This article is also available in Japanese.

The Tokyo Olympics has been clouded in uncertainty since the first initial COVID-19 outbreak in 2020. Initial concerns about the feasibility of hosting the games during the early stages of the first global wave led to an eventual year-long postponement. It was reported that in Japan 60 companies paid more than USD3 billion for sponsorship rights for the Tokyo Olympics. This is separate to international sponsors that purchase rights directly from the International Olympic Committee (IOC). Yet, following the decision to host the games behind closed doors, partners and sponsors are being forced to adjust how they go about maximising exposure and impact during the games. Physical assets on the ground in Tokyo were set to play a key role in the activation strategy for many brands. Lacking the usual Olympic fans and fanfare, brands need to adjust to maximise return on investment. How they respond will potentially influence sponsorship rights values not just for the Tokyo Games but for future Olympics also.

Can digital engagement salvage a positive ROI?

For brands focused on growing exposure rather than direct revenue (through sales of products and services) there remains opportunities to engage fans online. This is not unique to sports. Looking across industries, almost 60% of industry respondents saw digital engagement as the most important factor influencing digital commerce in the past year (Voice of the Industry, Digital Consumer Survey 2021).

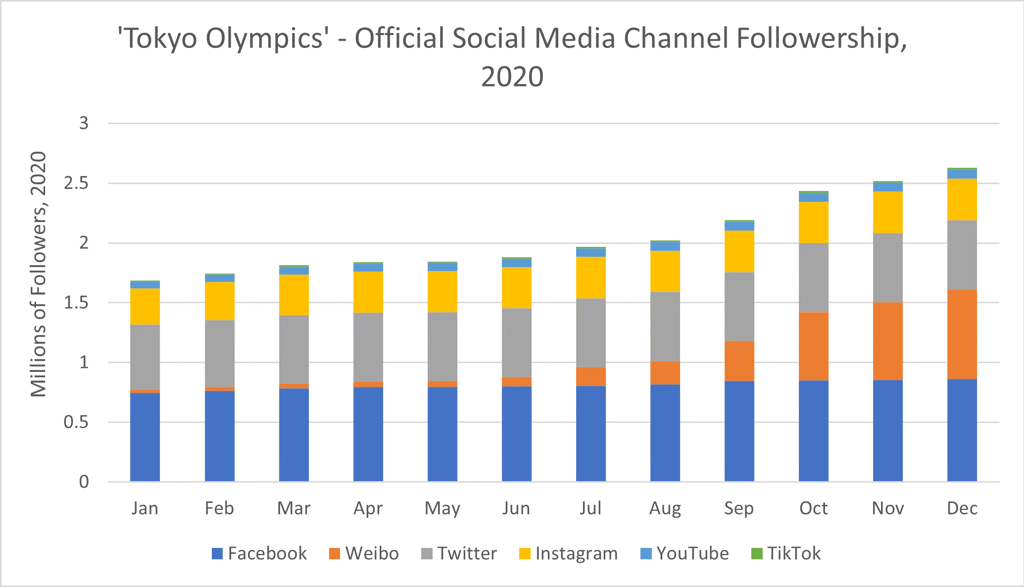

Sports properties over the course of the pandemic have worked to shine a light on sponsors through greater content creation strategies and digital activations. Several top leagues in Europe and the NBA in North America grew their digital footprint by over 10% between April 2020 and April 2021. Many official Olympic social media accounts have also seen notable growth across key platforms such as YouTube, Twitter and Instagram in the lead up to the Games.

While social media has played a role in how sports properties and brands have connected with their audiences it won’t be a universal silver bullet for sponsors.

Japanese companies that had long planned to use the influx of domestic and international fans as an opportunity to sell products and services will be unable to reap commercial benefits. Sponsor booths set to be installed along the Olympic promenade are being scaled down significantly.

Brand messaging throughout the Games is key – irrespective of channel

The biggest challenge for brands isn’t simply to reach fans online that would otherwise be flocking to Olympic events. The biggest challenge is understanding fans and striking an authentic tone in any marketing and advertising activities – a challenge seen across sports since the onset of the pandemic.

A tentativeness has hung over the industry, a result of the realisation that driving positive sentiment with fans might require more than the narratives atypical of sports marketing. This is undoubtedly true for an Olympics that has seen a waning of public support, throughout 2021 especially. For brands that react empathetically and authentically, brand exposure can still be converted into positive sentiment with fans.

How will sponsors measure success?

A successful sponsorship is highly dependent on the company or brand, its marketing objectives and how they choose to measure the impact of activations against the initial investment. The sponsorships best positioned to deliver amidst the uncertainty will stem from brands focused on digital activation strategies to drive exposure and amplify their brands globally. Those that can lessen the reliance on activating physical assets will outperform those that don’t or can’t.

Regardless of strategy or channel, engaging fans both in Japan and internationally in meaningful, authentic ways will be essential to ensuring any measure of campaign success.