Retailers and manufacturers in the Middle East are operating in an increasingly changing retail environment, where consumer maturity and expectations are supported by the emergence of new business models. Digital technology is playing a greater role in reshaping retail strategy in the region, and while having a digital presence has become important, particularly since the pandemic, retailers are increasingly considering the importance that the role of digital plays in reshaping in-store experiences.

Bricks-and-mortar establishments will need to make the in-store experience as convenient and seamless as the online one, while also creating a personalised and entertaining experience to attract and engage consumers. Adopting an omnichannel presence will be a major priority, as retailers’ success will hinge on a successful strategy built around seamlessness, convenience, experience, and personalisation.

Understanding consumer preferences is pivotal to developing retail strategies

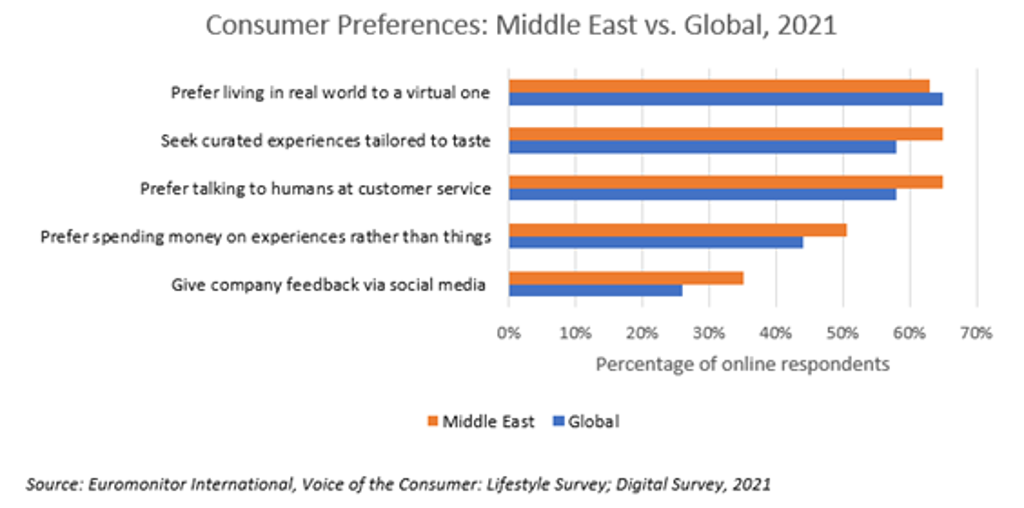

While new business models and technologies have an impact on retail strategies, multiple factors are at play. Differences in consumer values and attitudes tend to impact their expectations and preferences across the region.

In the Middle East, over 50% of consumers prefer spending money on experiences rather than things, compared to 44% globally, according to Euromonitor International’s Voice of the Consumer: Lifestyle Survey, 2021. Moreover, 65% of consumers seek curated experiences, much higher than 58% of consumers globally.

