Global Recovery Tracker: Momentum of the Recovery Likely to Have Peaked

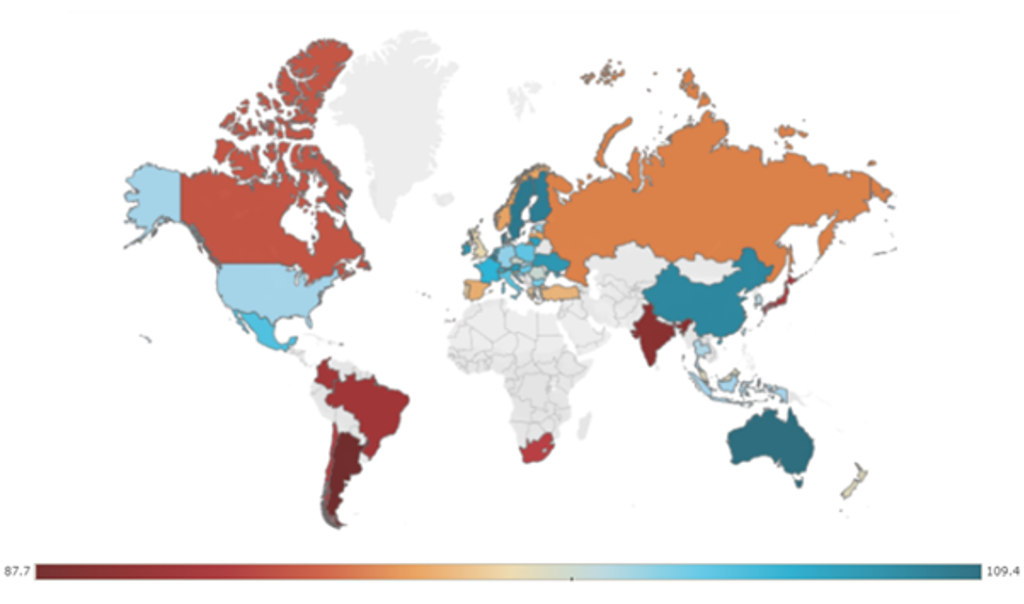

Out of the 48 economies covered by Euromonitor International’s Recovery Index (RI), 29 are expected to have recorded a score of 100 or over in Q3 2021, up from the 13 economies in the previous quarter (an RI score of 100 and over indicates a recovery in which economic output, labour market and consumer spending all return to or exceed the pre-pandemic levels of 2019). Even as more countries are expected to have recovered in Q3, the momentum of the recovery in 2021 is likely to have peaked, due to the spread of the highly contagious Delta Coronavirus variant, slowdown in vaccination campaigns in advanced economies and low vaccination rates in developing countries.

