchase step at 36% and 37%, respectively. By March, there was a nearly 30 percentage point gap between minimal online shoppers (20%) and heavy online shoppers (49%).

Who is behind the increase in digital shopping?

Different consumer groups are driving these shifts. Connected consumers between the ages of 30 to 44 were the most frequent users of the digital channel across all five categories. Given that this cohort already has the largest number of digital commerce users, one might not think this group would be the most likely to post the greatest increase in new users during the pandemic. However, the 30–44 age group did, across all categories, except for travel.

Older consumers are also turning to digital in greater numbers. Connected consumers over the age of 60 recorded the highest percentage increase of all age groups for researching and purchasing across categories online, excluding beauty, health and personal care, between the two fielding timeframes. In fact, this age group posted the greatest percentage point increase in digital channel usage for research across the other four product and service categories.

Companies have had to make significant operational and strategic changes to meet sudden demands and adapt to the unprecedented channel shifts that unfolded during the pandemic. In order to adapt strategies and remain competitive in the post-pandemic world, companies will need to explore such shifts in digital shopping behaviours that are taking place during this period of abrupt change. From faster fulfilment to more efficient last-mile delivery and collection services, digitalisation is at the core of these efforts because it enables businesses to quickly enhance capabilities and maximise efficiencies across their operations.