The World Economic Forum’s annual meeting in Davos, Switzerland shines a light on the global economy and the big themes shaping the world. The central theme for 2023 is “Cooperation in a Fragmented World”, as the global economy is experiencing a polycrisis, with multiple interconnected risks weighing on economies, business and consumers.

It is now more important than ever for companies to be one step ahead of potential shocks over the next year and beyond. Euromonitor International has identified four main global risks, with a summary of our key content to help you understand how these are shaping business environments and consumer markets.

1. Geopolitical Risks

Economies in 2023: Key Trends to Watch

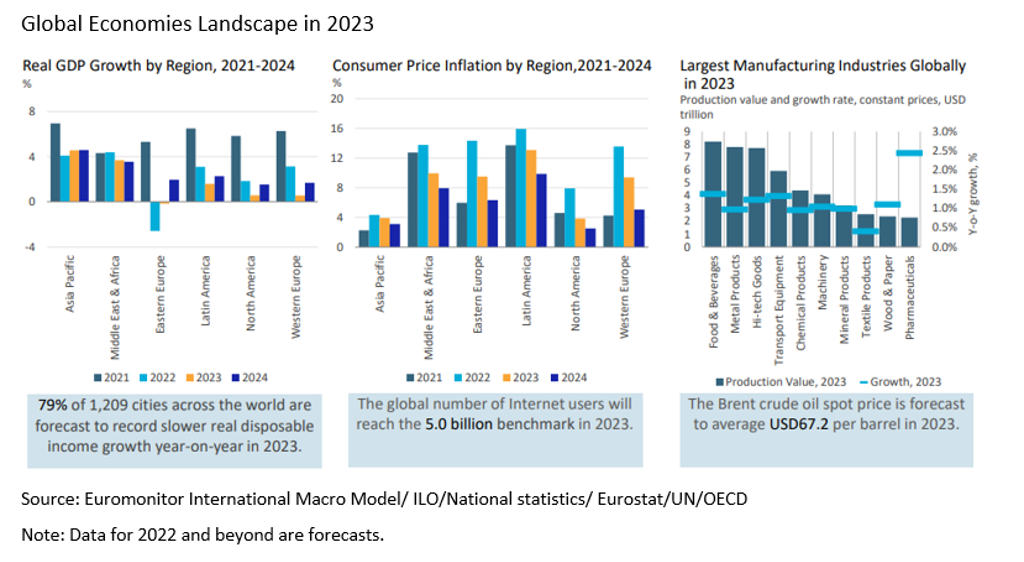

In 2023, global economies will continue to face multiple macroeconomic headwinds, including geopolitical uncertainties, inflation and tightened financial conditions. Global economic growth is expected to slow further, while cities will witness subdued growth in consumer spending. Commodity prices are likely to soften and global supply chains will recover, but upside risks on inflation will remain.

Global Economy 2023: What are the Key Recession Risks?

Economies, businesses and consumers now face a new set of challenges following the disruption caused by the pandemic since 2020. The prominent energy crisis, geo-political risks, high inflation and cost of living uncertainty will be some of the key themes shaping economic and industry outcomes over the coming year. Stream our webinar to get answers on economic trends, threats and opportunities.

Euromonitor International’s recent webinar, Global Economy 2023, discussed the outlook for the global economy. After a turbulent 2022, forecasts are for the global economy to slow further to 2.3% real growth in 2023, as global financial conditions tighten and the cost of living and energy crises persist. Recession risks loom larger in advanced markets, but some economies in Asia Pacific and the Middle East will continue to provide some bright spots.

2. Cost of Living Crisis

Cost of Living Crisis: How Does It Impact Companies and Consumers?

