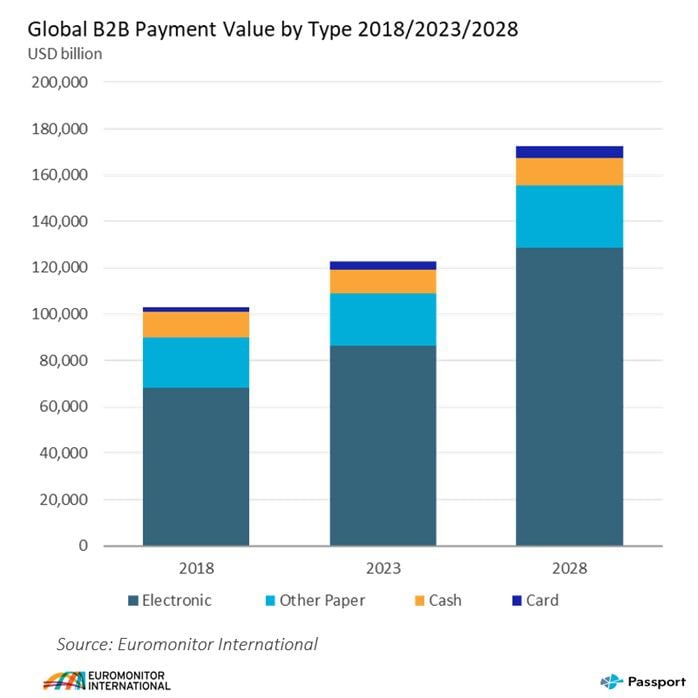

- Total B2B electronic payments value was USD 86,497 billion, an 8.3% increase from 2022

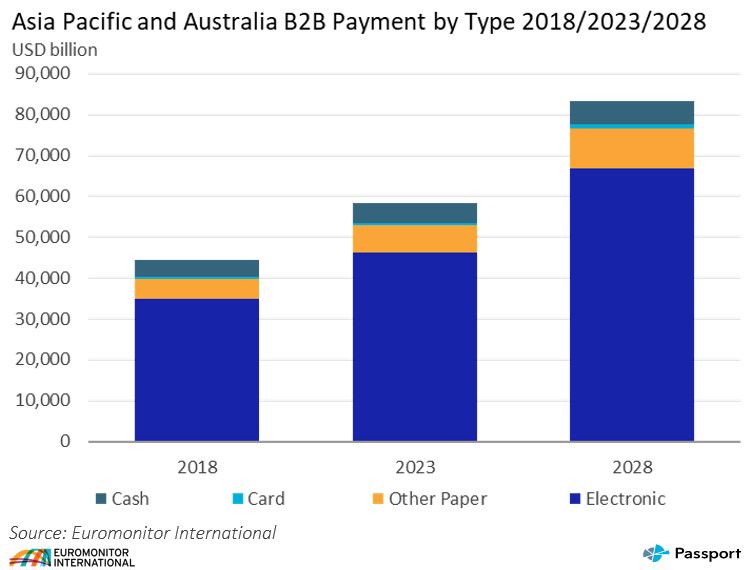

- Asia Pacific region generated the most B2B payment value with USD31.9 trillion

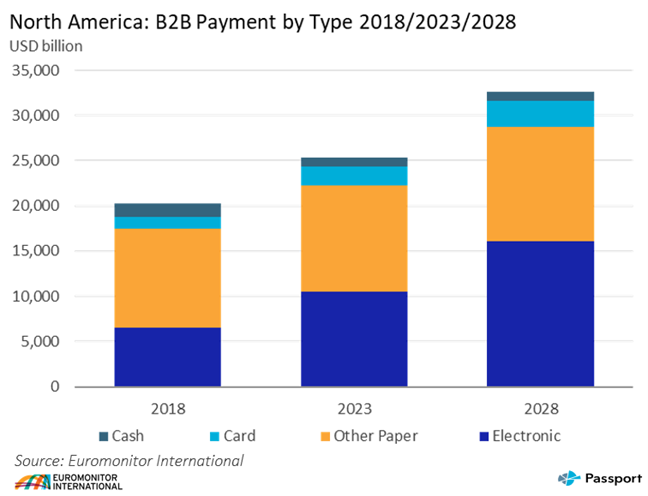

- The US is driving the commercial financial card market with 58% of total commercial card payment value

- Globally, nearly USD33 trillion in commercial payment value was made with cash, cheques and other paper

- Fintech is increasingly turning to B2B payments to drive greater value for merchants

LONDON, UK – As consumer cash, cheques and paper payments continue to decline, financial card and electronic direct payment platforms will increasingly target B2B spending to grow electronic and financial card payment volume, according to research by Euromonitor International.

Kendrick Sands, Head of Consumer Finance at Euromonitor International, said that electronic direct is the leading payment method, in part because of its convenience, low cost and the speed at which it can be processed.

“The increased availability of real time payments networks globally is moving more payment value to electronic for both consumer and commercial payments. With additional platforms currently being developed or rolled out on a global scale, it is likely to remain the most popular B2B payment channel beyond the next few years,” explains Sands.

USD32.7 trillion in B2B payment value was made with cash, cheques and other paper globally

The rising cost of goods, due to inflation and higher interest rates, has led many merchants to rethink their B2B payment structure. The most significant cost that paper payments can impose on merchants is the settlement time, additional to security and convenience.

Sands said: “Paper payments alternatives can also simplify matters for merchants engaged in cross-border business endeavours but has consistently dropped over the past decade. Most international card and electronic B2B platforms can adjust quickly to multiple currencies and other cross-border payment concerns, where paper has limitations.”

Asia Pacific and North America generate the most B2B payment value

The Asia Pacific region reflected the global B2B payment preference for electronic direct first and financial cards least in 2023. "Financial card companies have not targeted the B2B sector to the same degree compared to consumer payments. Electronic payments it is often the lowest cost option for merchants and is much more secure than paper transactions,” explains Sands.

Emerging fintech B2B providers throughout the region are creating commercial payment platforms that offer additional value, including marketing/advertising tools for merchants to grow their customer base and access to capital and financial products.

Sands said North America was the region that generated the most commercial payment value on financial cards last year, but the channel only accounted for 8.1% of total B2B transaction value. Regulations currently being considered, to limit interchange on financial cards in the US, have the potential to reduce the incentives of card networks and for issuers to convert additional payment value in the future.

“Innovation in these regions will create the global standard going forward in terms of what payments international merchants will need to accept,” added Sands.

“As more fintechs compete and innovate, more complete international B2B payment platforms will emerge and will challenge the local traditional financial sector. For local financial institutions to stay relevant it will be necessary to partner with these emerging platforms.”

For more information read Euromonitor International’s Commercial Payments Overview report.

For further information, please contact:

Euromonitor Press Office

Press@euromonitor.com

About Euromonitor International

Euromonitor International is the world’s leading provider of global business intelligence, market analysis and consumer insights. From local to global and tactical to strategic, our research solutions support decisions on how, where and when to grow your business. With offices around the world, analysts in over 100 countries, the latest data science techniques and market research on every key trend and driver, we help you make sense of global markets.