The breakaway European Super League (ESL) was set to bring together 15 (12 of which were formally announced) of the biggest European football clubs for a new midweek competition in place of the existing UEFA Champions and UEFA Europa League. However, plans quickly collapsed under intense scrutiny and pressure from fans, players, governments and other key stakeholders.

The ESL was set to change the face of European club football. Drafted from the upper echelons of the Premier League, La Liga and Serie A, 12 teams agreed to enter a closed league in place of the existing UEFA Champions League and UEFA Europa League, citing economic sustainability concerns as one of the primary reasons. The announcement was met with widespread hostility and threats of sanctions from governing bodies, prompting a hasty retreat by most clubs. Euromonitor’s Sports database and proprietary Club Index data can capture the scale of the potential disruption the project could have had on domestic leagues.

Club Index Data

The annual Euromonitor Club Index illustrates commercial performances of over 1,000 sports teams globally. Using a range of metrics such as ticket sales/attendances, historic success on the pitch and macro-economic indicators, this index is widely used in the industry to provide insights for existing and prospective sponsors. Here it demonstrates both the strength of ESL clubs and conversely the vacuum that would have been left across other domestic and continental competitions if the plan went ahead as intended.

| Club (A-Z) | Domestic League | Club Index Rank in Domestic League | Club Index Rank in World Football |

| AC Milan | Serie A | 3 | 19 |

| Arsenal | Premier League | 2 | 5 |

| Atletico Madrid | La Liga | 3 | 13 |

| Chelsea | Premier League | 6 | 10 |

| Barcelona | La Liga | 1 | 2 |

| Inter Milan | Serie A | 2 | 15 |

| Juventus | Serie A | 1 | 9 |

| Liverpool | Premier League | 3 | 6 |

| Manchester City | Premier League | 4 | 7 |

| Manchester United | Premier League | 1 | 1 |

| Real Madrid | La Liga | 2 | 3 |

| Tottenham Hotspur | Premier League | 5 | 9 |

Source: Euromonitor Club Index 2020

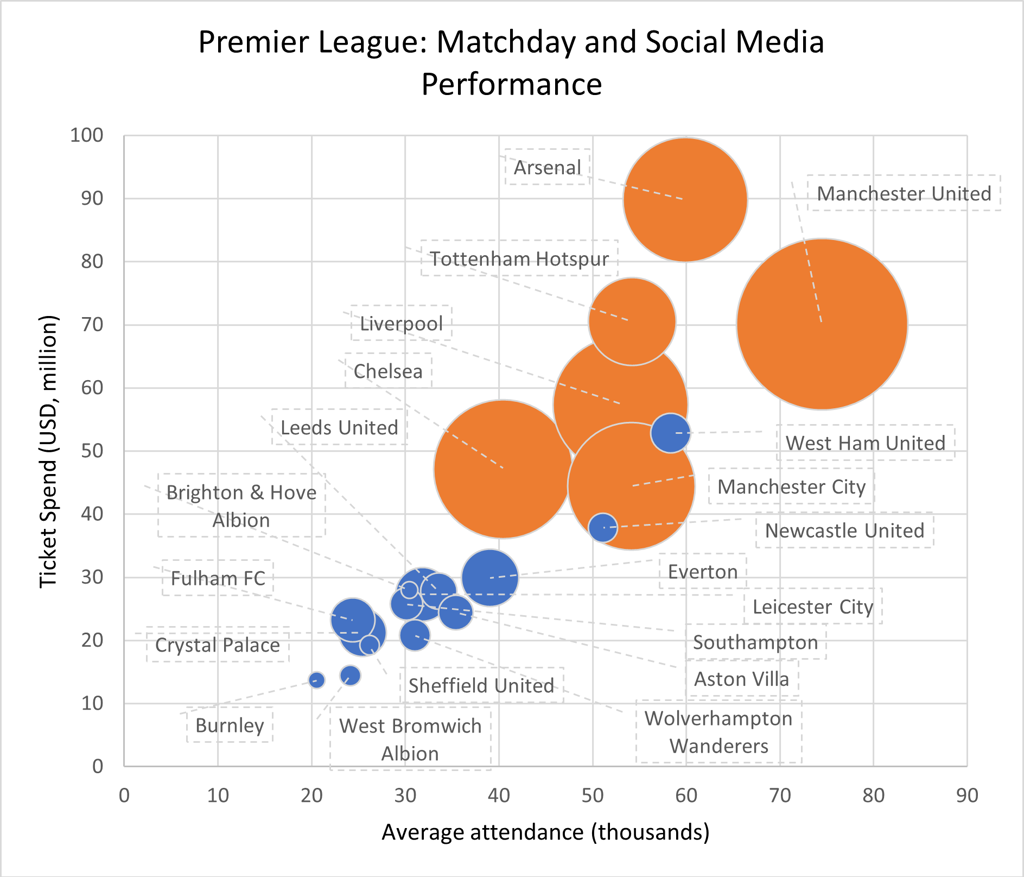

United Kingdom is at the epicentre of the ESL impact

The United Kingdom (UK) was undoubtedly at the centre of the impact since the announcement and subsequent retreat. ‘The big six’ Premier League teams had confirmed their participation in the ESL.

