The impact of the pandemic on retail sales across markets in Asia Pacific varied greatly in 2022. The impact was largely dependent on each country’s COVID-19 situation, containment measures adopted, and the approach taken towards an endemic future.

Retail offline sales slumped in China by 4%, in absolute dollar terms, as lockdown policies contributed to a decline in in-store foot traffic. Conversely, markets such as India (+14%), Indonesia (+10%) and South Korea (+4%) experienced healthy growth and revenge spending due to the resumption of pre-pandemic lifestyles and social activities. Retail channels such as apparel and footwear specialists, beauty specialists and vending benefited from the recovery of international travel and geographic mobility of consumers.

Retail e-commerce largely continued its strong growth in Asia Pacific in the wake of the pandemic, driven by merchant digitalisation and consumer habit persistence

The wide disparity in e-commerce development across Asia Pacific has resulted in differing strategic priorities and initiatives by brands and retailers.

Across developing Asia, e-commerce marketplaces offer a convenient and accessible option for retailers in their digitalisation journey. Platforms such as Daraz, Lazada and Tokopedia are popular among consumers in South and Southeast Asia due to their ease of use, wide product range and regular price promotions.

In developed markets, the focus has shifted towards innovation in meeting increased consumer expectations in e-commerce, such as product assortment and fulfilment flexibility. In South Korea, Shinsegae’s SSG.COM is implementing a “premium strategy” by introducing official stores of luxury brands on its platform, such as Gucci, Ferragamo, Burberry and Montblanc. Its competitor, Naver, is redefining consumers’ delivery expectations by launching its “Naver Guaranteed Delivery Programme” with CJ Logistics to provide overnight delivery to over 90% of South Korea’s regions.

Livestreaming and social e-commerce continue to thrive due to greater social media usage and high mobile penetration

Increased social media usage since the pandemic and high mobile penetration rates have provided a conducive environment for social commerce to flourish. In China, social media platform Douyin, owned by ByteDance (which also operates TikTok and popularised short-form video globally) allows merchants to match the interests and video preferences of the platform’s more than 600 million daily users with their product offerings for a tailored shopping experience.

Livestreaming, private traffic, key opinion leaders (KOLs) and consumers (KOCs) have also been critical in China in allowing retailers to reach and sell to consumers online. Similarly in India, leading e-commerce players such as Amazon and Flipkart have also launched livestreaming platforms, allowing brands to showcase products and build closer relationships with users.

Focus shifts towards experiential retail concepts that are augmented by technology

Consumers have returned to stores post-pandemic to find revamped outlet concepts that showcase the relevance of the physical store.

Experiential retail is taking centre stage as brands highlight their stores as more than a place to transact, but also a place where consumers can indulge in unique and memorable shopping experiences

Technology is also being used for a more customer-centric purchase experience in-store. Watsons’ “The Grand Store” in The Philippines utilises artificial intelligence (AI) and augmented reality (AR) as in-store tools to help consumers analyse their skin conditions or virtually try on cosmetics, helping consumers to find the most suitable products and be more confident in their purchase decisions.

Renewed focus post-pandemic on the environment and personal wellbeing in retail

COVID-19 has slowed down the pace of life and shone a spotlight on personal health and wellness, driving sustained sales through pharmacies and health and personal care stores. Preference for sustainable products has also grown, with retailers similarly placing greater emphasis on addressing environmental concerns through consumer education and in their retail operations. For example, AEON Group in Japan opened a store which runs on 100% renewable energy, with the aim for this concept to expand, and an end goal of achieving zero aggregate CO2 emissions from its stores by 2040.

Retailers must adapt and innovate to meet the new expectations of consumers

The post-pandemic Asia Pacific retail landscape remains competitive. There has never been a greater array of choices across physical and digital channels, and technology and online tools will continue to transform the way retailers engage and sell to consumers. Retailers across the region are certainly facing new and unprecedented challenges, but those that are able to turn these challenges into opportunities are well-placed to remain the preferred shopping destinations of consumers.

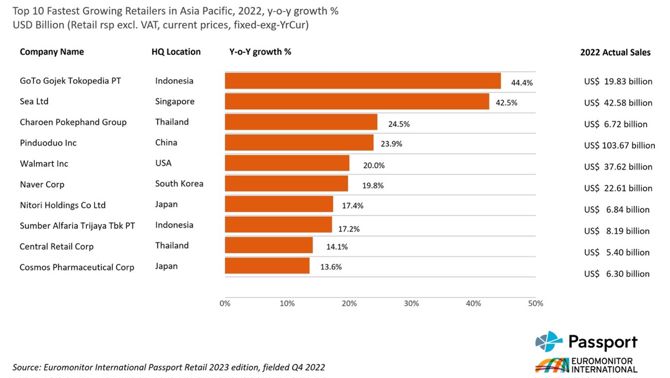

Rankings Spotlight - Top 10 Fastest Growing Retailers in Asia Pacific 2022

Sea Ltd stands out through hyper-localisation, competitive prices, and the extensive product range of its Shopee Marketplace

Sea Ltd ranked second in our list of fastest growing retailers in Asia Pacific, with sales growth of 43% y-o-y in 2022. According to Euromonitor International’s Retail research, Sea Ltd achieved USD43 billion in retail value sales in Asia Pacific in 2022.

Shopee is Sea Ltd’s flagship mobile-first e-commerce marketplace, which operates across seven Asia Pacific countries. It offers products in major categories from both third party merchants and official brand-owned e-stores, such as Shopee Mall.

Shopee is best known for its monthly sales and super brand days (exclusive partner-brand 24-hour sale events where the brand’s products highlight discounts, promotions and occasionally exclusive launches). It differentiates itself via its hyper-localised sites and marketing campaigns, competitive pricing and extensive product range. The Shopee app also includes livestreaming capabilities and interactive games (such as Shopee Farm) to drive consumer engagement.

Shopee is an attractive destination for third party merchants seeking to reach millions of e-commerce consumers across Southeast Asia and Taiwan, due to its high brand awareness and strong merchant support in driving sales via marketing and consumer engagement tools. Shopee has also expanded into adjacent services, such as food delivery and payments, to encourage continuous consumer reliance and spending on its platform.

Nitori sails through the post-pandemic era with aggressive regional expansion

Nitori is a leading home products specialist hailing from Japan. The retailer internally manages its vertical supply chain, which allows it to control an entire process from planning, manufacturing, distribution and retail, ensuring product quality and minimising external costs incurred.

The retailer has constantly expanded its footprint outside of Japan to markets such as Mainland China and Taiwan. In 2022, it opened its first outlets in Southeast Asia, in Malaysia and Singapore. Southeast Asia is home to the steady demand for homewares and home furnishings due to healthy economic growth and increase in number of households. Nitori has adroitly identified this opportunity in a rather fragmented industry.

Nitori plans to accelerate further penetration in overseas markets with 77 new outlets in the pipeline to open in the new fiscal, including entering other Southeast Asian countries, such as Thailand and Vietnam, where the retailer has operated production facilities for nearly two decades.

Stream our webinar, Mastering E-Commerce Growth: How to Win Online Amid Uncertainty, to find the next big retail opportunity and accelerate your online sales revenue.

Learn more about the global retail landscape in our report, World Market for Retail, and explore five trends that Euromonitor International has identified as shaping retail in 2023 and beyond.