Mobility patterns are changing as sustainability pressures, technological innovation, remote work arrangements and improving mobility infrastructure are altering consumer attitudes to travel. Euromonitor International launched its annual Voice of the Consumer: Mobility Survey, 2022 for 36 countries to help assess mobility trends based on commuting patterns, spending preferences, vehicle ownership and attitudes to autonomous vehicles. It has identified three key trends that consumers are focusing on in the fast-growing mobility industry which can support strategies for mobility companies in 2022 and beyond.

Shared mobility is a small but growing niche for commuter transport

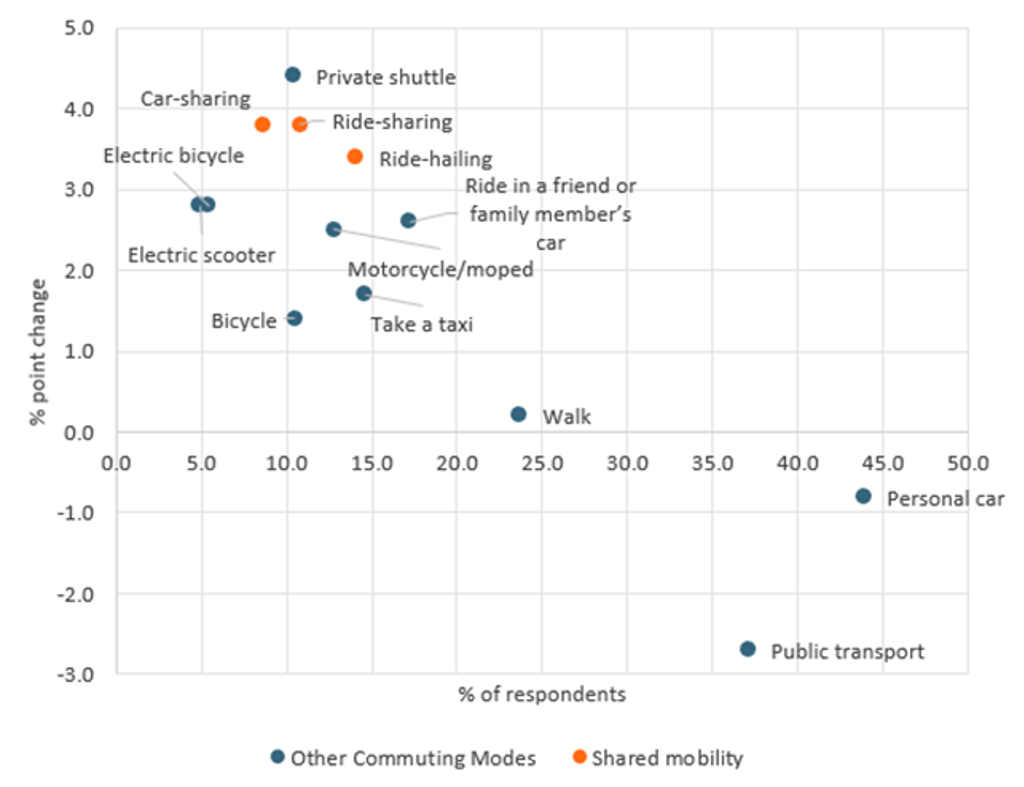

Shared mobility has disrupted the mobility scene over the last decade with more people valuing its convenience in an increasingly urbanised world. While ride-hailing, car-sharing and ride-sharing have grown in popularity, they remain a niche in the commuter market compared to public transport and personal car use. For example, according to Euromonitor International’s Voice of the Consumer: Mobility Survey in 2022, 14.1% of global respondents used ride-hail services to commute compared with 37.1% who used public transport and 43.9% that travelled by personal car. Supporting more coherent strategies by targeting specific consumer segments and positioning shared mobility within the broader context of the transport network, will be vital to further boost uptake:

- Companies should target younger commuters as they are generally more inclined to use alternative means of transport. Engagement should be driven by social media platforms such as Instagram and TikTok, which are trending among millennials and Generation Z.

- Position shared micromobility such as utilising bicycles and scooters for shorter journeys and car-sharing and ride-hailing for longer commutes.

- Build partnerships with local transport providers to better intertwine shared mobility within the larger urban commuter transport system.