Global Overview for Recovery Index in Q3 2021

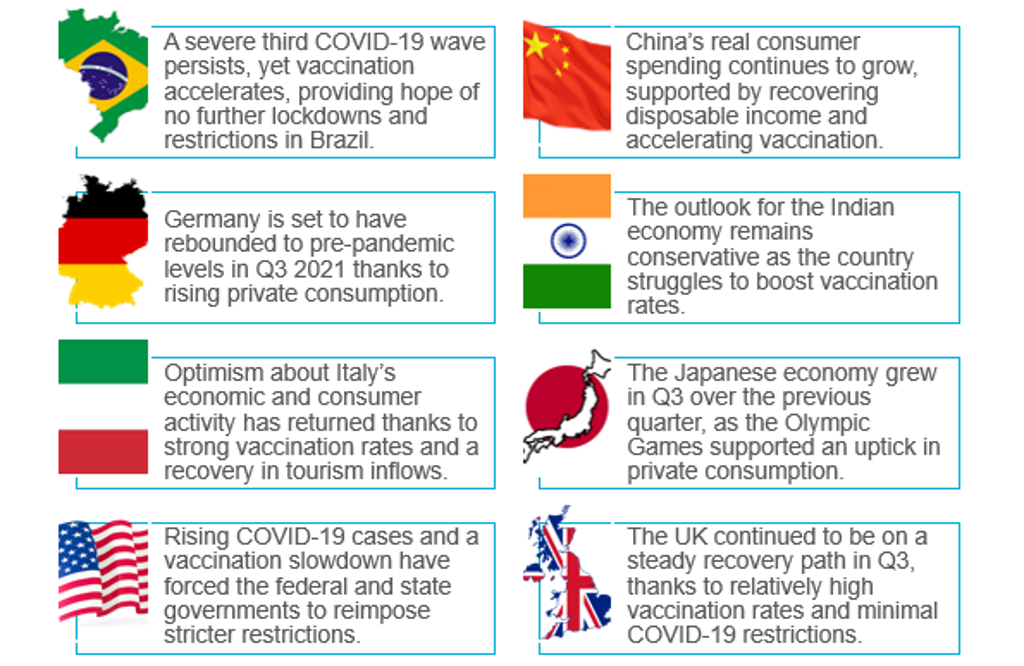

Recovery landscape in key economies

- The RI score for Brazil in Q3 2021 is estimated to have slightly improved to 91.3 from 91.2 in the previous quarter. A severe and prolonged third wave of the COVID-19 pandemic in Brazil persists, yet vaccination is accelerating, providing hope to avoid future lockdowns and strict social distancing measures.

- The RI score for China is expected to have reached 107.9 in Q3, up from 105.9 in the previous quarter. With the Chinese economy being the first to fully recover, the government appears to shift its focus from stimulating recovery to controlling risks relating to national security, technology, finance, and monopoly power.

- Germany is expected to have fully recovered from the COVID-19-caused economic downturn, reaching a RI score of 101.9 in Q3 2021, up from 99.5 in the previous quarter. The German economy is showing resilience and is forecast to maintain stable growth in Q3 2021. German consumers are projected to show rising expenditure, driving retail sales upward and supporting further economic growth.

- The RI score for India is expected to have improved to 89.6 in Q3 2021, up from 87.8 in Q2, thanks to recovering economic activity in the country and the uptick in employment trends. Nevertheless, the outlook for the country’s economy remains overall conservative, as India struggles to reach sufficient vaccination levels while private consumption, the main driver of the economy over the historic period, is expected to slip into more stagnating growth over the short term.

- Italy is expected to have recovered from the pandemic-induced economic shocks in the second half of 2021, with the RI reaching 103.1 in Q3 2021, albeit slightly down from 103.4 in the previous quarter. Strong vaccination rates, eased business restrictions and a recovery in tourism inflows have allowed for economic expansion and swift recovery in private consumption.

- Japan’s RI score is estimated to be 91.7 in Q3 2021, up from 89.7 in the previous quarter, despite the record surge of COVID-19 infections during July-September. This improvement was supported by the Olympic Games in July-August and associated uptick in private consumption. Nevertheless, while vaccination rates are improving, just half the total population was fully vaccinated by September 2021, and a significant rise in infection numbers over Q3 is negatively affecting consumer confidence.

- The US Recovery Index score is estimated to have deteriorated to 101.5 in Q3 2021, down from 102.8 the previous quarter, due to an uptick in new COVID-19 cases and slowdown in vaccination rates. The US could see further rapid spread of the Delta variant, leading to booming hospitalisation rates. Moreover, vaccine scepticism complicates government efforts to reach herd immunity, forcing state and federal governments to impose stricter regulations, which in turn are likely to cause some contraction in consumer spending, particularly on various non-essential services and recreation activities.

- The UK is expected to be nearly recovered from the COVID-19 impact in 2021, with the Recovery Index score estimated at 98.7 in Q3 2021, although slightly down from 99.1 in the previous quarter. Thanks to relatively high vaccination rates and minimal COVID-19 restrictions on business activities, business and consumer sentiment in the country have improved in the third quarter. Nevertheless, issues such as staff shortages and supply chain disruption persist and are set to be the major challenges for the country’s economic development over the coming quarters.

Out of the 48 countries covered by Euromonitor International’s Recovery Index, 19 countries are not expected to have seen their economies rebound to 2019 levels in Q3 2021.

