Global inflationary pressures are forecast to moderate further in 2024.

Under the baseline scenario, global inflation is predicted to stand at 4.9% in 2024, down from 6.9% in 2023

Source: Euromonitor International

Stricter monetary policies, weaker economic growth and a consequent demand slowdown are helping to ease the price pressures. Lower commodity prices are also expected to contribute to weaker inflationary pressures in 2024. Nonetheless, inflation in the largest economies remains above the 2% level due to persistently high core inflation (excluding price fluctuations of energy and food). This is likely to prompt central banks to keep interest rates higher for a longer period.

High economic uncertainty and rising geopolitical tensions are among the key risks that could contribute to higher inflation in 2024. This could lead to disruptions of established trade flows, export bans on certain goods or commodities as well as the possibility of restrictive trade tariffs. Such effects would result in higher prices of manufactured goods and increased inflationary pressures in the global economy.

Slower price growth of manufactured goods and services

Prices of manufactured goods are forecast to remain stable, with some temporary increases in Q4 2023 anticipated due to seasonal effects such as increased demand for energy and higher consumer spending.

Weaker global economic growth, stable commodity prices and lower prices of imported goods are set to ease supply-side inflationary pressures in 2024

Source: Euromonitor International

Slower economic growth in China and declining manufacturers' prices could help to limit global inflation growth. If China maintains stable prices of manufactured goods, it could reduce inflationary pressures by making imported Chinese goods cheaper for other countries. Supply-demand imbalances and consequently rising prices of manufactured goods were among the factors that sparked the inflation surge in 2022.

Tight labour markets and consequent wage growth also contributed to the sticky core inflation.

However, inflationary pressures in the services sector are predicted to marginally abate in 2024

Source: Euromonitor International

This is in large part due to slower economic growth and indications of the cooling labour markets in the largest economies. On the demand side, tighter monetary policies and slower consumer income gains are expected to limit demand for discretionary services and cap price growth.

Rising geopolitical tensions is the key risk for global inflation surge in 2024

Existing and newly emerging geopolitical tensions remain the key upside risk to inflation in 2024 and beyond, as they could spark additional supply chain disruptions. The Israel-Hamas war could lead to increased price volatility in energy markets and further exacerbate the ongoing geoeconomic fragmentation.

Rising US-China tensions will also continue to place greater pressure on the global supply chains and cause inflationary risks to remain for longer. Both China and the US aim to diversify and localise supply chains, especially production of critical components. Growing trade fragmentation and economic tensions could disrupt supply chains and inflate prices of manufactured goods.

Price pressures continue to ease across the largest economies

Slower economic growth and tighter monetary policies, to a large extent, help to ease inflationary pressures in the largest economies. Yet, divergent inflation trends in the largest economies prevail. Advanced economies are forecast to see a faster decline of inflation in 2024 compared to developing economies, in part due to more effective transmission of monetary policy.

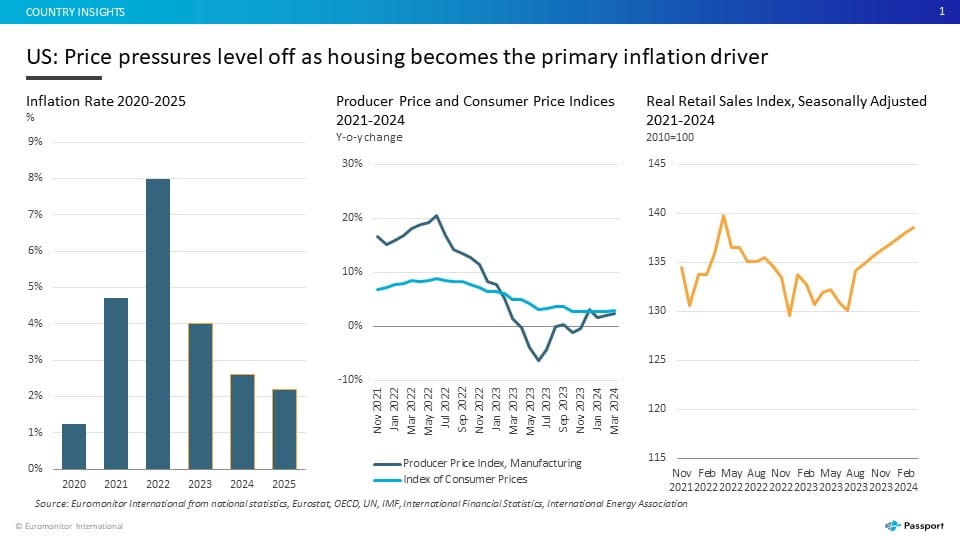

- Inflation in the US is expected to reach 4.0% in 2023 and slow to 2.6% in 2024. Price pressures continue to ease in large part due to lower energy and other commodity prices. However, core inflation remains sticky, with rising housing prices being the major upside risk for inflation in 2024.

