Globalisation Reset: Why Companies are Rethinking Global Strategy

Globalisation - the integration of the global economy through international trade, investment and migration - has much described world development in the last few decades. Economies, companies and consumers across the world have for years benefited from globalisation, while also experiencing the risks and negative impacts it can bring.

Since the Global Financial Crisis in 2008, the global economy has experienced some slowdowns and shifts in trade and investment flows, driven mainly by a wave of new technologies, changing global economic power and public concerns. Now Coronavirus (COVID-19) has turbocharged a globalisation reset, revealing the fragility of global connectivity, and prompting countries and businesses to rethink their trade, investment and operation policies. Understanding the forces shifting the global landscape and how globalisation is transforming will help business and investors prepare for the next phase of globalisation and the opportunities and challenges it will present.

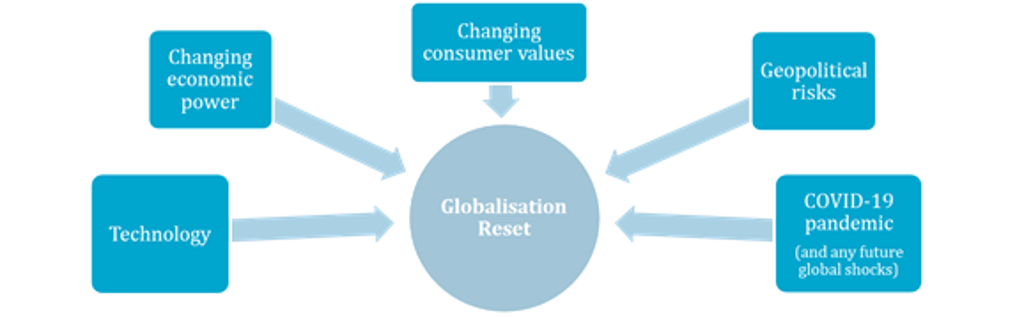

The forces shifting globalisation

Global trade and investment flows reflect where companies decide to invest and make, buy or sell things – and the arrangements/intermediaries they set up to do this as productively as possible. Now there are rising global forces that are influencing such business decisions.

The shift in global economic power is also reshaping the global value chains. China and other emerging and developing countries continue to be the manufacturing powerhouses for the global economy, but they have also emerged as new major consumer markets as they now can consume more and more of what they produce. Trade intensity has declined significantly in emerging and developing markets in recent decades, reflecting the countries’ growing industrial maturity and rising consumption power. Emerging and developing markets represented 37.6% of global consumer expenditure in 2020, up from 31.4% in 2010.

Source: Euromonitor International from national statistics/OECD/International Monetary Fund (IMF)

Note: Data for 2021 are forecasts.