The biggest and immediate challenge to the global recovery is to achieve rapid and widespread vaccine deployment, especially in major developing countries with ongoing strong pandemic waves and slow vaccination rates in order to control and stem the spread of new, potentially vaccine-resistant, variants of COVID-19.

Another major challenge is to facilitate and boost global investment for inclusive and sustainable growth that is less dependent on government debt, in order to create jobs and boost business and consumer confidence.

The momentum of the recovery in 2021 is likely to have peaked due to the spread of the highly contagious Delta Coronavirus variant, slowdown in vaccination campaigns in advanced economies and low vaccination rates in developing economies.

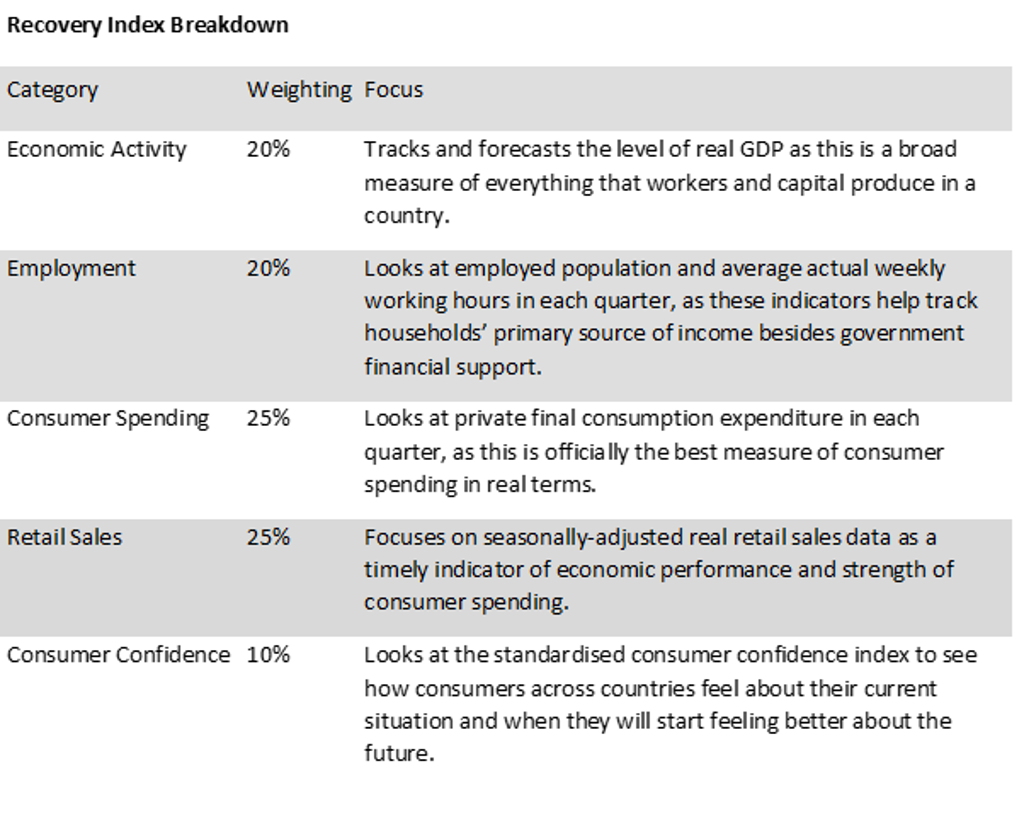

Euromonitor Recovery Index

Euromonitor’s Recovery Index is a composite index which provides a quick overview of economic and consumer activity and helps businesses predict recovery in consumer demand in 48 major economies. The index takes into consideration total GDP and factors that determine consumer demand – employment, consumer spend, retail sales, and consumer confidence. Index scores measure the change relative to the average per quarter for 2019. A score of 100 and over indicates a full recovery in which economic output, labour market, and consumer spending all return to/exceed 2019 levels.

Recovery Index Breakdown

For more information, see the Global Recovery Tracker: Q3 2021 report.