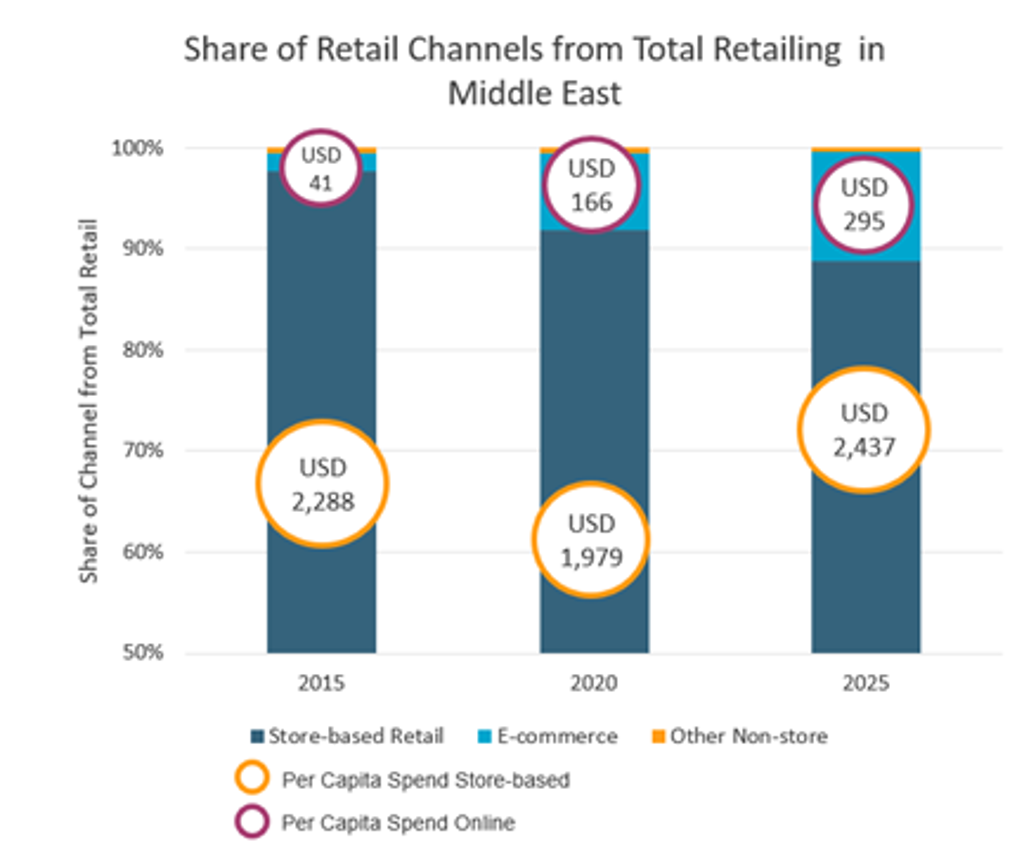

Physical retail remains strong, although consumer experience is key

In the Middle East, physical retailing remains stronger compared to other regions, although e-commerce is making strides. In 2020, the penetration rate of e-commerce in the region rose to 8% from 4% in the pre-pandemic period. Thus, while there has been a strong boost in e-commerce, store-based sales dominate the region’s retail landscape. Local consumers are expected to spend an average of over USD2,400 via physical stores in 2025, up from nearly USD2,000 in 2020, compared to only USD295 online the same year.

Source: Euromonitor International, Passport: Retailing 2022 Edition, Middle East includes: UAE, Saudi Arabia, Qatar, Oman, Kuwait, Lebanon, Jordan, Israel, Iraq. Other Non-Store Channel includes Direct Selling, Vending and Homeshopping.

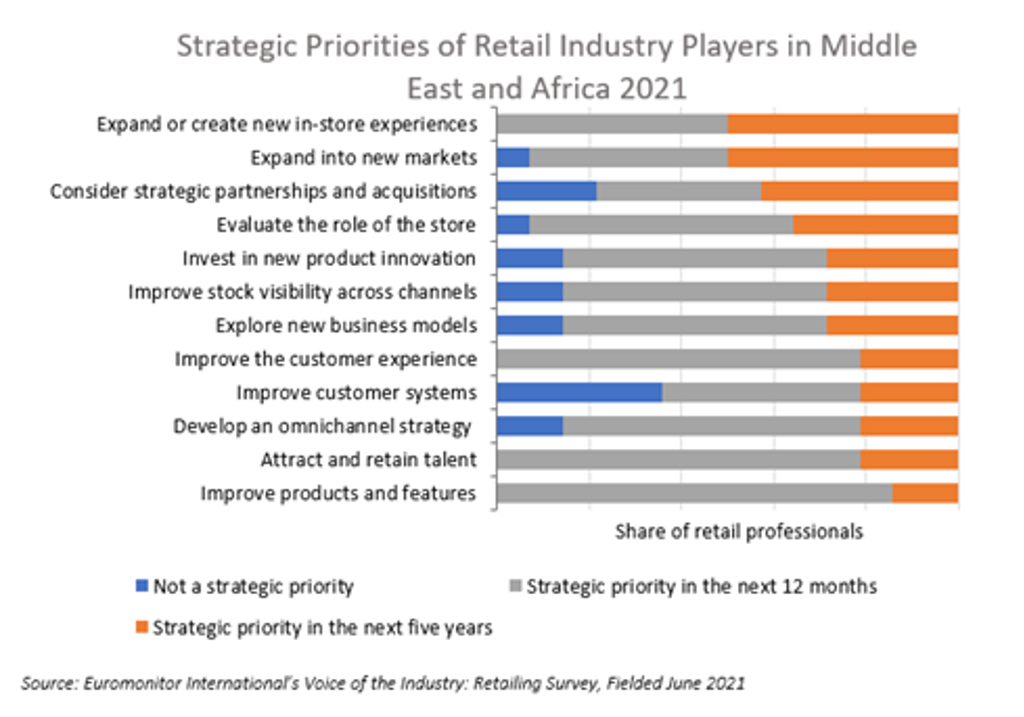

Given the fact that store-based retail remains highly relevant for the region, experiential retail holds unique importance for retailers, not only in attracting a higher number of customers, but also in developing “meaningful interactions”. These experiential centres will be driven by consumer preferences, as well as being tied to the reciprocal value of sustainability and economic repercussion for retailers in the region. Expanding or creating new in-store experiences remains a strategic priority for retailers in the region over the near-term and long-term, according to Euromonitor International’s Voice of the Industry: Retailing Survey.

Retailers taking the lead: adidas and Carrefour

Some retailers are already taking the lead in creating a personalised and engaging experience. The flagship store of adidas in the region opened in The Dubai Mall in February 2021 and features RFID Smart Fitting Rooms, as well as premium services such as “Maker Lab”, which enables customers to personalise products. The store offers eSports sessions to play FIFA in the men’s football area.

Equally, Carrefour launched the region’s first cashier-less and self-service store, Carrefour City+ in Dubai, deploying artificial intelligence and active sensory scanners that identify items with the highest accuracy. The store puts to test the possibilities offered by technologies, such as AI, to drive convenience and seamlessness.

What does this mean for retailers?

Going forward, retailers will need to compete on the customer experience and not just on product offerings. As retailers in the region focus on taking an omnichannel approach, experiential and personalised offerings are likely to be the key to future success. Digital technology will allow retailers to create more personalised experiences and drive cost efficiencies, in both offline and online environments. With greater digital integration, brands will have further opportunities to go direct to consumers and engage in new ways. This will offer brands access to a wider range of consumer data and insight, allowing retailers to curate personalised experiences and create new revenue streams.

Watch Euromonitor International’s Commerce 2040: The Future of the Store in a Digital World event to explore how evolving consumer expectations, new competitive realities and the accelerated digital transformation will impact the future of the store. To further explore how these trends are reshaping retail across various regions, download the full report: Commerce 2040: A Regional Exploration of the Future Retail Store.