Companies Eye Digital Tools for Supply Chain Fortification

Global manufacturing output has recovered from the pandemic shock, although supply chain disruptions and rising prices continue to weigh on companies. Moreover, transportation problems are expected to extend well into 2022 and hinder the performance of the manufacturing sector. To better shield from similar risks in the future, manufacturing companies are investing in digital tools. Production digitisation is anticipated to make supply chains more flexible, improve productivity and expand sales networks.

Component shortages and rising costs put pressure on supply chains in 2021

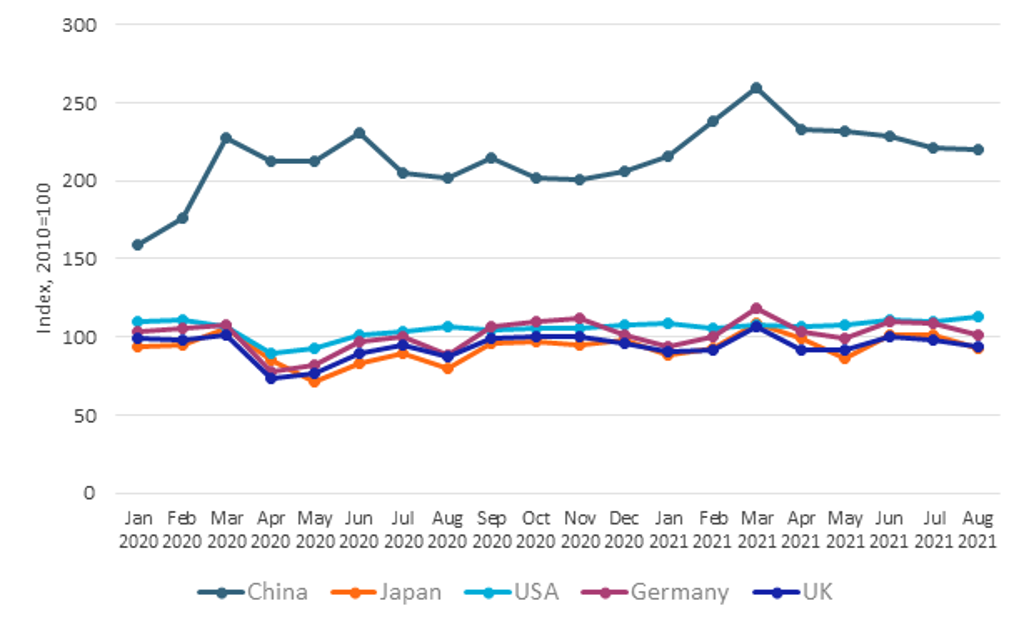

The global manufacturing sector has recovered from the COVID-19 shock in 2021. The industrial production index in the largest economies reached pre-pandemic levels in summer 2021. However, depleted inventory stocks, rising commodity prices and shortages of certain components, such as semiconductors, continue to put pressure on global supply chains. Even though demand is recovering, industries such as automotive, hi-tech goods and aerospace are struggling with scattered supply chains and cannot operate at full capacity.

Industrial Production Index in Selected Countries, Jan 2020-Aug 2021

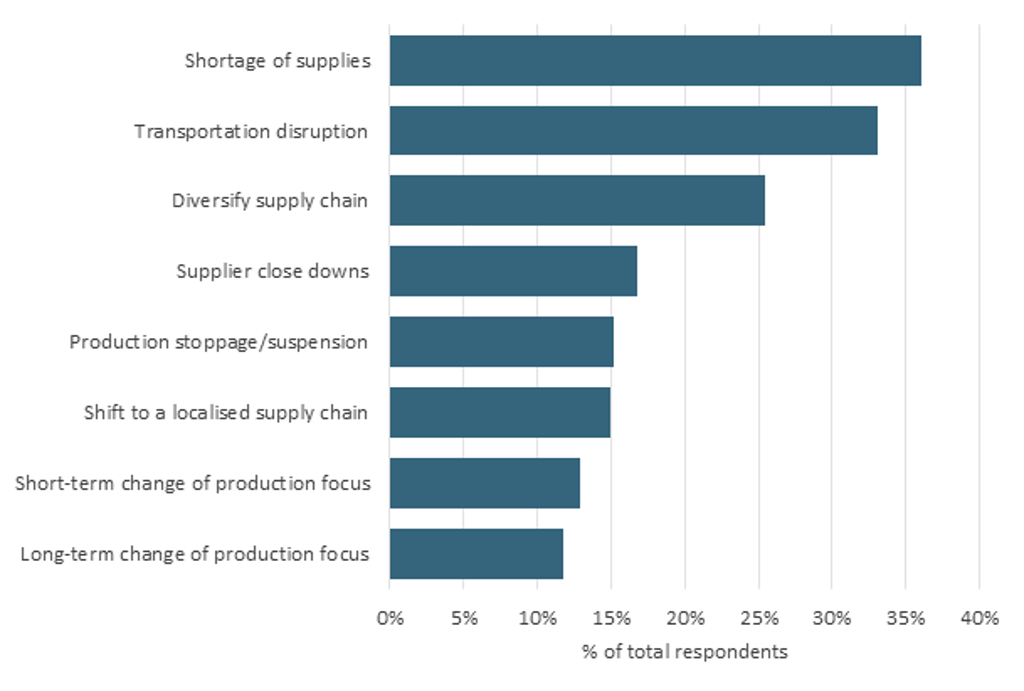

According to Euromonitor International’s Voice of the Industry COVID-19 survey, conducted in April 2021, around a third of companies globally indicated that shortages of supplies and transportation problems would continue to affect their supply chains in the coming six months. Supply chain management remains a top priority for manufacturers and companies, leading them to continue to invest in supply chain diversification, digital strategies and improved communications within the company and with clients. Greater transparency and communication can make supply chains more flexible and help companies to better adjust to the changing situation.

