Inflation currently dominates discussions throughout the consumer packaged goods industries. The rising costs of labour, energy, transport, packaging and inputs are sending ripple effects through every layer of the supply chain. Hot beverages are certainly no exception. The median price growth of coffee at retail globally since last April has been 6.1%, and that of tea 1.8%. However, they are uniquely cushioned from the impact of inflation because of the highly inelastic nature of demand.

Inelastic demand patterns make hot beverages different

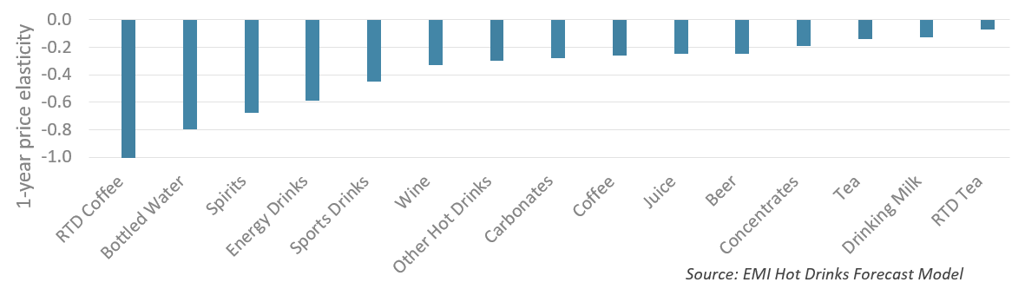

Hot beverages are critically important to many people’s daily routines. Because of their caffeine content and, in many cases, cultural significance, consumers are highly reluctant to cut back in volume terms. At a global level, coffee displays a one-year price elasticity of -0.26 (meaning that a 1% increase in price will, all else being equal, be expected to result in a loss of 0.26 percentage points from previous volume growth projections). Tea is at just -0.14, lower than all other beverages except drinking milk and ready-to-drink (RTD) tea.

The exceptions are subcategories that are easily substitutable with cheaper sources of caffeine and that are poorly culturally rooted. RTD coffee, for example, is highly exposed to price changes nearly everywhere, because it is usually a newer category and one that is relatively expensive compared with other caffeinated options.

1-Year Price Elasticities of Beverages at a Global Level (Retail Volumes)

Price hikes rather than cost-cutting measures have been the default industry response

The industry has therefore in most cases chosen to pass costs onto consumers directly. Levels of SKU rationalisation and packaging redesign are much lower than they are in other comparable CPG spaces. Coca-Cola, for example, which has been aggressively taking an axe to “zombie brands” in the name of supply chain efficiencies, has left its coffee and tea portfolio largely untouched.

Those that have spoken publicly in the industry have generally announced that they are raising prices. Tchibo spokesman Arnt Liedtke, for example, said in February, “We held out for as long as we could, but since last summer coffee prices have risen 50%. This is something that we have to accept and now pass on to consumers.”

This sentiment is hardly unique to Tchibo, and others, including Starbucks and JM Smucker, have publicly stated they are also raising prices. Commodity prices for coffee have skyrocketed since 2020, after bad harvests in key growing areas, combined with pandemic-induced labour and transportation shortages. This was particularly abrupt as it came after years of unusually low prices for the industry. By December of 2021 prices stood at USD2.68/lb, 111% over where they were two years prior.

So far, consumer blowback on the price hikes that have made it to retail have been relatively small. There are signs of it emerging, though. Pret a Manger’s 25% price hike for its popular beverage subscription programme in the UK, for example, was met with loud customer displeasure. Companies will likely pursue slower, more incremental increases in the future to avoid this sort of negative reaction.

How will consumers react to persistent inflation?

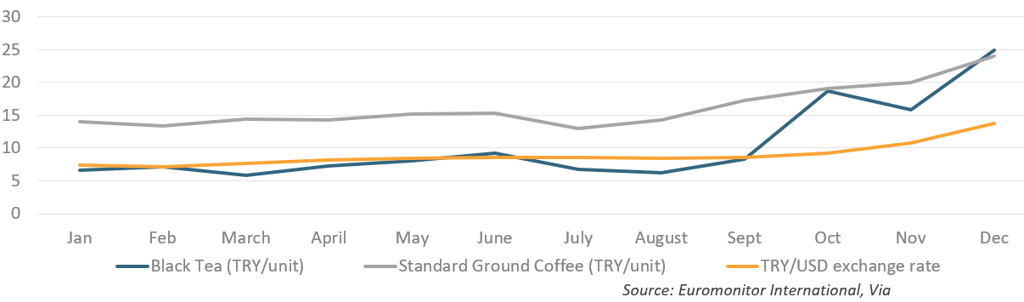

To understand how inflation might affect consumer behaviour, it is helpful to look at a market where it has been persistently high for some time. There are few better examples than Turkey, where inflation has been in the double-digits for years, and is now forecast to reach 57% in 2022.

Value-seeking behaviour among Turkish hot drinks consumers has been easy to see. Private label’s share in coffee, for example, rose from 13% in 2016 to 23% in 2021, while discounters gained five points of channel share in tea and 10 in coffee. However, overall hot drinks volumes have remained fairly stable. Both coffee and tea are very important in Turkey, and consumers are reluctant to reduce their consumption overall. As can be seen though, they are quick to substitute more inexpensive formats.

Price for Online SKUs of Hot Drinks in Turkey and Exchange Rate of the Lira vs. the US Dollar 2021

The Turkish experience is extreme, but it gives some indication as to what the future may hold for markets that are just now seeing inflation reach levels not seen in decades. The key takeaway is that brands and channels aimed at value-seeking consumers are likely to do well.

Disruption is far more likely in many developed countries because consumers there are less familiar with how to respond to inflation. Major hot drinks markets such as Brazil, Egypt and Turkey will see higher inflation rates in an absolute sense, but consumers there are also less surprised to see prices increase. It will be markets such as Spain or the US, where people are dealing with inflation not seen for decades, that will see consumers reacting more dramatically to price hikes.

At-home consumption gets an additional boost from inflation

Hot drinks overall will do better than many other categories during this global inflationary period, because of the inelasticity of their demand patterns. The biggest concern will be foodservice, which is already reeling from the economic effects of the pandemic, the loss of consumers to remote working, and struggles to find labour. Swapping a cup of to-go coffee for one at home for a fraction of the price is an easy money-saving tactic and one that many consumers will employ in the near future.

Foodservice will need to focus on hot beverages as a permissible indulgence – a treat that remains largely inexpensive compared with other indulgences, such as restaurant meals or new clothing. Premiumisation will also play a key role, as consumers are less likely to be bothered by price hikes if they are getting a higher-quality product, even if some of the price rise was purely inflationary.

It is important to note that the inelasticity of demand at top-line level does not mean brands necessarily enjoy significant pricing power. For basic categories with crowded shelves and price-sensitive consumers, such as black tea bags or standard ground coffee, one brand raising prices will simply send consumers moving to the next brand over. Many brands with a premium angle do have pricing power though – Nespresso has increased prices in 20 of 28 markets in which it has trackable online sales since 1 April 2021, and its sales performance continues to be strong.

The major industry winners will be those brands that can replicate expensive out-of-home beverage experiences in a more affordable at-home format. Pods, coffee creamers, delivery options and appliances are likely to be categories that will do especially well. At-home consumption has already seen several years of strong growth because of the pandemic, and inflation will continue to strengthen its position even further.