The word “metaverse” has been popular when discussing current and future digital trends, not only at dinner tables, but also in big corporations’ boardrooms. A third of businesses in APAC are planning to invest in augmented reality (AR) or virtual reality (VR) in the coming five years, according to Euromonitor International’s Voice of the Industry: Digital Survey.

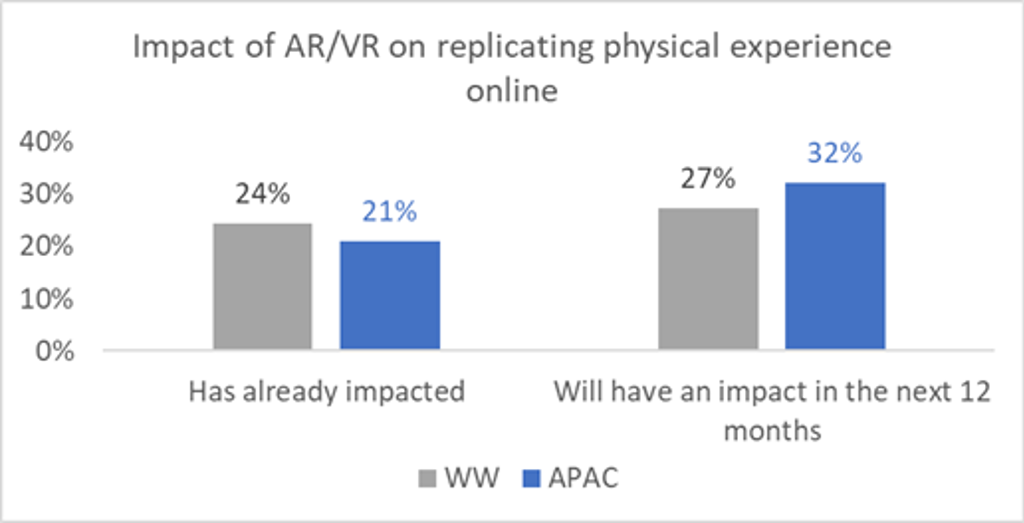

Consumers are already immersing themselves in technology to enhance their experiences, with a third of APAC respondents having used AR or VR to enhance their shopping experience at least once a month, which is higher than the worldwide average, according to Euromonitor International’s Voice of the Consumer: Lifestyles Survey. Replicating physical experiences online through AR/VR is expected to gain traction in APAC, with more than half of APAC industry professionals seeing or expecting a business impact in the coming year, according to Euromonitor International’s Voice of the Industry: Digital Survey. Industry efforts to increase investments in this space are being observed, with luxury fashion companies and tech giants paving the way for accelerated mass adoption, and there is a plethora of examples from which companies can draw inspiration to implement in the APAC market.

Businesses across industries are fighting to enhance consumers’ metaverse experience

As brand equity becomes intricately linked with how tech-enabled brands are, businesses across industries are diving into the metaverse scene. Virtual showrooms can replicate physical shopping journeys while enhancing the consumer journey with more immersive and engaging experiences in the metaverse, aiding emotional and impulsive purchases. APAC sees opportunities in creating virtual showrooms capitalising on AR/VR capabilities, as 48% of APAC industry professionals took note of the phenomenon and expected impact in the coming year, according to Euromonitor International’s Voice of the Industry: Digital Survey.

Luxury is all about intense value creation, which means experience is the core of a brand. Well-known digital assets platform Decentraland collaborated with curated NFT marketplace UNXD to run the Metaverse Fashion Week in late March, with Selfridges, Dolce & Gabbana and Tommy Hilfiger participating. Replicating fashion week events from the physical world, such as New York Fashion Week and Paris Fashion Week, there are immersive spaces and installations on top of runway shows for participants to enjoy. While players from non-tech industries struggle to extract value from the AR/VR world and the metaverse, luxury fashion players are ahead of their peers.

Comparable to the Metaverse Fashion Week, Korean tech conglomerate Samsung modelled its New York flagship in Decentraland for consumers across the globe to immerse themselves in the virtual experience. The brand’s metaverse store, Samsung 837x, allows consumers to test products, shop for Samsung electronics and earn or trade virtual Samsung avatars. The virtual store has enabled Samsung to reach a wider audience and engage with consumers to reinforce its brand equity.

Virtual tourism sees great potential in the metaverse

Immersive experiences is a key feature of the metaverse, meaning travel and tourism see huge opportunities in this space. Travellers are keen to experience the real world, with 77% of travellers globally agreeing that they value real world experiences, according to Euromonitor International’s Voice of the Consumer: Travel Survey.

With travellers worldwide keen on virtual tourism due to COVID-19 travel restrictions, APAC cities have started to offer virtual tours of museums and landmarks. Historical South Korean landmarks such as the Seodaemun Prison History Hall have been replicated on the metaverse platform Zepeto. Many of the prison’s features, such as the cells and cafeteria, were recreated in the prison’s era, allowing curious tourists to visit and experience the area with a level of detail that could not be found in the physical location.

