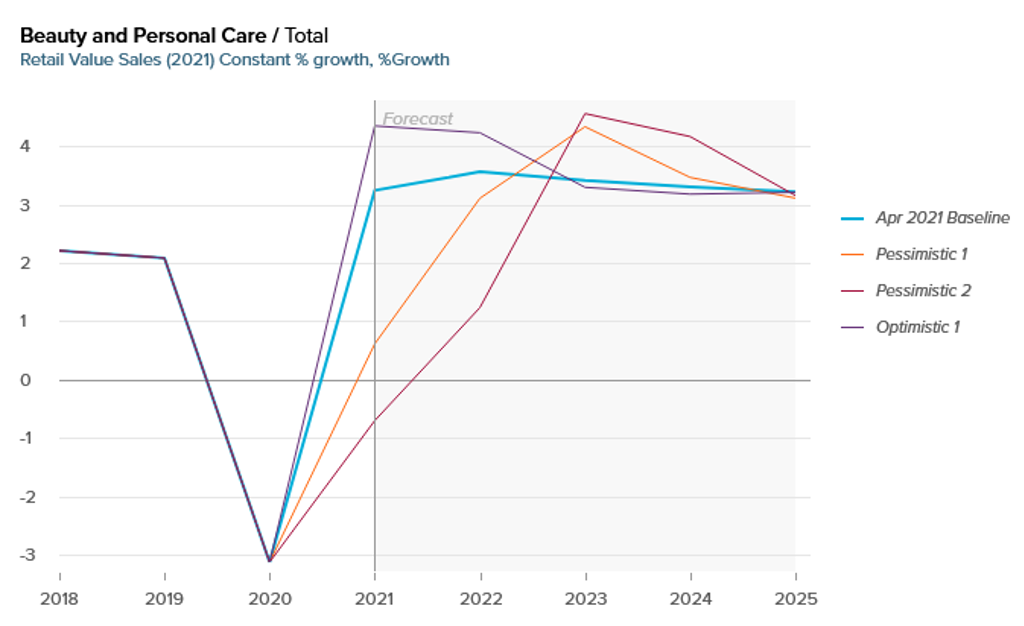

Global beauty and personal care declined -3.3% in constant terms in 2020, down from 1.9% in 2019. Western Europe accounted for the highest value shares of absolute value losses in 2020, followed by Asia Pacific and North America. However, Asia Pacific was the first to enter the recovery phase and is expected to have the most robust growth globally in 2021. As the first half of 2021 concludes, beauty and personal care are expected to rebound by 3.3% in 2021 in constant terms. However, given the ongoing uncertainty with COVID-19 regarding the spread of variants, vaccine distribution, and resumption, imposition, or lifting of restrictions, Euromonitor developed several scenarios, anchored by its baseline projection that has the highest probability of occurring.

Source: Euromonitor International’s Beauty and Personal Care Forecast Dashboard: Last updated April 10, 2021

Beauty players adapt to an evolving business environment

With the competitive environment shaken up in 2020, major companies continue to face share erosion from smaller indie players. In fact, the top five beauty and personal care players globally saw their combined share drop two percentage points between 2015 and 2020. Covid-19 bought along with new challenges, with the severity of the impact of Covid-19 resting on portfolio and geographic exposure. As a result, beauty players are facing a deeply transformed consumer and retail landscape. Moving into 2021, the beauty industry will experience M&A activity, especially in categories with a strong wellness narrative. However, minority investments and gradual acquisitions may be more common post-pandemic than pre-pandemic, given a tenuous supply chain and reserved cash flows in certain markets.

Top trends shaping the industry

Following a similar pattern after the financial crisis, beauty consumers 2021 onward are likely to prioritize efficacy, affordability, and multi-functionality and science-backed clinical positioning, while brands and retailers highlight hero products. Beauty brands that are purpose-driven, digitally-savvy, clinically-backed, price accessible and approachable are most likely to thrive post-COVID. Clean beauty will also become the new default in many markets, considering an overarching consumer shift towards safety and biocompatibility, regardless of the origin of ingredients. Recent industry positioning of “clean beauty” is becoming less about the label of “clean” (since the definition is subjective and non-standard) but more about transparency and safety. As a result, the appetite for sustainability and ethical claims will increase. These trends have been influencing personal care segments as well, especially bath and shower and oral care.