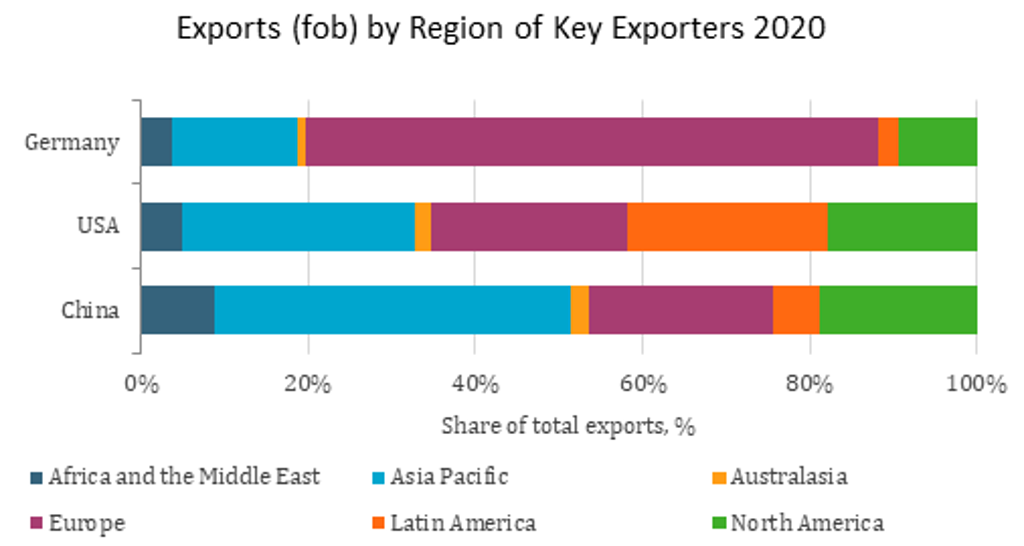

Along with the rising power of China and other emerging markets, geopolitical risks in the form of populism and protectionism - as manifested recently in Brexit in the UK, and the US-China trade war - have resulted in tensions and threatened a reversal in global trade. In some countries, tariff and non-tariff barriers have risen again. Intra-regional trade and supply chains have thus witnessed a rising role in the global value chains. Having witnessed the supply shocks caused by the COVID-19 pandemic, manufacturers now increasingly prioritise speed to market and proximity to customers.

Source: Euromonitor International from World Trade Organisation

Equally profound are the changes in consumer values and preferences. While global companies are used to producing standardised products, consumers nowadays tend to prefer more customisation and differentiation. Also, well before the pandemic, global trade and multinational businesses have already been put under stricter scrutiny as consumers increasingly request more transparent and socially responsible supply chains of goods and services. The pandemic has brought all these purposes and value to the fore.

The new globalisation is leading to changes in the fashion industry

The fashion industry has over the years developed a complex, interconnected global supply chain. Large volumes of production were however concentrated across several Asian countries such as China, India, and Vietnam, given the region’s relatively low production costs and favourable investment policy. But the cracks in this approach were highlighted during the pandemic as production, transportation and consumption experienced disruption due to intermittent lockdowns. As such, fashion manufacturers and retailers have started reassessing their manufacturing and sourcing decisions. Some have started to partially shift to produce locally or regionally to minimise such risks. European fast fashion retailer C&A, for example, has moved part of its textile production to Germany to enhance agility by inaugurating a jeans-focused innovation hub in Mönchengladbach called Factory for Innovation in Textiles (FIT). Through this, it aims to develop sustainable products and manufacture around 800,000 jeans per year. While building resilience is a priority, diversification of production locations will be a challenge for apparel companies in the years to come, as the industry remains relatively labour-intensive.

Fashion retailers are also focusing on supply chain efficiency and agility via investments in production automation technologies. According to Euromonitor International’s Voice of the Industry COVID-19 Survey in 2021, 34% of apparel and personal accessories retailers plan to increase investments in automation tools. This would allow fashion retailers to fulfil e-commerce orders in less time, further boosting their omnichannel presence. Retailers are also developing micro-fulfilment centres and reducing reliance on a few warehouses to bring flexibility to operations. In sync with this, Gap Inc invested USD140 million in a new distribution centre in Texas. This was in response to the spurt in e-commerce sales triggered by COVID-19. This facility aims to process about one million units daily by leveraging latest technologies, including robotics and automation.

Adapting to the new global era

With uncertainties on the rise, building resilience across the supply chains, markets and operations is now high on the business agenda. In order to stay ahead of future changes, companies need to understand the factors shaping the global new business landscape. Identifying evolving trends and learning how these would transform the global manufacturing, trade, finance and movement of people will help businesses to mitigate risks and secure better access to supplies and markets globally.

For more analysis on how diversification, digitalisation and sustainability strategies are reshaping the global manufacturing and trade landscape and their impacts on business, please read our full report Globalisation Beyond the Pandemic: Opportunities from a Great Reset and watch our on-demand webinar Explaining (de)Globalisation: What’s Next for Companies and Investors?