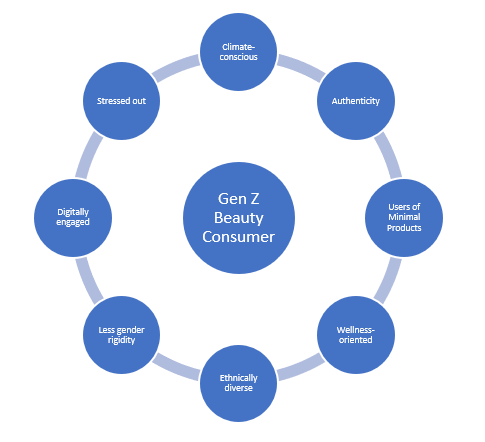

Born between 1995 and 2009, Generation Z is coming of age alongside significant changes in the post-pandemic economy, and is becoming a growing focus for the beauty industry. Faced with stressors such as post-COVID-19 income declines, rising inflation, and social, political and climate upheaval, Gen Z is under more pressure than other age groups. Consequently, Gen Z tends to prioritise certain values to a greater extent than other generations, especially self-expression, value for money, holistic wellness, genderless beauty, and support for social causes. These shifts are key to understanding this multi-faceted cohort, how these people are building their relationship with beauty, and how brands must evolve to keep up with their ever-changing needs and values.

Stress during formative years creates appetite for emotional wellness and value

For Gen Z, the COVID-19 pandemic began while they were in school, university, or at the beginning of their careers. Gen Z witnessed a huge life pause, and this time was used for self-reflection.

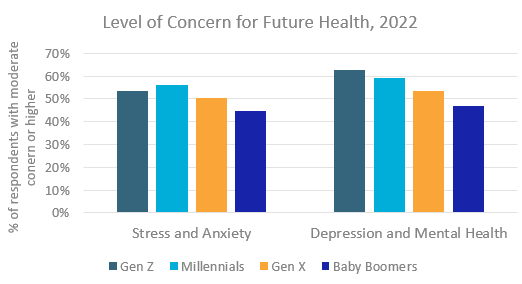

According to Euromonitor’s Voice of the Consumer: Health and Nutrition survey, fielded January to February 2022, over half of Gen Z respondents reported being extremely or moderately concerned about stress and anxiety, and depression and mental health. While the survey was fielded before the invasion of Ukraine, the subsequent impact of the humanitarian crisis, inflation, rising cost of living, and geopolitical changes are very likely to have added to the weight.

It is no surprise that Gen Zs’ idea of beauty and personal care is becoming intertwined with emotional wellness and self-care, especially since they leaned on beauty to provide a sense of comfort or opportunity for indulgence during the pandemic. Two years later, this behaviour is still holding strong. Value, price accessibility, and affordability will continue to be key factors for Gen Z beauty consumers.

Individualism and wellness characterise Gen Zs’ definition of beauty

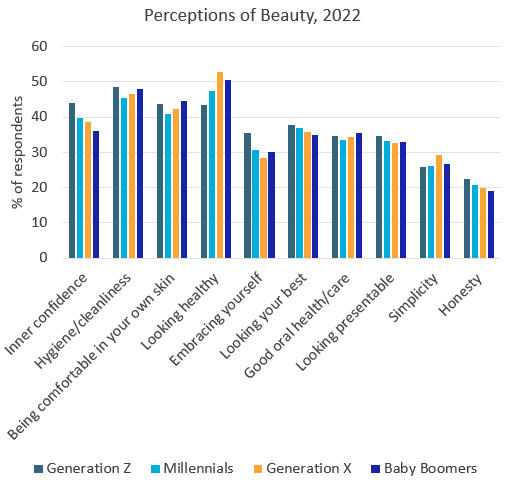

Euromonitor’s Voice of the Consumer: Beauty survey, fielded June to July 2022, revealed that Gen Z associates beauty more closely with intrinsic values in comparison with other generations. So, concepts such as inner confidence (44%), being comfortable in your own skin (44%), and embracing yourself (36%) carry more weight among Gen Z. As health, emotional, mental, and spiritual wellbeing are increasingly being treated as personal responsibilities, beauty regimens and wellbeing-led beauty are proving to be quite popular with this age range.