Leading claims globally in beauty and personal care categories, 2020

| Category | #1 Claim | #2 Claim | #3 Claim |

| Beauty and Personal Care | Natural | Hydrating | No Parabens |

| Baby and Child-specific Products | Fragrance-Free | Hypoallergenic | No Parabens |

| Bath and Shower | Natural | Organic | No Parabens |

| Colour Cosmetics | Natural | No Parabens | Vegan |

| Deodorants | No Alcohol | No Aluminium | Natural |

| Depilatories | Sensitive Skin | Natural | Dermatologically-tested |

| Fragrances | Natural | No Alcohol | Energy-boosting |

| Hair Care | Natural | No Parabens | Organic |

| Men’s Grooming | Sensitive Skin | Natural | No Parabens |

| Oral Care | Natural | Antibacterial | No Fluoride |

| Skin Care | Hydrating | Organic | Natural |

| Sun Care | Antioxidant | Sensitive Skin | No Parabens |

Source: Euromonitor International’s Product Claims and Positioning

As the industry begins its journey to recovery, brands must look to re-centre their strategies to reflect newly-emerged priorities and shopping behaviours evoked by Covid-19. With a heightened emphasis on physical and mental wellbeing, self-care is expected to remain at the forefront as consumers look for products with a strong alignment to health, therapeutics and overall wellness, but backed by efficacy. Meanwhile, increased hygiene awareness will also boost prosperity for preventative health products, with both trends expected to hold long term transitions for the industry.

Beyond 2021

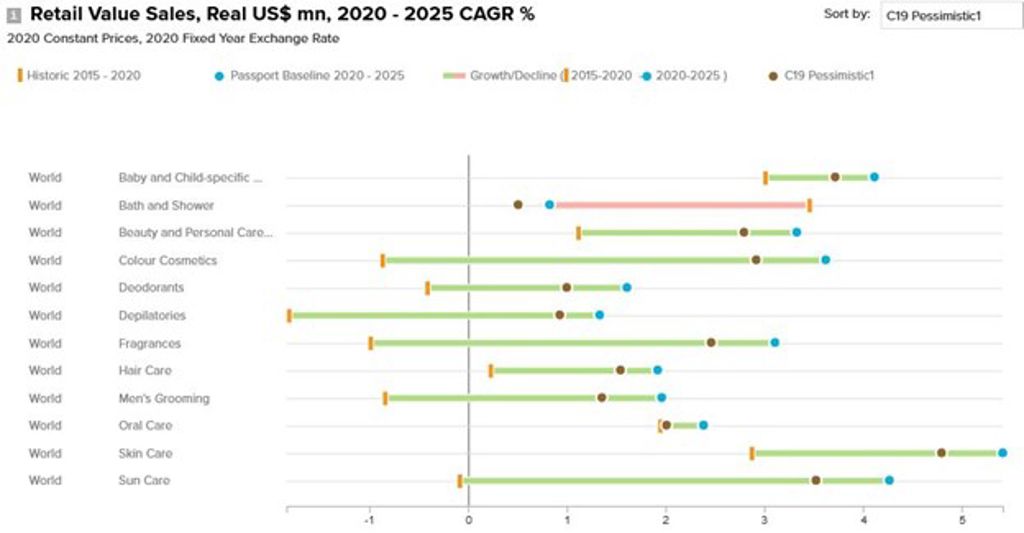

Source: Euromonitor International Last updated August 24, 2020

As the largest category globally in 2020, skincare outperformed expectations. Skincare will still be the brightest spot of the global beauty industry into 2025, while bath and shower decelerate alongside a moderation of preventative health urgency. Colour cosmetics and fragrances are expected to make a healthy rebound over the 5-year period, driven notably by the Asia Pacific, but market performance is varied and dependent on the resumption of social events and the lifting of mask mandates.

Overall, beauty and personal care have shown it is relatively more resilient than other non-essential FMCG goods, and that the wellness narrative is influential in boosting particular categories. Beauty and personal care e-commerce and digitalization will be at the forefront of competition 2021 onward, as brands vie for consumers’ increased digital attention and work to provide a positive consumer experience both online and offline.