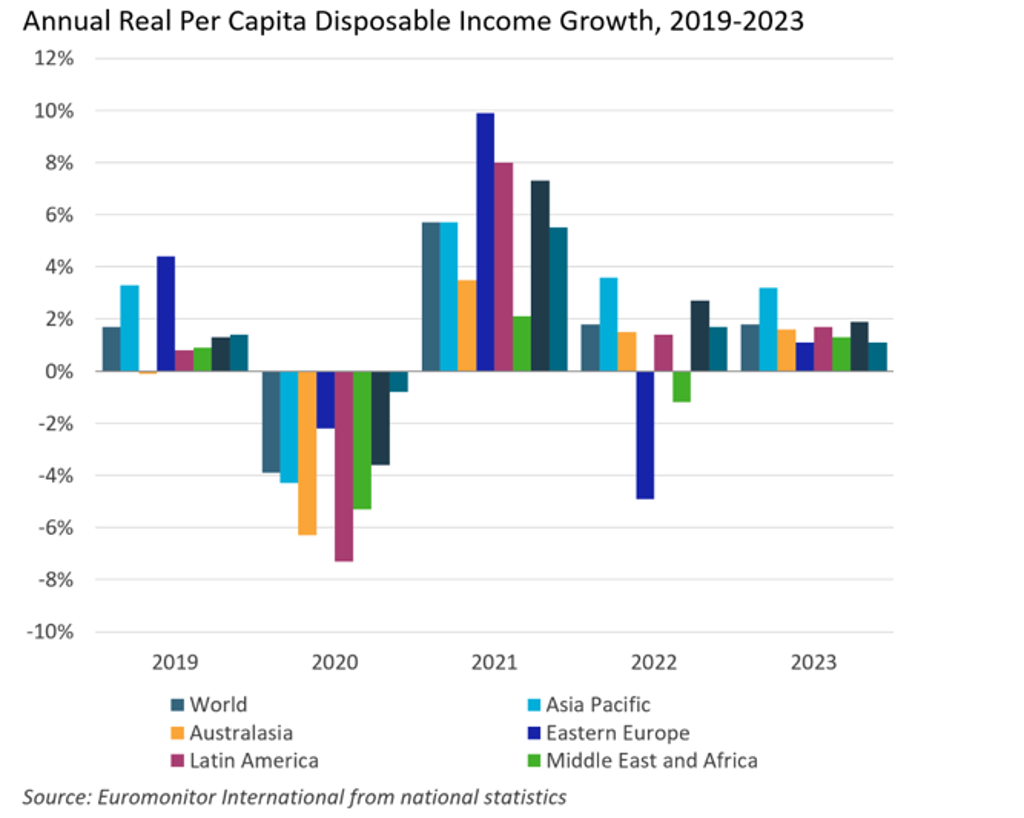

After decades of low inflation, economies, companies, and consumers worldwide are struggling to cope with higher prices and the rising cost of living. The term “cost of living crisis” is often used to refer to the situation many of us are living through, but what does this mean, why is it happening, and how does it impact companies and consumers?

With inflation front of mind for consumers and companies alike, it is important to understand how inflation affects households differently according to their income types and spending habits. Such insights – based on Euromonitor International’s proprietary Consumer Price Index built for specific income types – are powerful, because they reflect more accurately the experience of inflation for different households, and thereby help businesses successfully navigate the consumer landscape with targeted pricing strategies.

Consumers are Pursuing Value: Why Brands Need to Pay Attention

Value is front of mind for many consumers. But value is more than just value for money, and the pursuit of value is here to stay as one of the 10 most influential megatrends, identified by Euromonitor International as having far-reaching impact on industries, companies, and consumers. In this podcast, An Hodgson explains the Pursuit of Value – where it comes from, why businesses should pay attention, and how can they win through undersrtanding and implementation of this megatrend.

3. Climate Crisis

Disruptive Opportunities Behind Net Zero Strategies

Global professionals agree that climate change will have a direct impact on their businesses, according to Euromonitor International’s Voice of the Industry: Sustainability Survey, fielded January 2022, (n=588). 76% think it will affect consumer demand, while 71% mentioned supply chain disruptions. Additionally, increasing pressure from stakeholders is pushing corporates to demonstrate commitment through traceable and transparent actions. Therefore, properly implemented net zero strategies will remain integral considerations.

The Rising Importance of Sustainability Strategies

There is a global consensus on the impact that climate change has on businesses, as reflected by the increasing number of global experts (82% in 2022 - a 2.2 percentage point increase on 2021) who consider climate action to be very or extremely important for their business, according to Euromonitor International’s Voice of the Industry: Sustainability survey 2022.

Europe Leads Euromonitor International’s Sustainable Travel Index

Climate change is the biggest threat to people and planet, and poses a very direct existential threat to the future of travel and tourism, with this industry accounting for 8% of global carbon emissions. If travel and tourism were a country, it would rank third behind the US and China in terms of the scale of its emissions.

4. Looming Food Crisis

How Consumers and Businesses are Reacting to Food Price Inflation

The food industry is being affected by rising costs of production, including raw materials, commodities, labour, energy, and transportation. While the COVID-19 pandemic and Russia’s invasion of Ukraine have been the major determinants inflating global food prices, challenging weather conditions and export restrictions are also contributing to higher price pressure globally. Food companies need to adapt their product strategies to respond to rising costs and consumer reactions.

War, Protectionism and Climate Change Inflate Global Food Prices

The prices of food commodities are rising, hitting economies, manufacturers and consumers worldwide. Food inflationary pressures are likely to remain high as some pandemic-induced supply bottlenecks remain, while Russia’s invasion of Ukraine has added a major supply shock and a wave of export restrictions. Furthermore, climate change impacts will continue to threaten agricultural yields and food security.

Key Risks and Opportunities in the Global Food Commodity Market

Euromonitor International has identified key factors that will continue to shape food commodity markets, including commodity price volatility, uneven development in food demand, shifts in global supply chains, climate change and sustainability pressures. Keeping abreast of these trends is extremely important for businesses if they are to manage supply risks, adjust sourcing and pricing strategies, identify and seize new market opportunities, and navigate the turbulence of food commodity markets.

For further analysis please read Euromonitor International’s Economies in 2023 and watch the on-demand webinar Global Economy in 2023: What are the Key Recession Risks?