The EV (electric vehicle) industry is a fast-growing market, but challenges remain

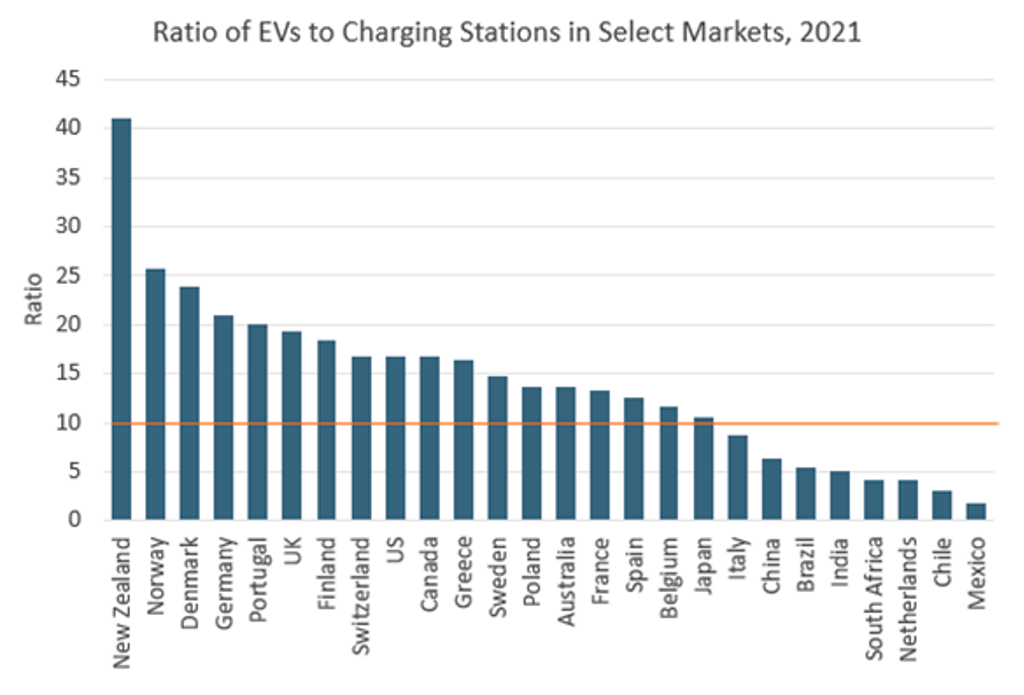

The global EV market is growing swiftly as governments seek to decarbonise the transport industry. Yet a sizeable proportion of consumers are not rushing to jump on the EV bandwagon. According to Euromonitor International’s Voice of the Consumer: Mobility Survey in 2022, 60.8% stated that electric vehicles are too expensive, while 41.9% of respondents reported a poor charging infrastructure as a factor in not buying an electric vehicle. While this is a challenge for electric vehicle manufacturers, it is also a window of opportunity to scale charging infrastructure:

- Target countries such as New Zealand and Norway where EV uptake has surged faster than the development of charging stations. This can help to further boost EV uptake among the consumer segment which typically avoids EVs due to range anxiety.

- Position in countries with coherent and ambitious sustainable transport plans. This can help companies and end consumers to leverage tax credits, financial support, and other incentives that governments may offer to bolster electric vehicle expansion.

- Consumers still view EVs as a premium purchase despite prices falling over the last decade. Targeting the mass market can help better scale revenues in developed, but also emerging, markets which are benefiting from a growing and upcoming middle class.

Note: orange line denotes the EU recommended maximum guidance value of 10 EVs to 1 charging station.

Source: IEA, Euromonitor International from trade sources/national statistics

Emerging market consumers are more likely to purchase a car in the coming year

Since 2020 when supply chains were heavily impacted, the automotive industry has struggled due to microchip shortages. The issue is still present in 2022, with several automotive firms including Toyota and Volkswagen vowing to either reduce or pause production. Despite this, emerging and developing market consumers seem buoyant about the prospects of buying a new or a used car in 2022. For example, over 70% of respondents in the Middle East and Africa suggested buying a new or used car in 2022 – this contrasts with North American and European consumers where approximately only 40% agreed according to Euromonitor International’s Voice of the Consumer: Mobility Survey. From a commercial perspective, this can offer growth and diversification opportunities at a time when rising inflation is hitting consumer spending:

- Establish sales channels to reach middle-class consumers in emerging and developing markets. This is especially the case in Asian economies such as China, India, and Pakistan which are expected to deliver the largest rise in middle-class households (households with real disposable incomes between 75%-125% of the median) over 2021-2026.

- In addition to physical stores, focus on targeting consumers via digital channels. With smartphone and internet penetration rates surging in emerging and developing markets, it offers a new and modern alternative to the traditional bricks-and-mortar business model.

- Have carefully planned pricing strategies that can target a wide range of consumers from price-sensitive buyers living in smaller cities on lower incomes, to young and more affluent big-city customers who will pay a premium for more sophisticated models and specific features.

For the latest and more in-depth insights on the Mobility Survey, please refer to the Voice of the Consumer: Mobility Survey 2022 Key Highlights

For more analysis on EV development, click here, and for shared mobility it's here.