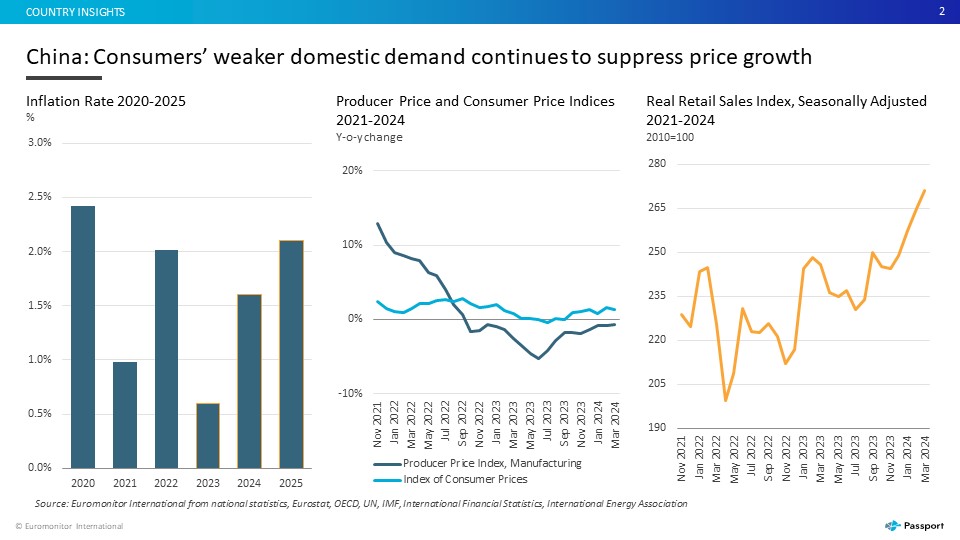

- Inflation forecast for China has been revised downward to 0.6% 2023 and is set to stand at 1.6% in 2024. Weak economic and private consumption growth continue to cap the price increases. The deflationary environment indicates that there is potential for further government intervention, which is expected to increase consumer confidence in 2024.

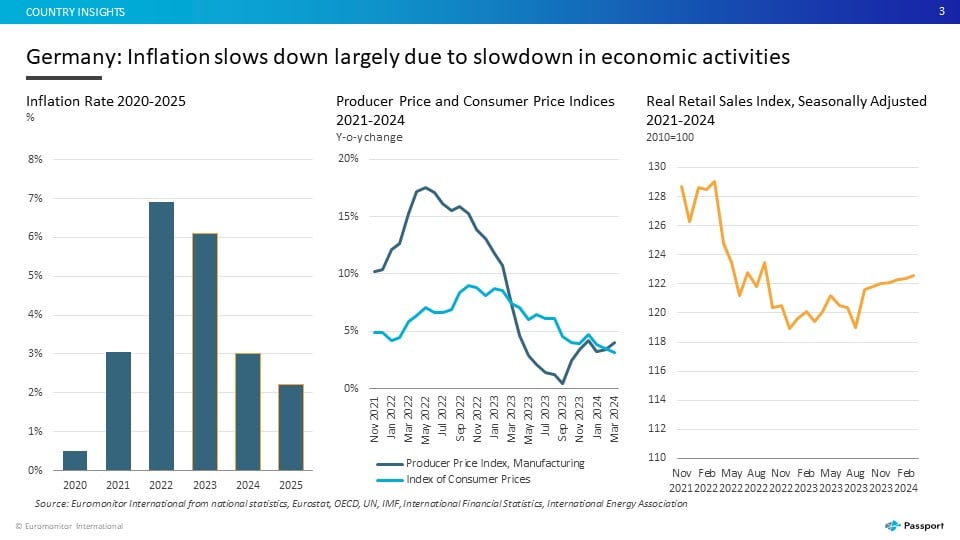

- Inflation risks in the eurozone continue to ease in large part due to stabilisation of the energy prices, yet disparities among the countries prevail. Inflation in the largest eurozone economies, Germany and France, is forecast to reach 3.0% and 2.6% respectively in 2024. However, France is likely to witness delayed inflationary effects as government interventions in 2022 helped to postpone negative effects stemming from energy price increases.