Global goliaths Manchester United had the highest pre-pandemic average match attendances in the UK of over 70,000 and by far the largest online following with over 150 million fans on social media. It is unsurprising that London clubs were a key feature in the ESL even if on-pitch performance isn’t always reflective of the size and appeal of the club. For example, the average ticket price for attending Arsenal games in London is substantially higher than league competitors and more than double of other teams such as Leicester City.

On average, the big six teams had 31 sponsors in 2020.

Source: Euromonitor Sports. Note: The size of the bubble represents the social media following as of December 2020. Matchday data as of 2018-19.

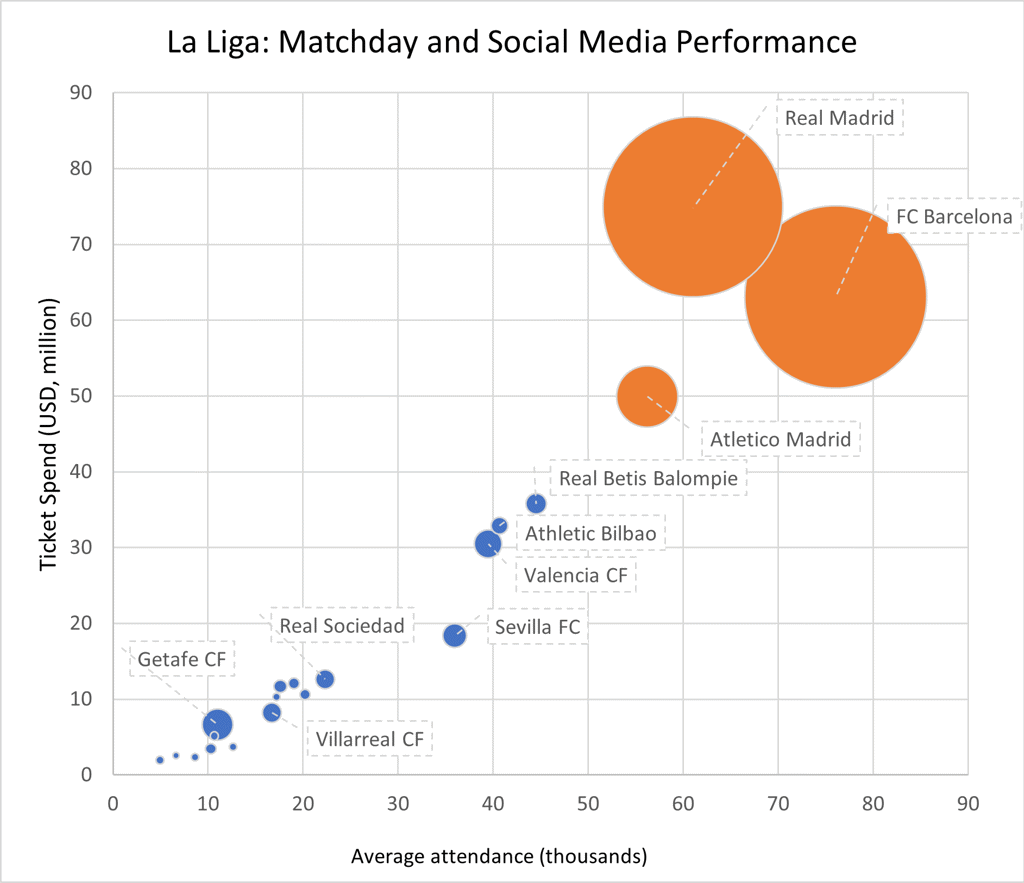

Three teams attract 37% of total attendances in Spain

Spanish giants FC Barcelona, Real Madrid and Atletico Madrid originally confirmed their participation in the ESL. The combined attendance for them pre-pandemic was 3.77 million, accounting for almost 37% of total attendances.

Both Real Madrid and FC Barcelona have a huge global following online, while most other clubs rely more heavily on local fans than global followers.

