Although the packaged food industry remains one of the fmcg industries with the smallest penetration of e-commerce, the channel skyrocketed during 2020. This fact, combined with incredibly tech-savvy millennials and Generation Z consumers, has reinforced the need to prioritise online strategies to succeed in an increasingly digital world for food brands and retailers alike; both need to find ways to meet this demand.

Online shopping disrupts the industry and is here to stay

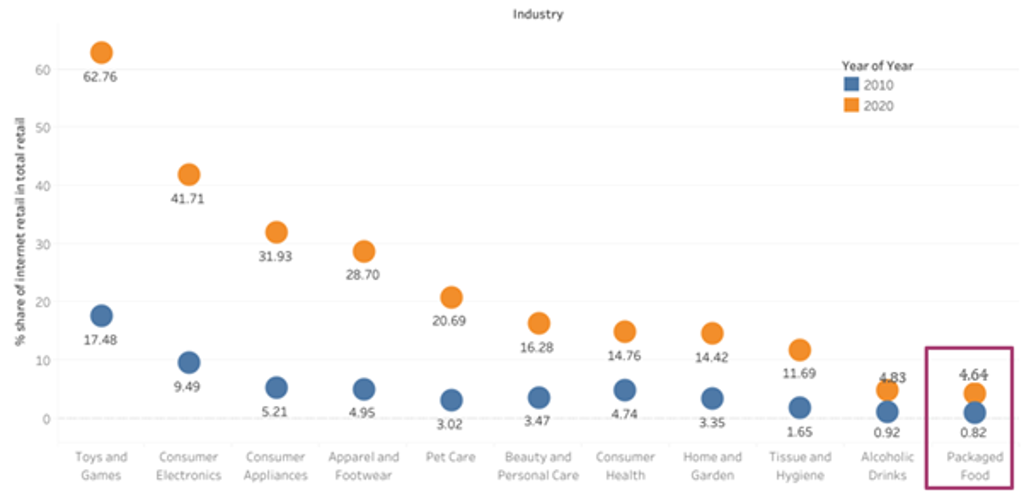

E-commerce represents a small distribution channel within packaged food, accounting for less than 5% of total retail sales. Store-based retailing remains the main distribution channel, with grocery retailers accounting for 87% of all packaged food sales. There are a number of reasons for this including food being a very tangible product with many consumers preferring to browse the shelves and buy perishable food on site. In addition, categories such as snacks heavily rely on impulse consumption, which was not feasible through online channels until more recently.

Internet Sales Across Selected fmcg Industries Globally (2010-2020)

However, e-commerce accelerated at an all-time record pace in 2020 as it enabled consumers to access packaged food from the safety and convenience of their homes amid the pandemic, a first for many consumers trying this channel. This resulted in unprecedented global growth of 54% in 2020, which makes it undeniable that a key strategy to gain share within grocery retailing is through online channels.

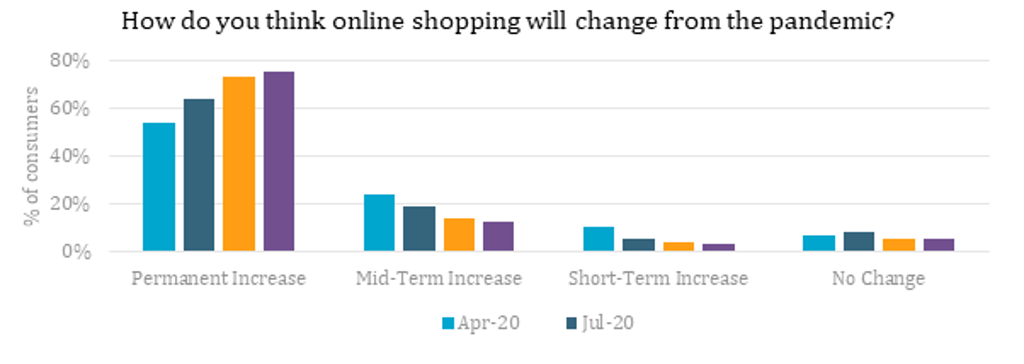

Industry professionals also believe that this is a permanent change. According to Euromonitor International’s Voice of the Industry Survey (April 2021), online shopping’s increase was considered a permanent change by 73% of industry professionals, up 13 percentage points compared to responses from the previous year. This reinforces the need to place e-commerce at the forefront of business strategies to succeed in an increasingly digital world.