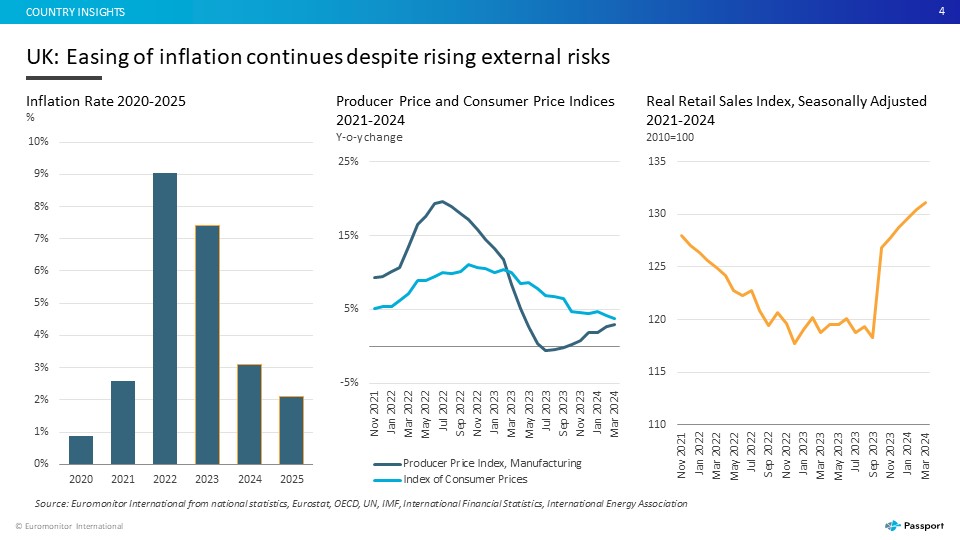

- Inflation in the UK is forecast to remain elevated at 7.1% in 2023 but ease to 3.1% in 2024. Slower economic growth and stricter monetary policy are helping to ease price pressures. In addition, cooling of the labour market could contribute to the lower prices of services in 2024.

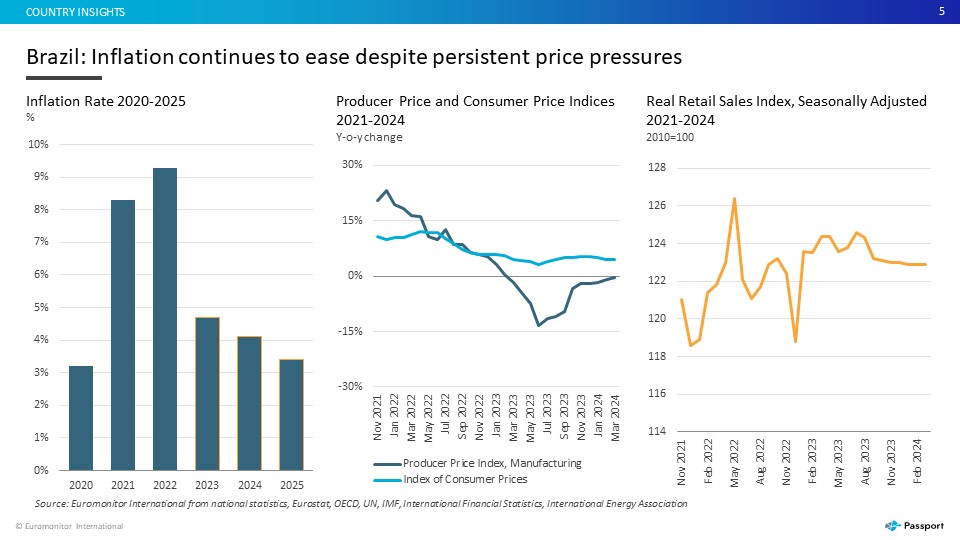

- Inflation in Brazil is projected to reach 4.7% in 2023 and moderate further to 4.1% in 2024. Lower agricultural commodities and food prices are helping to cap price pressures. Nevertheless, services inflation remains sticky due to resilient demand and pressures on transportation prices.