Furthermore, Gen Zs’ perceptions of beauty are becoming more centred around personal expression, identity and individualism than previous generations. As a social media-native and smartphone-driven generation, Gen Z tends to embrace individualistic expression, but is at the same time influenced by external opinions and outside pressures. Indeed, there is growing awareness of the negative mental health effects of adhering to conventional beauty standards, and since Gen Z consumers want to build a kinder relationship with themselves, an undercurrent of rebellion is starting to emerge.

Gen Z sees beauty as a means to become their true self, as opposed to achieving perfection. One example of the manifestation of this trend is the rise of unconventional beauty, with styles such as bleached eyebrows or a shaved head becoming more popular.

Colour cosmetics are a means of expression, but skin care is paramount for Gen Z

The colour cosmetics routines of Gen Z highlight how values surrounding personal expression and individualism are impacting product usage, with a dichotomy emerging between expressive make-up and natural aesthetics.

Euromonitor’s Voice of the Consumer: Beauty survey, fielded June to July 2022, found that 37% of Gen Z daily make-up is “natural or barely there” in style. Indeed, Gen Z is drawing inspiration from popular shows such as Euphoria, and expressive styles used by K-pop groups such as Blackpink, which are further driving their desire to embrace and express themselves on certain occasions. In 2022, this is manifested in the return of the indie sleaze trend, but it is coming back with a larger focus on eye make-up rather than facial make-up. This dichotomy suggests that beauty players should look to balance their product portfolios between everyday, skin-first products, and products designed for occasions to best meet Gen Z demands.

Beauty and personal care industry responds with holistic wellness and acceptance

As aspects of health are incorporated into Gen Zs’ definition of beauty, it will present opportunities for players looking to adjacent categories that promote wellness, such as vitamins and supplements and home ambience. For example, beauty and personal care players are identifying opportunities and launching new products across the entire female wellness spectrum, some of which include skin health, sexual health, incontinence, mental and gut health.

The value of individualistic expression is also manifesting across new product categories. For instance, fragrances benefited from a repositioning into a wellness and self-expression product. Strong growth in fragrances in China and Latin America in 2021 was lifted by Gen Z, who associate fragrances with mood and identity, as they established fragrance wardrobes for different daily mood or identity expressions.

Messaging and marketing around beauty will also have to align with these values to find success with Gen Z, with more campaigns that help build self-worth or image expected. One example is US-based hair care brand Amika’s 2022 “love all your hair days” campaign, which showcased a more relatable approach to daily hair care that also highlights other values important to Gen Z, including inclusion and diversity.

Future outlook

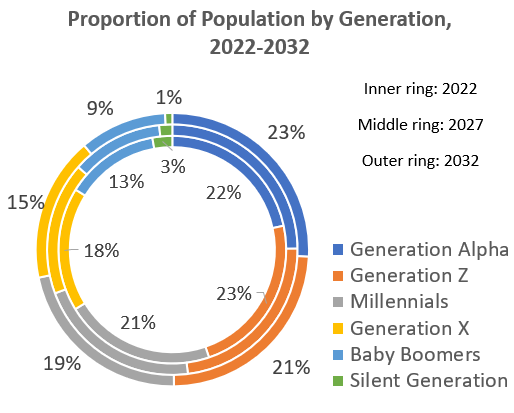

In 2032, Gen Z is projected to account for 21% of the global population. As their purchasing power rises, beauty and personal care players will have to address their demands for more creativity, accountability, purpose, sustainability, authenticity, wellness, and – above all – a clear brand mission that speaks to their own values.

For more in-depth analysis, read our briefing The Gen Z Beauty Consumer.