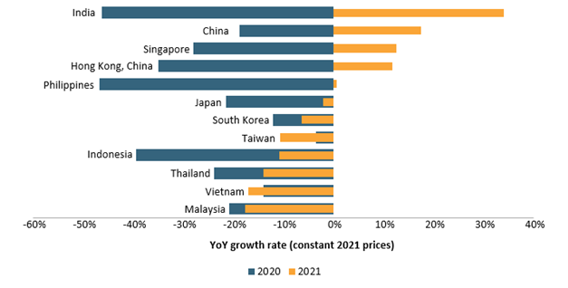

It is no secret that the consumer foodservice industry anticipated 2022 would see a rebound from the effects of the Coronavirus (COVID-19) pandemic in 2020 and 2021. However, unlike in Western regions, many Asian markets continued or even intensified restrictions in 2021, as the pandemic hit them harder than in 2020. This caused the industry to continue to shrink in 2021 in most major Asian markets, such as Malaysia (-18%) and Vietnam (-17%). Many of these markets are also expected to finish 2022 with slower growth than previously anticipated in 2021, due to the impact of the war in Ukraine, which is causing restrictions on raw materials supply and inflationary pressures.

Consumer Foodservice Growth Rates, 2020 vs 2021 Asia Pacific

Foodservice Value RSP

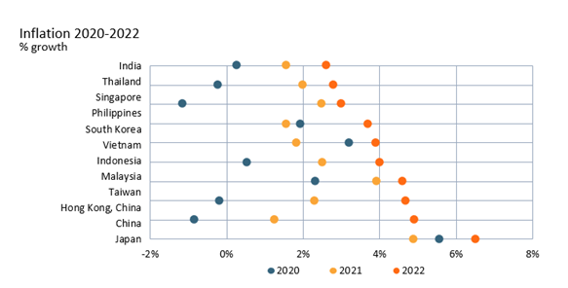

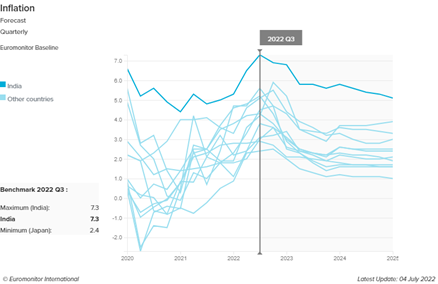

Inflation puts pressure on menu prices and consumer spending

Price sensitivity has become more pertinent in many Asian markets. With lower disposable incomes, dining out is often cut back, and consumers may be sensitive to perceived indulgence. As in 2022 inflation is experiencing the strongest growth since the pandemic began, businesses are experiencing both weaker value demand and higher costs.

The prices of sunflower oil, for example, have registered record highs on the back of the rising prices of commodities following Russia’s invasion of Ukraine – on the retail side, value sales projections for the years between 2022 and 2027 have been revised upwards between October 2021 and May 2022. On the flip side, this has created a tight market, reflected in the downgrading of retail volume sales globally. India, as a top importer of this commodity, is most affected by the sunflower oil supply crunch. The combination of limited volumes and high costs will create challenges to foodservice businesses, as certain types of oil are non-substitutable in local cuisines.

For restaurants, it is essential to create pricing strategies based on their brand image and positioning in the local market. For example, higher-income consumers may be less likely to switch to lower-priced restaurants, and may instead increase their basket sizes for higher perceived value, such as larger meals or a more indulgent food option. This was seen in South Korea, where larger, innovative sets triggered higher-priced checkouts so that consumers could meet the minimum value for delivery orders. In comparison, in Vietnam, a vast majority of consumers traded down from mid-priced restaurants to local, cheaper foodservice outlets that offer food with economical ingredients.

