A version of this article originally appeared in CStore Decisions.

To ensure they were not being left behind during the pandemic, many convenience stores prioritised their omnichannel strategies by deploying newly essential services like a curbside pickup. In the US, this helped ensure that the convenience stores channel was able to record over 2% growth in 2020 value sales, according to Euromonitor International data. However, the real story continues to play out in delivery.

Certain c-stores have been able to go it alone, like upscale brand Foxtrot, where its 60-minute delivery promise has seen success with urban millennials. But many do not have the resources to offer their own proprietary delivery services. Instead, these players are partnering with third-party delivery aggregators that operate their own mobile apps. This gives retailers exposure to an enormous pool of potential customers without having to invest in building delivery infrastructure themselves.

Delivery apps play host while also competing for customers

Despite efforts to expand their online reach, convenience stores are increasingly facing competition from the very partners they have relied upon to do so. For example, in 2020 DoorDash introduced its online convenience store platform DashMart. Akin to the delivery-only ghost kitchens that have proliferated throughout the restaurant industry, DashMart’s virtual stores are able to operate at a much lower cost than their brick and mortar counterparts.

The growing number of options available to consumers on third-party apps is bound to take away the share from the more established c-store players. With mobility still somewhat suppressed due to the lingering effects of the pandemic, it will be some time before c-stores are able to fully capitalise on one of the most important groups within their traditional customer base – commuters.

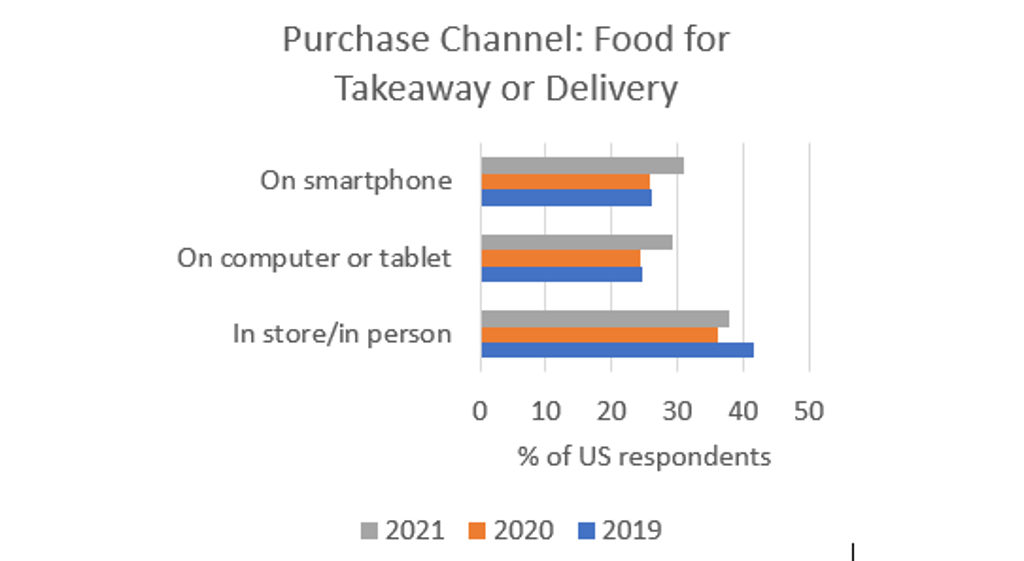

Source: Euromonitor International’s Voice of the Consumer: Lifestyles Survey

What next for convenience store delivery services?

For now, convenience stores have little choice but to continue partnering with delivery apps. Over the short term, a multi-pronged approach to omnichannel – combining in-house services with external partnerships – is perhaps the best way to expand their customer base and drive sales. The long-term benefits of partnership, however, are less clear. Once people return to work and pre-pandemic travel patterns fully recover, some convenience stores may decide that offering delivery is a luxury they no longer need to accommodate. But for consumers who appreciate the option of having an emergency bottle of wine or a late-night snack delivered in short order, the genie may well be out of the bottle.