Source: Euromonitor International Voice of the Industry Survey, April 2021 N= 1,527; October/April/July 2020. October N=2,803; July N=1,452; April N=2,922

Top priorities to succeed in the online food retail future

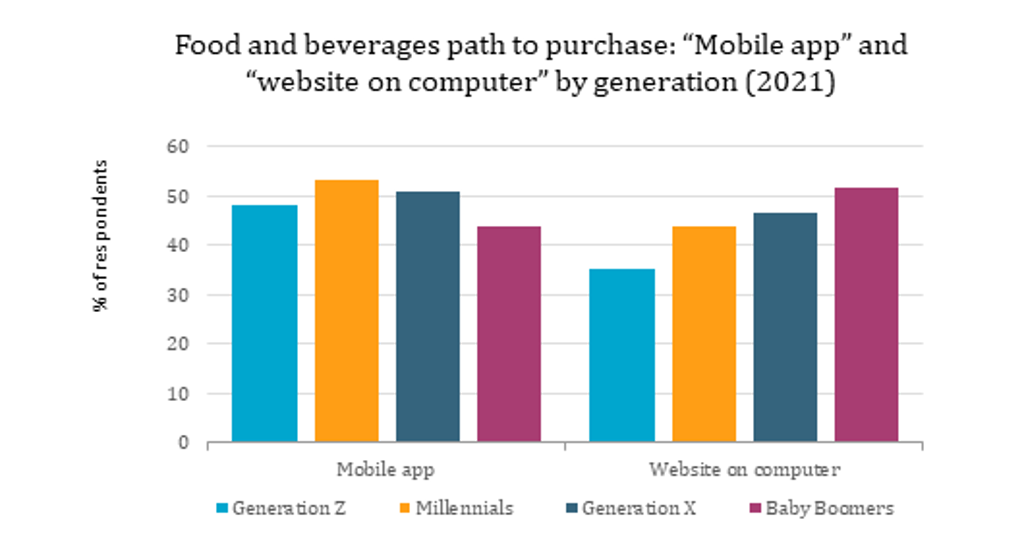

- Focus on the smartphone as a key path to purchase alongside more traditional website channels

According to Euromonitor International’s Voice of the Consumer: Digital Survey 2021, 50% of global consumers who purchase food and drinks online do so through a mobile app, versus 45% through a website on a computer. Millennials are the driving force behind purchasing on mobile apps, while older generations still rely more on their computers when ordering groceries online.

Source: Euromonitor International’s Voice of the Consumer: Digital Survey, May 2021; (n=10,921)

- Define appropriate positioning and assortment for online channels

Similar to brands’ strategies in the offline world, it is crucial to ensure that they have the most adequate pricing policies and product assortment. Packaging is an important point in this context, because whilst packaging provides a primary means of branding and communication in store-based retailers, this impact is significantly limited on a 5-inch mobile screen. E-commerce demands that products tell stories in entirely new ways, from new forms of media such as video, to personal-level engagements with shoppers on social media.

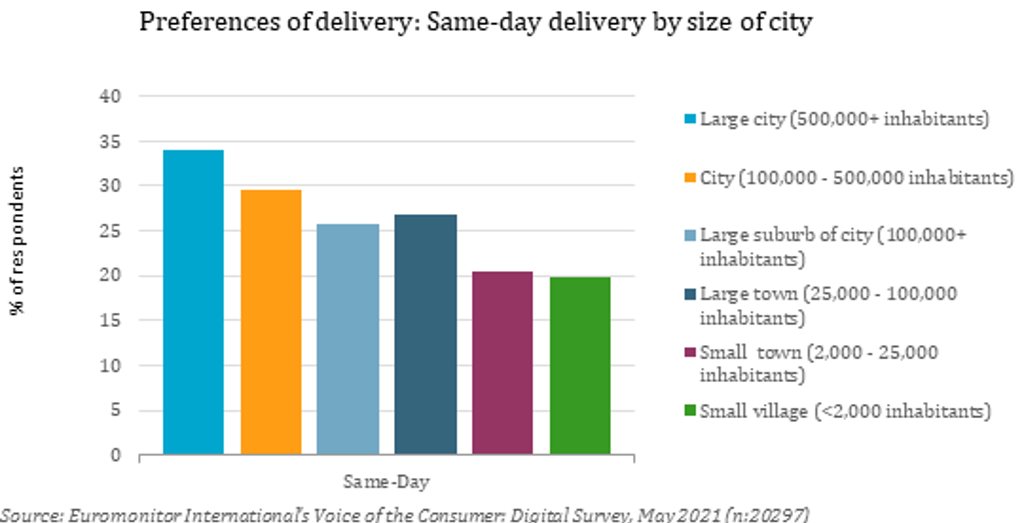

- Adapt to consumer demand for fast delivery of online purchases

Delivery time is now considered a major requirement for many consumers, influencing their purchasing decisions and shopping from online platforms that can deliver their goods in a speedy manner. This trend is more pronounced amongst younger consumers and those living in large cities than in towns or villages.

