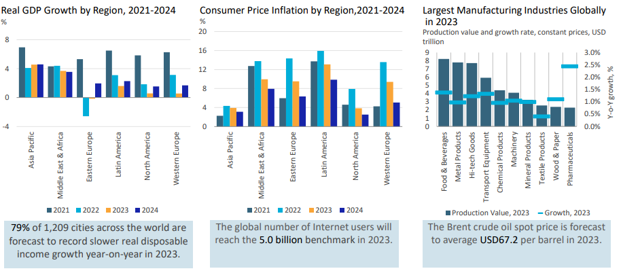

In 2023, global economies will continue to face multiple macroeconomic headwinds, including geopolitical uncertainties, inflation and tightened financial conditions. Global economic growth is expected to further slow, while cities will witness subdued consumer spending growth. Commodity prices are likely to soften and global supply chains will recover, but upside risks on inflation will remain. Food and beverages and pharmaceuticals are sectors that are expected to be resilient, while the outlook for energy-intensive industries remains challenging.

Below is a summary of some key trends in the global economy, cities, business environment, industrial production and commodities market for businesses to consider in 2023.

Global Economies Landscape in 2023

Note: Data for 2022 and beyond are forecasts.

A new economic reality shaped by geopolitical tensions, high inflation and rising interest rates

Maxim Hofer – Senior Economies Consultant

Businesses and consumers will face a challenging economic setting in 2023: global real GDP growth is expected to slow further to 2.3%. Meanwhile, a new economic reality is arising, characterised by a multitude of challenges, risks and crises that will result in an unusually high level of uncertainty. Sharply reduced purchasing power and a rapidly changing interest rate environment will further dampen business and consumer confidence. Rising geopolitical tensions could result in immediate economic shocks, while also raising the potential of broader shifts in global trade. Advanced economies are forecast to grow by 0.7% in real terms in 2023, driven by high recession risks in the US and Europe. Emerging and developing economies are expected to grow by 3.7% in the same year, with some outperformers in Asia Pacific and the Middle East.

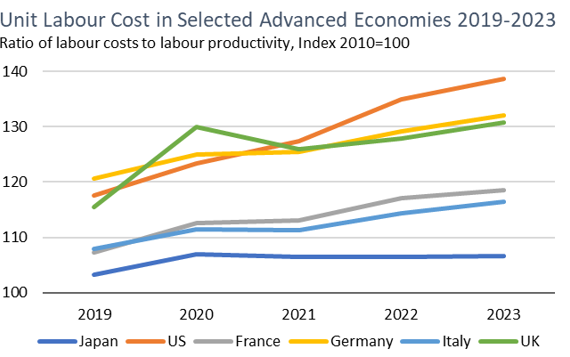

Labour market tightness likely to continue, despite potential increase in unemployment

Lan Ha – Head of Economies Practice

Entering 2023, the impact of near-term pandemic-related factors (health concerns, declining immigration, changing work preferences) that led to tight labour markets in previous years will ease. Economic slowdown could also reduce the demand for workers and result in higher unemployment rates in some countries. However, several existing structural changes will keep the global labour market tight. Among the main issues are the rapid ageing of workforces in advanced and some large emerging markets, as well as political and other risks to labour force migration, thus restricting overall labour supply. A tight labour market will continue to push up nominal wage growth, adding to inflation risks and pressures on companies’ costs. Businesses in 2023 will thus still face the challenges of attracting and retaining workers, prompting the need for investment in human capital, organisational adjustment and productivity enhancement.