Which of the following do you think are the most likely effects of the COVID-19 pandemic on your company’s supply chain in the next 6 months?

Besides supply shortages, inflation and rising transportation costs are other issues impacting global manufacturers in 2021. To a large extent, rising inflation has been caused by depleted inventories and recovering commodity prices, and inflationary pressures are anticipated to ease in 2022 as the supply of materials gradually improves. However, transportation bottlenecks remain an issue and will take longer to solve. For example, the average price to ship a 40ft container reached around USD8,400 in July 2021 – four times larger than the year before. This especially affects industries with long supply chains that are heavily reliant on international trade, such as hi-tech goods, machinery or household goods. Transportation costs are anticipated to increase further as the Christmas holiday season is approaching. Thus, manufacturers are likely to continue production localisation and automation efforts to manage soaring transportation costs.

Digital strategies, diversification and automation to reshape supply chains in the long term

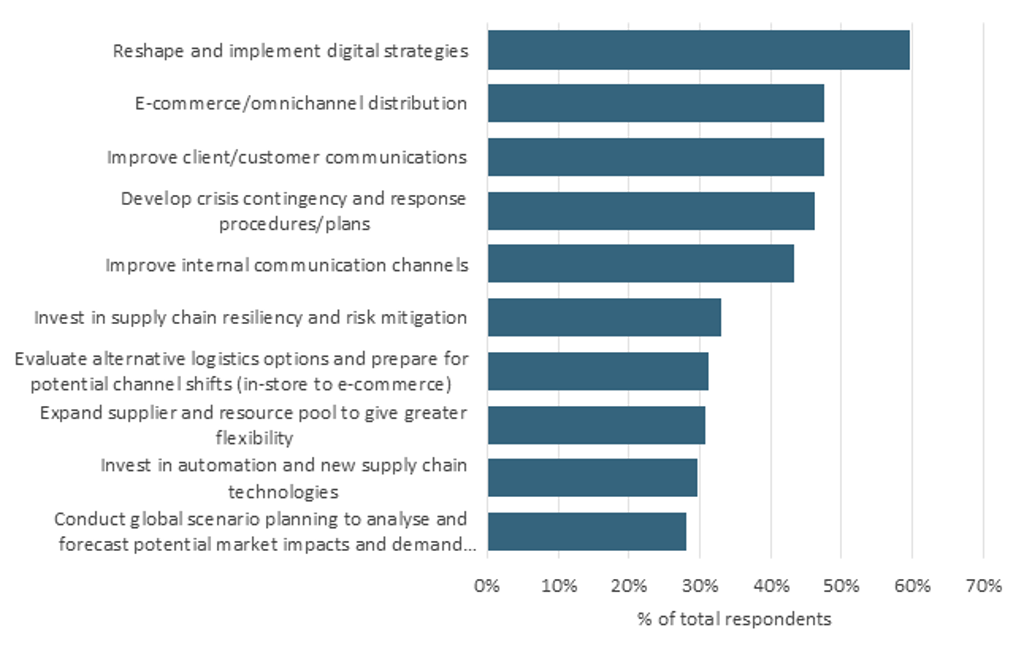

Looking into the long term, companies are eyeing production digitalisation as a way to strengthen their operations and avoid similar disruptions in the future. According to the Voice of the Industry COVID-19 survey, almost 60% of companies plan to reshape and implement digital strategies, and 48% plan expansion into e-commerce. Digital and supply chain management tools can improve the resilience of supply chains, add more transparency and reduce reaction times during times of emergency. E-commerce also proved a powerful tool during the pandemic and lockdowns. Now companies want to better capitalise on this trade channel. The global B2B e-commerce market is forecast to more than double by 2030 to reach USD6.3 trillion, with retail, ICT service providers and the transport equipment industry leading this growth.

What future measures do you expect your business to introduce or adapt to prevent similar risks in the future?

Besides digital tools, companies also aim to better diversify their supply chains to avoid similar disruptions in the future. According to the survey results, around a third of companies globally plan to expand their supplier pool, invest in supply chain resiliency and evaluate alternative logistics options. Production diversification can help companies to add flexibility to their production networks and better distribute resources across different manufacturing hubs. This could mainly affect industries providing critical components, such as food products or pharmaceuticals, or industries with long supply chains, such as rubber and plastic, chemical products and machinery. These industries also play a critical role in the production networks of other B2B industries.

Lastly, around 30% of companies globally indicated plans to invest more in production automation and new supply chain management tools. Production automation can help to reduce operating costs, and at the same time locate production activities closer to end consumers. Production automation would mainly benefit industries with wide product portfolios and relatively high transportation costs, such as the food and beverages, automotive, machinery or hi-tech goods industries. If these changes were applied on a global scale, global manufacturing output could be increased by around USD1.0-1.3 trillion each year, thanks to the better planning of production, elimination of bottlenecks and a smoother product design process.

If you would like to learn more about the evolution of digital manufacturing and how companies are adapting, please check the latest strategy briefing, Digital Transformation in Global Manufacturing.