This article originally appeared in The British Chamber of Commerce's Orient Magazine.

Change was the only constant over the past two years, with the COVID-19 pandemic having a unique impact on consumers’ behaviours, attitudes and motivations. Today, even though the effects of the pandemic are abating, evolved behaviours are expected to have a continuing impact. These behavioural changes make it imperative for businesses in the region to understand the drivers and motivations behind consumers’ purchasing decisions and how these can be harnessed to unlock the growth potential in Southeast Asia.

Southeast Asia is one of the most significant economic engines in Asia Pacific, with the region accounting for 9.4% of APAC’s economy in 2021. By 2030, countries such as Indonesia, the Philippines and Vietnam are poised to see stronger growth than the overall APAC region, including China.

With Southeast Asia positioned as one of the vital consumption engines in APAC, understanding emerging consumer trends in the region is crucial for businesses looking to tap into a fast-evolving economic and consumption landscape. Euromonitor International has identified the Top 10 Global Consumer Trends expected to drive global markets in 2022. We will be exploring how three of these consumer trends: Backup Planners, Climate Changers and Financial Aficionados, manifest in Southeast Asia, alongside the consumer motivations and behaviours causing them, and what this means for businesses.

Supply chain disruptions lead to the search for next-best options by Backup Planners

From stockpiling in the initial days of the COVID-19 outbreak to ongoing global supply chain issues, product access and availability have come under threat. Lockdowns in China during the first half of 2022 further exacerbated this situation, as manufacturing and freight movement were challenged.

As social occasions and discretionary spending start to return, consumers are looking to indulge in spending on non-essentials. However, as availability remains challenged, consumers often struggle to secure their chosen products. Backup Planners then look for creative ways to procure the items they need. One such approach is embracing technology and alternative business models, such as subscription services or D2C brands, to secure products/services.

According to Euromonitor’s Lifestyles survey, when asked about the motivation behind subscription services, global respondents indicated that convenience was a leading factor. This desire for convenience and the local availability of such services can help businesses meet consumers where they are. Subscription services are also penetrating Southeast Asia, as demonstrated by Treatos by Joey, and BarksJOY – both Filipino companies offering subscription boxes within the pet care space.

Product availability drives profit, while supply shortages can weaken consumer loyalty. Even as supply chain constraints stabilise over time, evolved shopping habits will dictate how Backup Planners discover and shop for products. In such a scenario, businesses that can pivot and provide solutions for customers to access products and services are likely to benefit from this consumer cohort.

Climate Changers are increasingly aware of how their choices impact the planet

There has been growing awareness among consumers of their contribution to climate change. This awareness is driving environmental activism and influencing purchasing decisions. The Climate Changer is looking for products/services that help them make more sustainable choices, while also demanding more transparency and better labelling from brands.

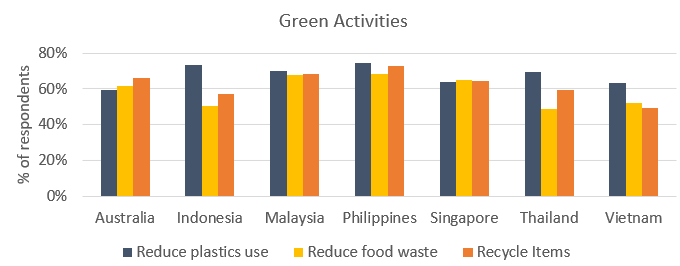

When we look at what consumers across different Southeast Asian markets are doing regarding sustainable choices, we observe that reducing the use of plastics is one of the more popular green activities undertaken.

Businesses in the region are also responding to these evolving preferences. They are adjusting their portfolios to meet consumer demand by offering more eco-friendly products and services. IKEA, for instance, transformed its Bang Yai store into a circular shop where consumers can sell pre-owned home furnishings, buy second-hand IKEA furniture at a discount, and drop off recyclable waste in exchange for IKEA Family Points. Through this effort, IKEA is encouraging extending the use of materials and products through sharing, reusing, refurbishing and recycling.

An observable development in sustainable packaging initiatives has been the rise of refill stations. From The Body Shop in Singapore to IP One in Thailand, brands are introducing refill stations in retail locations as part of their sustainability efforts.

The launch of such initiatives in the region indicates how global and local players are responding to the growing sustainability narrative. As more offerings align with the expectations of Climate Changers, more brands will see their products and services resonate.

Democratised money management for Financial Aficionados

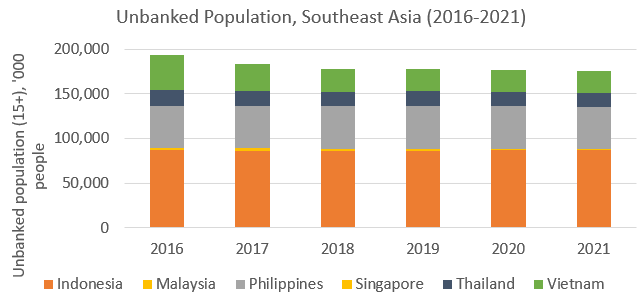

The pandemic bought with it a shift in consumers’ approach to money management and financial security. An uncertain and unstable economic environment has led Financial Aficionados to take better control of their money. From improving their financial literacy to using apps/services that enable them to become financially savvier, consumers are finding ways to feel more financially empowered.

Businesses are also responding with resources that give consumers more control and confidence. In Thailand, KASIKORN BANK, in collaboration with LINE Financial Asia Corporation, introduced a social banking platform called LINE BK. The app allows customers to transfer money, open a savings account, apply for loans, and make payments, all within the LINE app itself. Such product offerings not only appeal to a mobile-centric demographic, due to their convenience and ease of use, but also to the unbanked population.

Providing consumers with better access to easily digestible, educational and simple money management apps can help businesses benefit in this era of financial democratisation.

Key takeaways

Rapidly changing consumer behaviours are challenging traditional business models. Past purchasing habits do not necessarily imply continued brand loyalty. While access to alternatives is one way to engage Backup Planners, Climate Changers will look for products and services that resonate. And simplicity, along with educational content, can help build trust with Financial Aficionados.

Watch our webinar, 2022 Top Consumer Trends in Asia Pacific to explore how the shift in consumer behaviours in the Asia Pacific region impacts your business and understand their expectations.