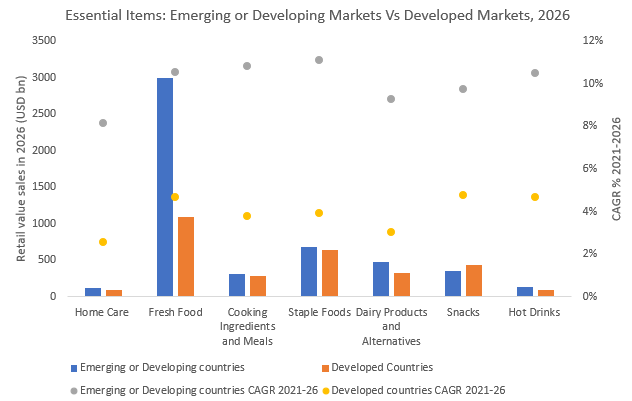

Over the last few years, emerging or developing markets have steadily become important pockets of growth for consumer packaged goods companies. Improving economic situations, favourable demographics, and strong growth potential in underpenetrated categories make these geographies ideal for expansion, and they provide respite from tapering progress in developed countries. These markets are expected to remain important even in the future, as they have strong growth forecast.

In the current inflationary environment, companies are also adopting different strategies to prevent the erosion of their profit margins and, if possible, grow them. One such approach is focused on streamlining product portfolios to distribute manufacturers’ resources to those products that bring in higher revenue. These are often premium products, products with added benefits, or products to which consumers can upgrade by paying a slightly higher price. Thus, in this case consumers who are willing to pay more would be the ideal target group. Through this article, two key categories of essential items are explored – food and beverages, and household essentials – to understand product features for which consumers are willing to pay more.

Food and beverages

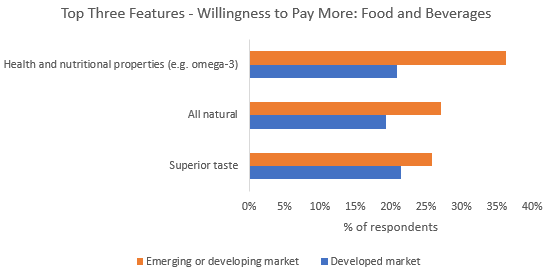

30% of global respondents in Euromonitor International’s 2022 Voice of the Consumer: Lifestyles survey agreed that they would be willing to pay more for health and nutritional properties (e.g., omega-3), more than any other feature, when purchasing food and beverages. This trend is more prominent in emerging or developing markets, with over one in three respondents (compared with one in five in developed markets) agreeing to the same statement. The Voice of the Consumer: Lifestyles survey is fielded annually among online consumers in 39 markets across all global regions.

As consumers have become more health-conscious, they are increasingly adopting healthier diets and prioritising nutritious food. In this context, reducing the consumption of less healthy ingredients, such as sugar, and increasing the intake of specific nutrients, such as protein, is more prevalent among consumers. Consumers are also focusing on edibles that are all-natural, thus limiting the intake of artificial ingredients. While the focus on health has been universal, one of the reasons for emerging or developing markets showing a greater interest in health and nutritional properties is growing awareness of nutrition and its source.

For instance, India faces severe protein deficiency. According to the National Sample Survey, more than 80% of Indians suffer from protein deficiency, with per capita protein consumption declining in both urban and rural areas. According to the Indian Council of Medical Research (ICMR), adults should consume 1g of protein per kilogram of body weight daily. Misinformation and lack of adequate knowledge about vegetarian protein sources are the primary reasons for protein deficiency. However, with government initiatives and brand push, consumers are now slowly becoming more aware, and thus actively seeking products which bridge that nutrition gap.

Household essentials

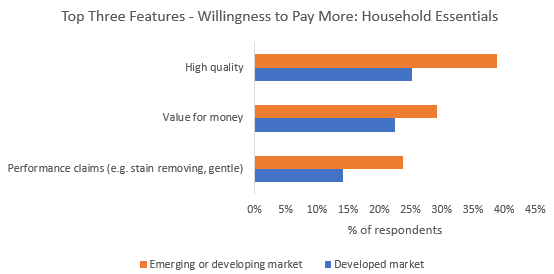

Compared with developed markets, respondents from emerging or developing markets are nearly twice as willing to pay more for high quality when purchasing household essentials such as home care and cleaning products. The focus on the value derived from the consumption of products remains higher in emerging or developing markets, thus, consumers are also willing to pay more for value for money. Brands have taken note of this in the past, positioning their products as the smart choice by showcasing better usage results. This is evident in those product categories in which branded products are pitted against DIY or local cleaning solutions.

Another important feature, performance claims, sees high willingness among consumers to pay more. Within the industry, to create and leverage demand, brands are focusing on relevant claims. Often through these claims, brands try to justify the products being more expensive compared with mass products. With high decibel brand promotion and growing awareness about the possible benefits of such claims, consumers have shown an inclination to pay the premium.

Conclusion

In the current environment and in the future, a spotlight on consumers is necessary. In emerging or developing markets, although the growth potential remains high, it will be important for brands to understand what consumers are looking for when they are buying products, and for what features they would be willing to pay more. This will help players formulate sharper strategies for growth.

For further discussion and valuable insight, read our report Understanding the Southeast Asian Consumer.