Note: Data from 2022 are forecasts

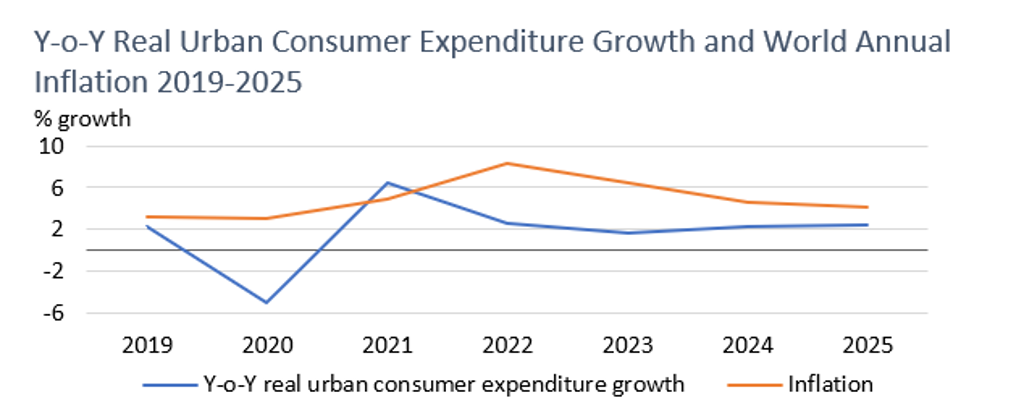

Urban consumer spending to be curbed by inflation and cost of living crisis

Fransua Vytautas Razvadauskas – Senior Cities Consultant

High inflation and economic instability will curb urban consumer spending in 2023, as people will continue to direct more of their incomes to cover necessities such as food and utilities. This will challenge those cities where the local economy heavily depends on leisure, recreation and accommodation services, with tourism-focused cities such as Athens and Bangkok feeling the pressure of reduced inbound consumer spending. On the other hand, cities in Asian and Middle Eastern and African urban areas are expected to see resilient growth in consumer spending due to solid demand-side growth, with 4.2% and 2.5% year-on-year real growth being forecast, respectively, for 2023.

Note: Data from 2022 are forecasts.

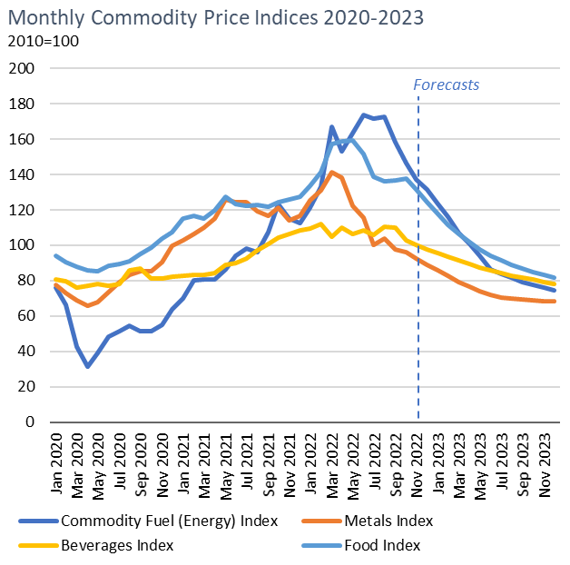

Commodities price pressure to ease, but volatility remains

Aleksandra Svidler – Economies Consultant

Macroeconomic uncertainty will continue to affect commodity markets in 2023. Prices of major energy, metal and agricultural commodities are set to follow a downward trend, due to weaker demand amid the global economic slowdown, high interest rates and elevated inflation. Investment in diversification and resilience of commodity supply chains will be key for businesses to mitigate risks associated with geopolitical tensions, climate change and shifts in global demand.

Note: Data from November 2022 are forecasts.

Global supply chains expected to recover despite existing risks

Justinas Liuima – Industrial Insights Manager

After two years of turmoil caused by the global pandemic, supply chain pressures are forecast to finally ease in 2023. A number of risks, including China’s abrupt reversal of its “zero-COVID” policy, rising energy prices and increased geopolitical risks, continue to cloud the swift recovery of global supply chains. Nevertheless, improved production capacity, restored inventory levels, increased transportation capacity and generally weaker demand growth, due to a slower economic performance in 2023, are all predicted to help rebalance demand and supply, and ease supply chain issues. Ongoing production reshoring efforts and tight labour markets are also set to support faster investment growth in digital and production automation tools.

For further analysis please read Euromonitor International’s full report Economies in 2023 and watch the on-demand webinar Global Economy in 2023: What are the Key Recession Risks?