Electric vehicles (EVs) have shown tremendous growth and 2022 is predicted to be another record year, with 13.3% of new passenger car registrations being EVs – up from 9.5% a year earlier. Yet, skyrocketing electricity prices, especially in Europe due to the war in Ukraine, are likely to test the EV industry’s resilience, which has already been challenged by semiconductor shortages and rising production costs.

With EVs becoming less affordable, it may influence a renewed interest in internal combustion engine (ICE) vehicles, although this is expected to be a short- to medium-term change as governments continue to advocate for low emission mobility.

Electricity price surge raises the running costs of EVs

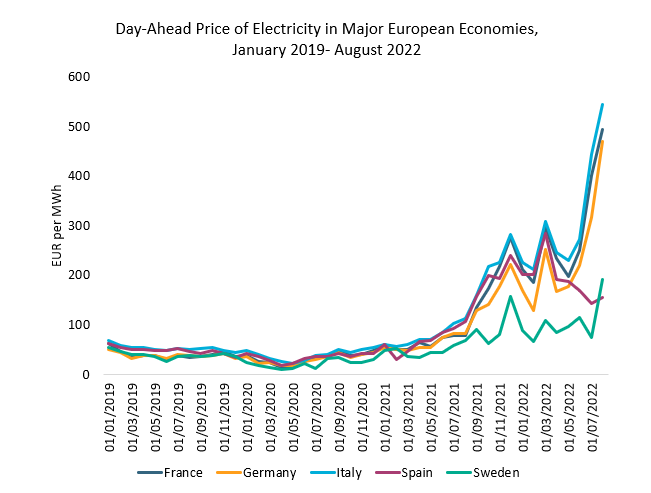

The war in Ukraine has been the main culprit behind the energy crisis, especially in Europe. Natural gas prices, which dictate electricity costs, have soared in 2022, as Europe’s dependence on Russian supplies has weakened the region’s economic position.

According to the energy think tank Ember, Germany’s electricity prices in August 2022 were, on average, 460% higher year-over-year. In 2021, 55% of Germany’s natural gas imports came from Russia, although this had dropped to 26% by June 2022, according to the World Economic Forum.

Rising electricity prices in 2022 have diminished the notion of cheaper running costs for EVs compared with ICE vehicles, as residential and commercial EV charging rates have surged. The EV charging operator Allego raised charging tariff rates in most European countries in September 2022 and has announced a further rise in October 2022. For example, in France, a kWh price for an ultra-fast charging unit (>50kW) will reach EUR0.98, up from EUR0.79.

Moreover, according to the UK breakdown service the RAC, the cost of charging an electric car using public charge points increased by 42% in just four months between May and September 2022 in the UK. While the cost per mile of USD0.20 for electricity is lower than for petrol (USD0.21) or diesel (USD0.23), the difference has become marginal.

Semiconductor shortages and rising inflation are making EVs a luxury purchase

Yet, the energy crisis has not been the only challenge for EVs. Semiconductor supply shortages have hit automotive production since the outbreak of the coronavirus (COVID-19) pandemic in March 2020. This has particularly squeezed battery electric vehicles (BEVs), which generally require twice as many semiconductors as conventional vehicles. According to Pat Gelsinger, CEO of the global technology firm Intel, the global semiconductor shortage could extend into 2024, after his initial estimate of 2023.

A global recession in a stagflation scenario has further intensified the challenging state of affairs, as consumers face a cost-of-living crisis. Euromonitor International predicts the rate of global inflation will reach 7.3% in 2022, up from 4.7% in 2021, although it is expected to stabilise at 5.5% in 2023. With the rising cost of consumer goods, big-ticket purchases such as electric vehicles may be relegated by consumers as they prioritise non-discretionary expenditure such as utilities and food.

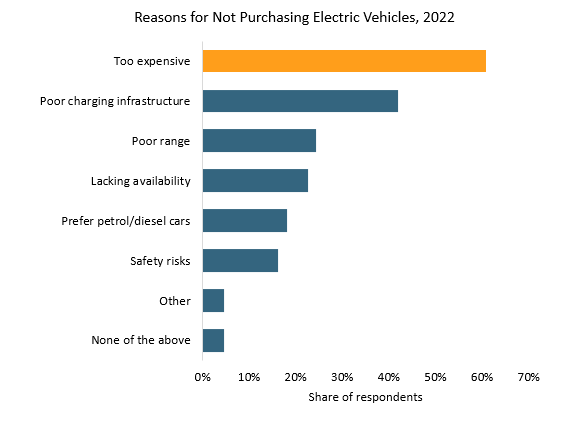

Furthermore, rising inflation is exacerbating the view of EVs as being a luxury purchase. According to Euromonitor International’s Voice of the Consumer: Mobility survey, most respondents said they did not buy an EV due to their high price tag in 2022. Indeed, the International Energy Agency (IEA) pointed out that the average sales weighted cost of battery electric vehicles (BEVs) in Europe and the US was around 45-50% more expensive compared with conventional vehicles in 2021.

Back to internal combustion engine vehicles?

The high price tag and rising cost of ownership of EVs may encourage consumers to reconsider ICE vehicles. However, with carbon emission reduction measures, changes in consumer habits away from EVs are only likely to be short- to medium-term as governments continue to promote sustainable mobility. For example, Norway has set a target of banning the sale of new diesel and petrol vehicles by 2025; meanwhile, the UK and France are planning to implement this change in 2030 and 2040, respectively.

In addition, EV sales figures in 2022 have so far been robust. BYD reported EV sales of 174,000 in the month of August 2022 – an 87% rise over the same period a year earlier. Tesla, GM, VW and other leading automotive companies have also performed well and recorded strong sales in the same period.

According to current forecasts by Euromonitor International, 13.3% of new passenger car registrations are projected to be battery and plug-in hybrid electric vehicles in 2022. Yet it remains to be seen if further escalation of electricity prices, as well as mounting inflation and slowing economic growth under a more adverse economic scenario, could lead the industry to decelerate in 2023.

For further discussion about EVs, read our article EV Readiness Index.