Source: Euromonitor Sports. Note: The size of the bubble represents the social media following as of December 2020. Matchday data as of 2018-19.

Smaller clubs are heavily dependent on fixtures with the big three. For example, CD Leganes in 2018-19 boasted the highest home attendances and 100% sell-out ratios against Atletico Madrid, Real Madrid and FC Barcelona. The three Spanish ESL teams had on average fewer sponsors than their counterparts in the UK with 26 sponsors.

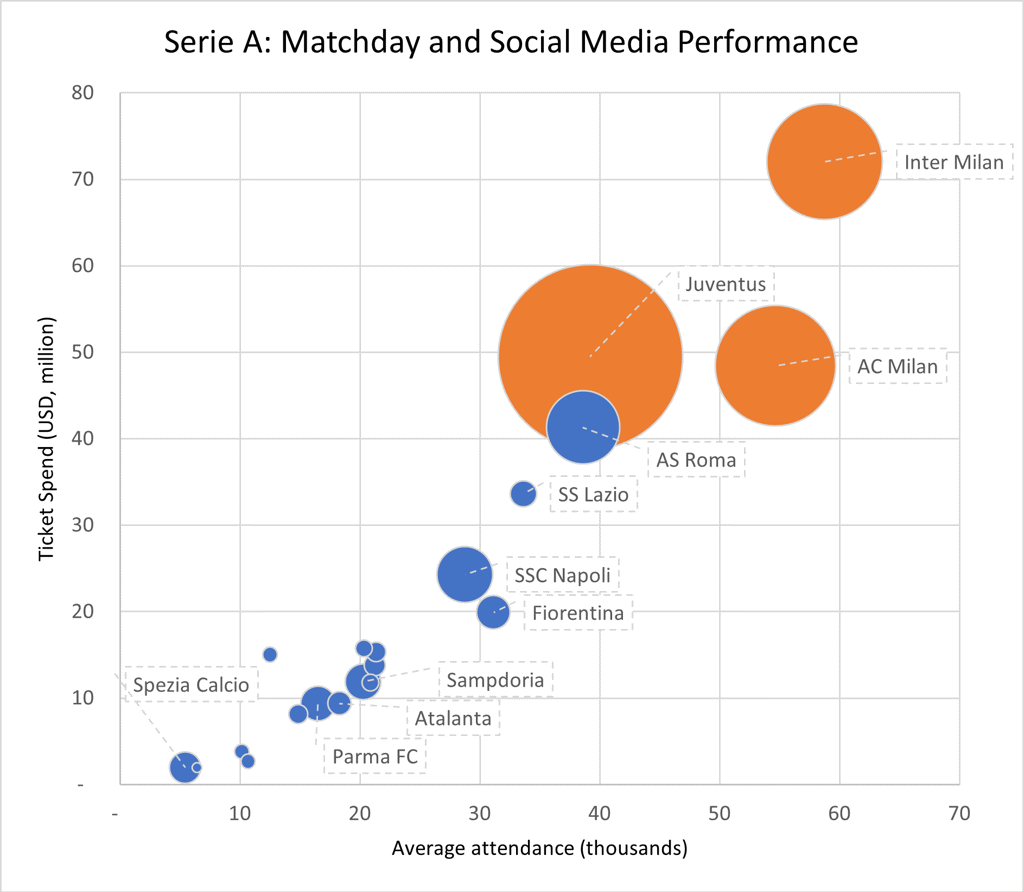

Deep disparities in Serie A commercial performance in Italy

Juventus, Inter Milan and AC Milan also signed up to the ESL. In Serie A, AC and Inter were the only clubs to bring in over one million fans across the 2018/19 season.

Juventus demanded the highest ticket prices (USD63), which is considerably more expensive than teams at the other end of the league spectrum such as Atalanta (USD26).

The three clubs have made headlines following notable moves to appeal to broader global audiences, ranging from re-brands to entertainment partnerships. Juventus has over 100 million followers on social media, compared to other Serie A teams which are yet to reach the 1 million follower milestone.

In 2020, the Italian ESL teams had on average 34 sponsors outpacing both Spanish and UK counterparts.

Source: Euromonitor Sports. Note: The size of the bubble represents the social media following as of December 2020. Matchday data as of 2018-19.

An uncertain future for all stakeholders in European football

The pandemic has already been hugely detrimental to the sports industry. European football still faces uncertainty among key stakeholders such as fans and sponsors even during the early phases of a post-pandemic recovery. As economic sustainability is an ongoing issue within football, objective data is essential to navigate through uncertainty.