To accomplish fast delivery, proximity is key and there is a need for an evolution of the supply chain, with hyper-local and micro fulfilment taking a front seat. These models are particularly relevant to capture lost impulse occasions for snacks, enabling the instant gratification that e-commerce could not traditionally offer.

- Tap into emerging business models and e-commerce ecosystems to engage and retain consumers

In addition to positioning, delivery and fulfilment, and engagement and retention of customers, are crucial in the new online environment. In this context, new emerging models such as direct-to-consumer or subscriptions can support further expansion. A great example of this is the booming demand for meal kits and prepared meals delivered to consumers’ doorsteps. Subscription models are also fundamental for the growing trend of personalised nutrition. This is already broadly extended in the pet care industry (Tails.com, Barkyn, the Farmer's Dog) and has potential in a variety of categories such as baby food and snacks.

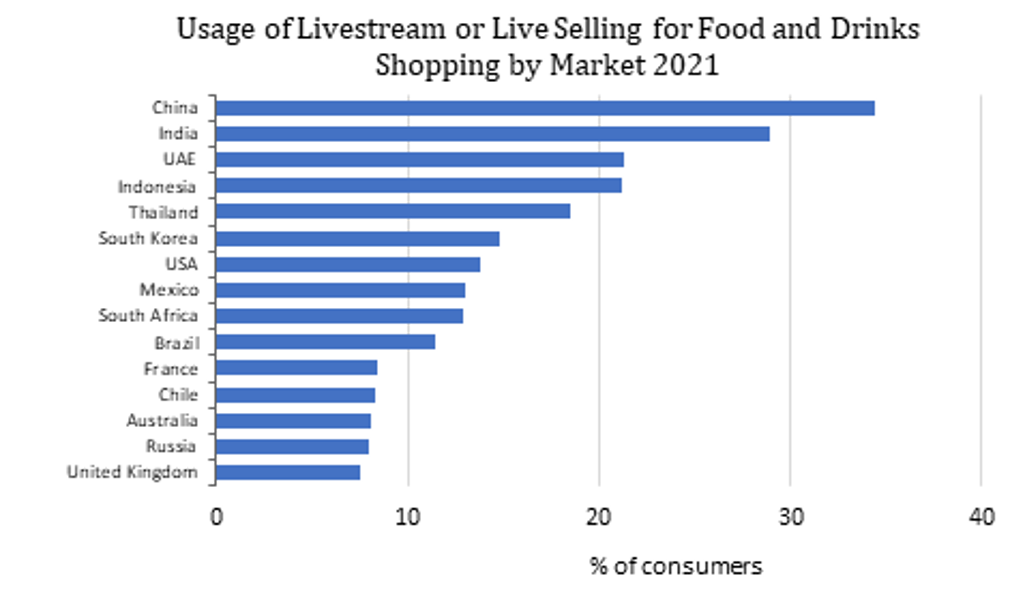

New commerce ecosystems such as social media platforms and all-in-one apps are also becoming incredibly powerful ways to connect to and engage with consumers. Social commerce and live selling are some examples of this, which consist of having the entire shopping experience within the social media platform, from product discovery and research to the check-out process. These trends are especially prevalent in emerging markets such as China and India.

Source: Euromonitor’s Voice of the Consumer: Digital Survey, May 2021 (n:20,297)

Becoming tomorrow’s leader in the e-commerce channel

With an incredibly large amount of consumer data collected when purchasing online, companies can leverage and analyse this information to understand their customers’ purchasing behaviour. In addition, besides retailers’ online channels, there are a host of new customers that brands need to target. Customers using super apps, younger generations spending many hours a day on social media platforms, the growing importance of dark stores boosted by consumers searching for speedy delivery; food manufacturers should invest in all of these platforms if they want to be ahead of the game.

For further insight, see the report The Future of Food Retail: A Spotlight on E-Commerce.