Similarly capitalising on the metaverse under COVID-19 restrictions, Hong Kong’s local theme park Ocean Park partnered with metaverse gaming platform The Sandbox to become the first amusement park to go virtual. It is currently undergoing major changes in its business operations and strategies. This strategic pivot enables it to refashion engagement with tourists in its virtual theme park through immersive experiences and events, in line with the current major revamp of its brand image.

Chinese companies are embracing cross-app functionality while preparing for the metaverse

Chinese companies are establishing a foothold in the “meta-race” as VR technology becomes more mainstream. For example, Tencent has started working on its metaverse foundations by embedding the video game engine Unreal Engine into the well-known Chinese social media app QQ. This upgrade gives the QQ app the necessary specs in the future to host and expand any upcoming metaverse functions.

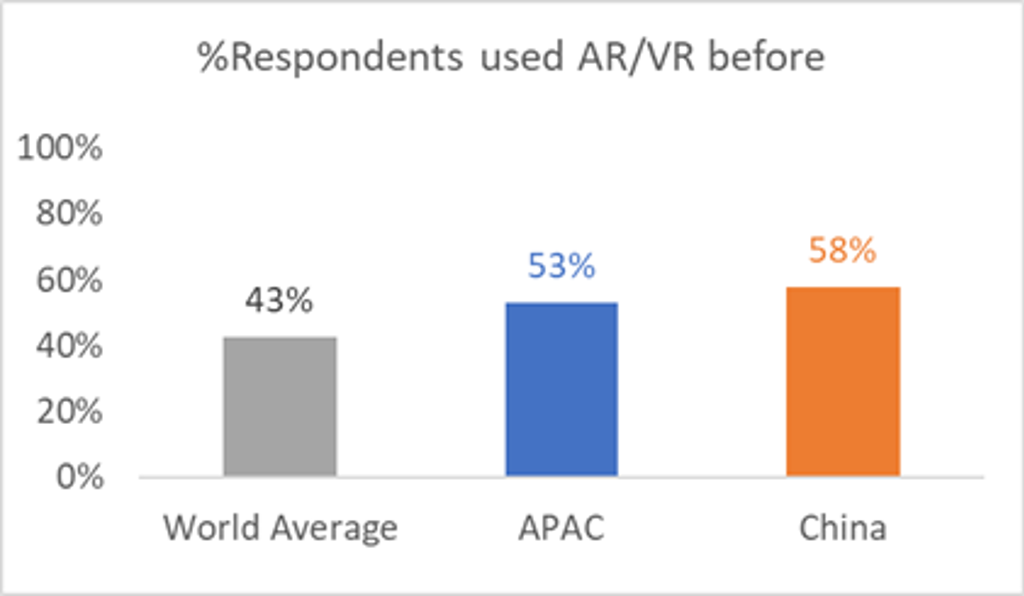

Chinese consumers are more familiar with the usage of AR/VR devices compared with other APAC countries, as 58% of digital consumers in China have used AR/VR devices, compared with an APAC average of 53%, according to Euromonitor International’s Voice of the Consumer: Digital Survey. Therefore, Chinese tech companies are keen to leapfrog into the space ahead of their APAC peers.

Source: Euromonitor International’s Voice of the Consumer: Digital Survey (2021)

Apart from building its metaverse foundations, Tencent is also aiming to break down the walls between China’s most popular social media apps by allowing WeChat users to link external shopping sites such as Alibaba and Taobao on their app, a function that was previously impossible. This contributed to the Chinese sentiment that every business can tap into and profit from the metaverse, and gave birth to the phrase “万物皆可元宇宙” (every business can tap into metaverse technology), which has been trending on Chinese social media. This shows that China is aiming to have multiple platforms that users can travel between seamlessly, thus giving them an easier time in the metaverse, as they only need a single user identification tool to enjoy all the benefits of the Chinese metaverse.

APAC metaverse still in nurturing stage – but companies are increasingly able to extract value

The adoption of modern technology enhances brand equity. Swift moves by luxury fashion, tourism and tech players to pivot towards the virtual world have attracted attention. Thus, all types of businesses are moving towards marketing and monetising their brands, products and services on the metaverse. 42% of APAC industry professionals believe that AR/VR technology will impact their business in the next five years, according to Euromonitor International’s Voice of the Industry: Digital Survey. This shows that a lot of companies are investigating potential applications to stay ahead of the technological curve, and that opportunities in the metaverse can be capitalised on by a wide range of industries.

While the market is currently in the nascent stages in terms of the ability to extract value from the metaverse, current developments can help APAC businesses plan their next steps in terms of how more value can be extracted. Considering the current infrastructure, APAC companies are well-positioned to lead this metaverse movement and usher in a new technological era.

Learn more about how companies are tapping into the metaverse trend to enhance commerce experiences in the Top Five Digital Consumer Trends in 2022 webinar.