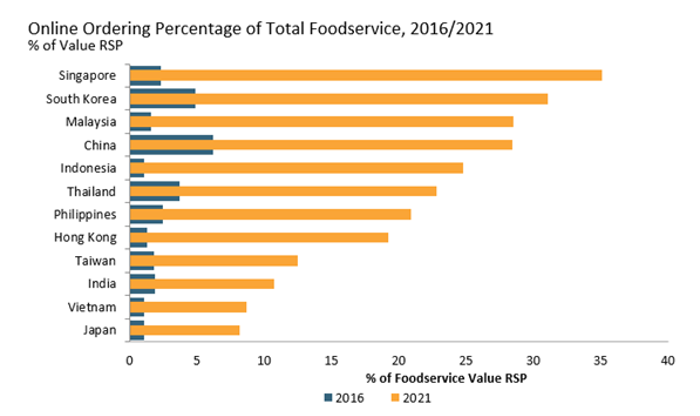

Digital strategies soften labour crunch

Digitalisation played a major role in softening the 2021 declines significantly, whether it be in terms of fulfilment or in-store ordering, although this is a double-edged sword. On the one hand, going digital eases the burden on crew members; on the other hand, opening new doors of revenue whereby consumers are able to make orders remotely drives volume sales, adding pressure to food preparation. Hence, end-to-end digitalisation is necessary, as both an alternative channel for customers, and also to support food preparation and fulfilment.

Singapore and South Korea, with more sophisticated digital infrastructures, led the proportion of online orders in 2021, which include in-store kiosks and digital apps. However, it is also worth mentioning markets such as Malaysia and Indonesia, which have improved their percentage of online ordering by 27 percentage points and 24 percentage points respectively since 2016 – evidence of the change in consumer habits over time.

This surge in online orders is partially attributed to the push of digital adoption since before the pandemic. Whereas companies that digitalised in 2020 and 2021 were ensured a better chance of survival, companies that led this industry-wide shift and continued feeding evolved consumer needs had a particular advantage.

For example, delivery aggregators (3POs) in India helped to establish a strong familiarity with online channels for many years. During the pandemic, the Domino’s native mobile app took the opportunity to launch price promotions and bundles unique to its own platform, hence gaining greater consumer trust and brand share despite the tough conditions, standing out amidst the fragmented online environment, where virtual brands have added to the competition. Domino’s also strengthened its fulfilment capabilities, reducing the delivery time from 30 to 20 minutes in cities with a higher density of its stores, hence raising the bar for digital efficiencies in the local market.

The way forward: Focus on on-demand and in-store innovations

Inflationary pressures are expected to be as intense over the forecast period. India, for example, is set to lead inflation growth up to 2025, with above 5% increases year-on-year, while Japan is set to be the steadiest.

Source: Euromonitor International Macro Model

Hence, a closer look into repositioning foodservice providers’ brand image and the bundling of menu items may help to determine the return of customers. Market rebound hopefuls must ensure that their foodservice outlets are equipped to manage evolved consumer expectations in terms of food, price and service.

For instance, despite delivery taking a bigger share of sales compared with pre-pandemic, eat-in will remain important, as consumers seek a return to novel experiences and social gatherings. Foodservice outlets must consider the size of waiting areas, including temporary parking spaces for delivery riders. At the same time, the experience of in-store diners must not be compromised amidst a consistent flow of to-go orders. Hygiene and food safety measures practised in-store will also be of greater priority.

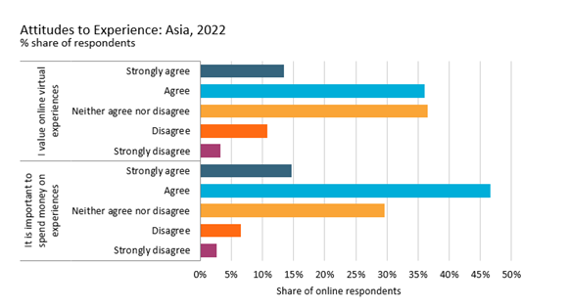

Digital efficiencies and innovative virtual experiences will also help to ensure the customer journey is seamless. Although a large proportion of surveyed respondents tend to be uncertain about their opinion of virtual experiences, there is a generally positive attitude to its value.

Looking ahead, we can expect a greater focus on in-store concepts that typically adopt technology. Although food product innovation is key, businesses will offer new value propositions by reinvigorating customer experiences, from ordering to fulfilment, to encourage continued patronage amidst volatile market conditions and consumers’ reluctance to spend.

For further related insights, read our reports, Evolution of Physical Space in Hospitality, and Limited Service Restaurants in Asia- Pacific